The board of AltaGas Ltd. (TSE:ALA) has announced that it will pay a dividend of CA$0.083 per share on the 16th of August. This payment means that the dividend yield will be 3.8%, which is around the industry average.

Check out our latest analysis for AltaGas

AltaGas' Earnings Easily Cover the Distributions

While it is always good to see a solid dividend yield, we should also consider whether the payment is feasible. At the time of the last dividend payment, AltaGas was paying out a very large proportion of what it was earning and 459% of cash flows. This is certainly a risk factor, as reduced cash flows could force the company to pay a lower dividend.

Looking forward, earnings per share is forecast to rise by 36.1% over the next year. Assuming the dividend continues along the course it has been charting recently, our estimates show the payout ratio being 52% which brings it into quite a comfortable range.

Dividend Volatility

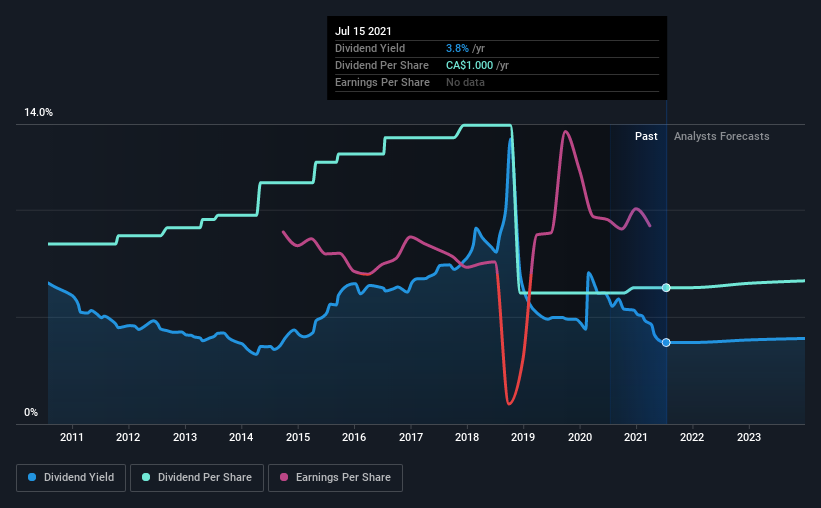

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. Since 2011, the dividend has gone from CA$1.32 to CA$1.00. The dividend has shrunk at around 2.7% a year during that period. A company that decreases its dividend over time generally isn't what we are looking for.

AltaGas Might Find It Hard To Grow Its Dividend

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. AltaGas has seen EPS rising for the last five years, at 28% per annum. However, AltaGas isn't reinvesting a lot back into the business, so we wonder how quickly it will be able to grow in the future.

AltaGas' Dividend Doesn't Look Sustainable

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. While we generally think the level of distributions are a bit high, we wouldn't rule it out as becoming a good dividend payer in the future as its earnings are growing healthily. We would probably look elsewhere for an income investment.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Case in point: We've spotted 5 warning signs for AltaGas (of which 1 is a bit unpleasant!) you should know about. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:ALA

Fair value low.

Similar Companies

Market Insights

Community Narratives