- Canada

- /

- Transportation

- /

- TSX:TFII

Why TFI International (TSX:TFII) Is Down 8.4% After Weaker Q2 Earnings and Revenue Decline

Reviewed by Simply Wall St

- TFI International recently reported its second quarter and first half 2025 financial results, revealing that both revenue and net income declined compared to the same periods last year, with revenue for the quarter totaling US$2.04 billion and net income at US$98.18 million.

- An interesting detail is that while TFI continued its share buyback program, repurchasing 2.76% of its shares for US$226.6 million, the lower earnings and revenue drew the most investor attention.

- We'll examine how the weaker revenue and profit performance may affect TFI International's longer-term investment outlook and key valuation assumptions.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

TFI International Investment Narrative Recap

To be a shareholder in TFI International, you need to believe in a cyclical recovery in North American freight demand and TFI's ability to unlock value through operational efficiency, margin growth, and disciplined capital allocation. The latest weaker second quarter results amplify near-term concerns about persistent sluggish volumes and pressure on earnings, but they do not materially alter the central catalyst for the business, which remains a potential rebound in demand and improved pricing in the U.S. LTL segment. The biggest risk reinforced by these results is the continued sluggish pace of freight recovery, which could weigh on profits through 2025 if industrial activity stays muted.

Amid the mixed quarterly performance, TFI's recently completed US$226.6 million share buyback, totaling 2.76% of shares, stands out as the most relevant announcement. This move reflects the company's ongoing commitment to return capital to shareholders using its strong free cash flow, even as near-term earnings soften, supporting per-share value while cyclical headwinds persist and efficiency gains gradually flow through. Investors should watch if the buyback activity continues as a support for value amid ongoing uncertainty in freight demand.

In contrast, investors should be aware of one key risk: if industrial and freight activity remain subdued longer than expected, TFI may face…

Read the full narrative on TFI International (it's free!)

TFI International's outlook anticipates $9.2 billion in revenue and $557.7 million in earnings by 2028. This is based on a 3.6% annual revenue growth rate and a $189.5 million increase in earnings from the current $368.2 million.

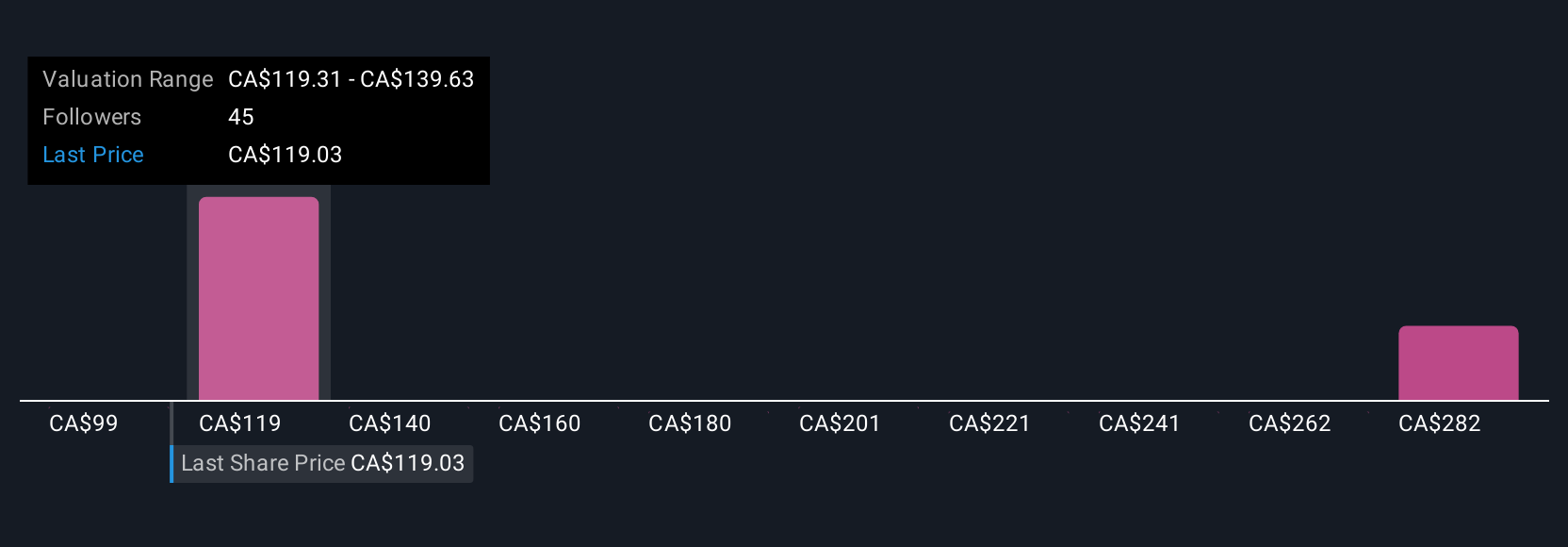

Uncover how TFI International's forecasts yield a CA$136.18 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community shared target fair values for TFI International ranging from US$98.99 to US$299.23. While opinions differ, many are factoring in ongoing concerns around freight demand and margin pressure that could influence future results.

Explore 5 other fair value estimates on TFI International - why the stock might be worth over 2x more than the current price!

Build Your Own TFI International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TFI International research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free TFI International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TFI International's overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Outshine the giants: these 21 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TFI International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TFII

TFI International

Provides transportation and logistics services in the United States, Mexico, and Canada.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives