- Canada

- /

- Gas Utilities

- /

- TSX:ALA

AltaGas (TSX:ALA) Valuation in Focus Following Entry Into FTSE All-World Index

Reviewed by Kshitija Bhandaru

AltaGas (TSX:ALA) just made a new mark by being added to the FTSE All-World Index, a move that tends to catch the attention of both institutional investors and retail shareholders. This kind of index inclusion is not just a line in a press release; it can influence how investors perceive AltaGas, with funds that track the index potentially buying shares to match its composition. For anyone watching for shifts in ownership or liquidity, this event is worth noting as it can impact how the stock trades in coming months.

The backdrop to this inclusion is a year where AltaGas has already been building momentum. Shares have climbed 27% so far this year and are up 31% over the past twelve months, suggesting more investors are pricing in steady growth and perhaps a shift in risk perception. That said, recent months have shown only a modest uptick in price, which may reflect markets catching their breath after a strong run. The long-term trend remains firmly positive.

After climbing the ranks this year and landing a spot in a global benchmark, does AltaGas offer investors attractive value at today’s prices, or has the market already factored in its future growth?

Most Popular Narrative: 3.9% Undervalued

The most widely followed narrative suggests that AltaGas is currently undervalued, with the fair value positioned a modest 3.9% above the latest share price. Analysts use a discount rate of 6.1% in their valuation model, reflecting current market risk expectations and anticipated returns.

Major investments in modernization and export infrastructure are set to drive stable, diversified revenue growth in response to rising energy and electrification demand. Operational efficiencies, capital recycling, and stronger balance sheet flexibility support margin expansion and increased free cash flow for reinvestment.

This story is just getting started. Curious how these strategic bets and efficiency moves translate into the future price expectations? The analysts’ model runs on ambitious growth assumptions and a profit multiple usually reserved for high-flying sectors. Wondering what is fueling this bullish narrative, and what numbers justify the seemingly tight margin to fair value? Take a closer look to uncover the pivotal quantitative levers behind this forecast.

Result: Fair Value of $44.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, policy changes related to decarbonization, as well as rising infrastructure and debt costs, could easily disrupt AltaGas's growth narrative and impact future returns.

Find out about the key risks to this AltaGas narrative.Another View: Industry Comparison Adds a Twist

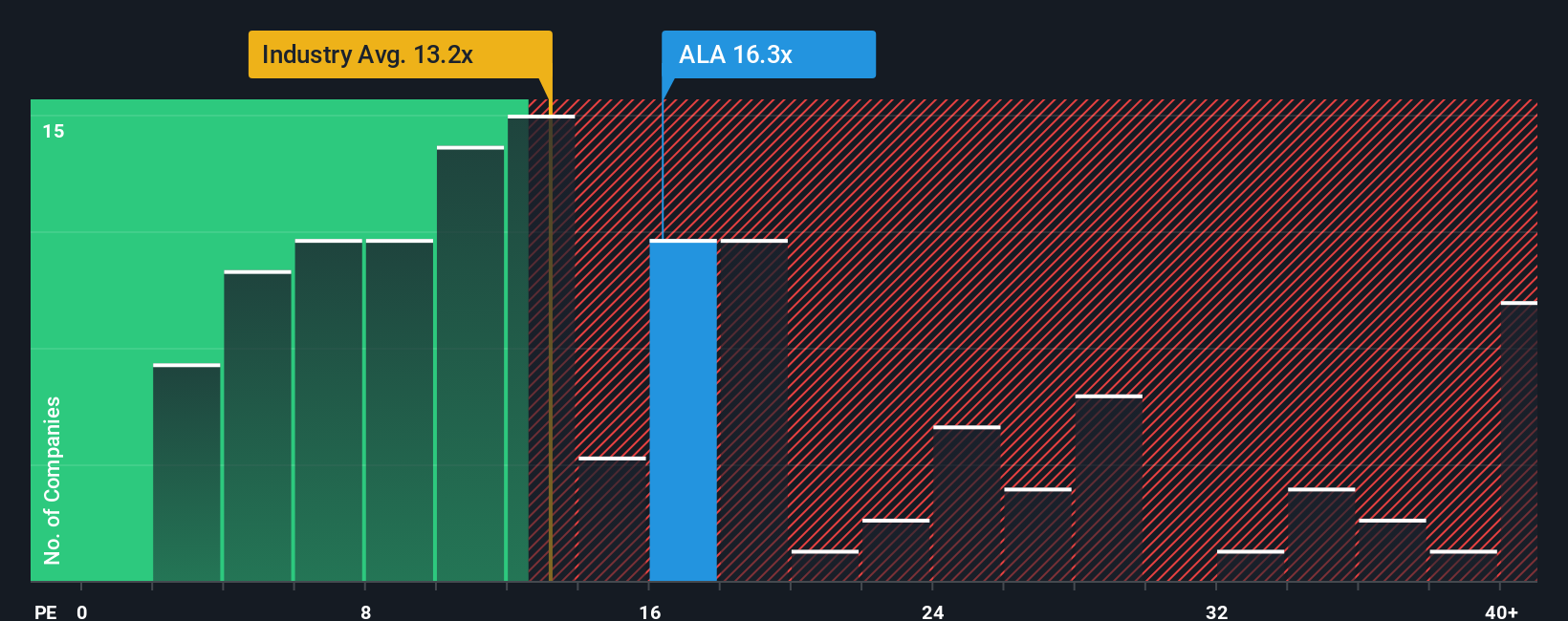

While the narrative and target price suggest AltaGas is a touch undervalued, an industry metric adds a twist. Compared to its sector's average, AltaGas currently screens as expensive. Might the market know something others do not?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding AltaGas to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own AltaGas Narrative

If you see things differently or want to dig deeper on your own, you can craft your own take in just a few minutes: Do it your way.

A great starting point for your AltaGas research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why settle for just one opportunity when you could spot the next big winner? Use these expert-curated stock screens to find unique companies matching your strategy before everyone else takes notice.

- Tap into rapid innovation and shape your portfolio with companies driving progress in quantum computing with the power of quantum computing stocks.

- Target safe, steady returns by focusing on stocks delivering impressive income streams using our dividend stocks with yields > 3%.

- Catch fast-growing tech disruptors in artificial intelligence before they hit the mainstream using the AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ALA

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives