- Canada

- /

- Hospitality

- /

- TSX:MTY

Top Undervalued Small Caps With Insider Action In Canada July 2024

Reviewed by Simply Wall St

As the U.S. presidential campaign unfolds, key economic issues such as government debt, Federal Reserve policies, and trade dynamics are poised to influence market sentiments broadly, including in Canada. These broader economic indicators and the resulting market environment provide a relevant backdrop for evaluating small-cap stocks in Canada, particularly those that may be undervalued and show promising insider activity. In this context, understanding which stocks demonstrate solid fundamentals and strategic insider commitments can be particularly compelling for investors looking to capitalize on potential market adjustments.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Dundee Precious Metals | 8.8x | 3.0x | 45.38% | ★★★★★★ |

| Calfrac Well Services | 2.4x | 0.2x | 26.66% | ★★★★★☆ |

| Bragg Gaming Group | NA | 1.4x | 21.69% | ★★★★★☆ |

| Primaris Real Estate Investment Trust | 11.8x | 3.1x | 33.48% | ★★★★★☆ |

| Nexus Industrial REIT | 2.6x | 3.2x | 15.94% | ★★★★☆☆ |

| Guardian Capital Group | 10.4x | 4.0x | 31.25% | ★★★★☆☆ |

| Sagicor Financial | 1.1x | 0.4x | -85.89% | ★★★★☆☆ |

| Russel Metals | 9.3x | 0.5x | -9.66% | ★★★☆☆☆ |

| AutoCanada | 11.1x | 0.1x | -94.88% | ★★★☆☆☆ |

| Freehold Royalties | 15.8x | 6.8x | 47.40% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

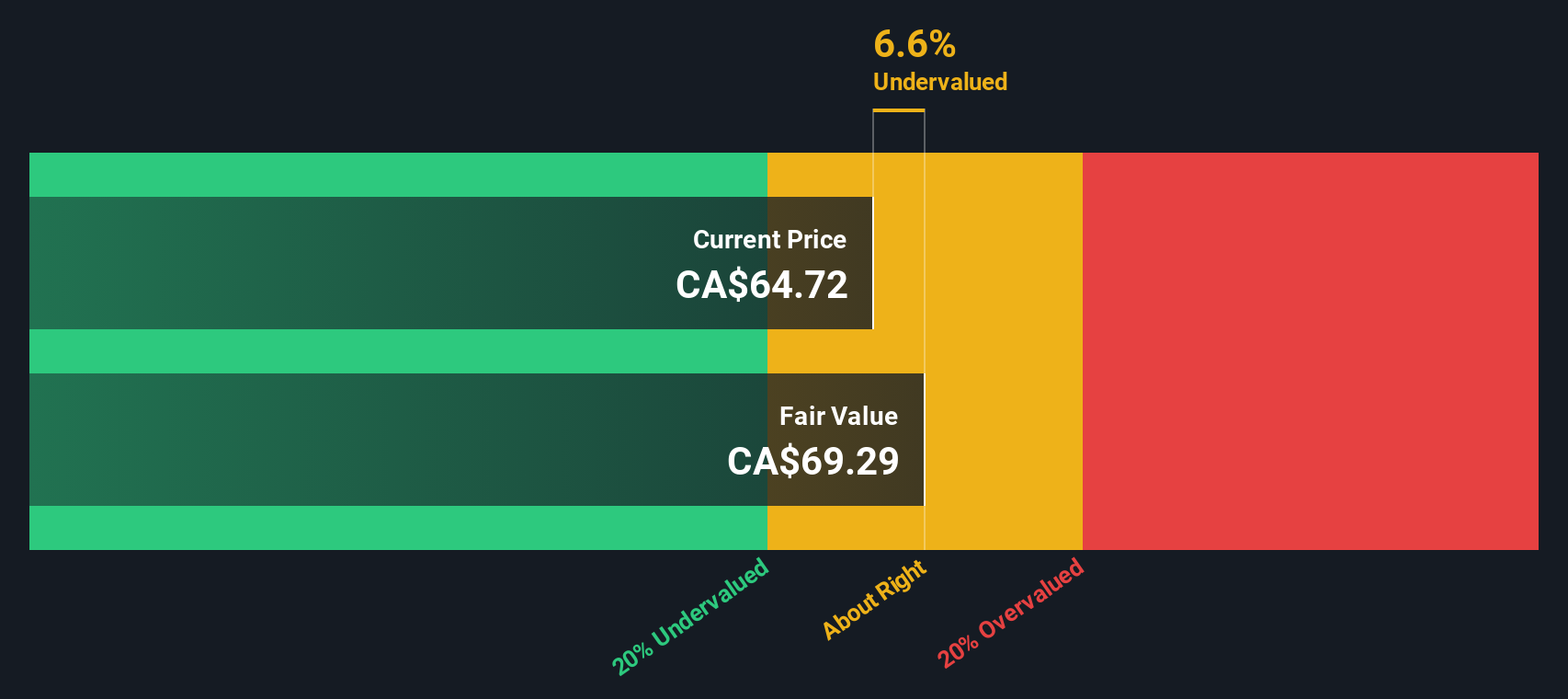

Exchange Income (TSX:EIF)

Simply Wall St Value Rating: ★★★★★☆

Overview: Exchange Income is a diversified company operating primarily in the manufacturing and aerospace & aviation sectors, with a market capitalization of approximately CA$1.6 billion.

Operations: Manufacturing and Aerospace & Aviation are the primary revenue contributors, generating CA$1.03 billion and CA$1.54 billion respectively. The company has observed a gross profit margin trend, which stood at 34.55% as of the latest report in 2024, reflecting its cost management in relation to generated revenues.

PE: 18.8x

Exchange Income's recent declaration of consistent monthly dividends, including a CAD$0.22 per share for July 2024, underscores its financial stability and commitment to shareholder returns. Despite a slight dip in net income from CAD$6.86 million to CAD$4.53 million in the first quarter of 2024, revenue growth is evident with an increase from CAD$526.84 million to CAD$601.77 million year-over-year. This growth trajectory, coupled with insider confidence demonstrated by recent share purchases, suggests a resilient business model amidst external borrowing risks.

- Unlock comprehensive insights into our analysis of Exchange Income stock in this valuation report.

Understand Exchange Income's track record by examining our Past report.

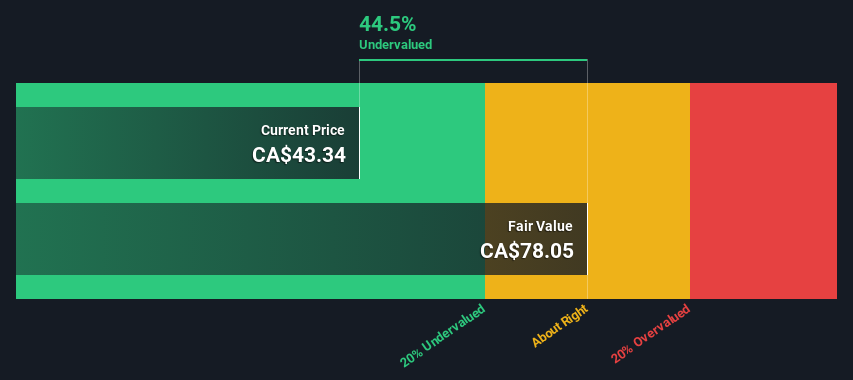

MTY Food Group (TSX:MTY)

Simply Wall St Value Rating: ★★★★☆☆

Overview: MTY Food Group is a diversified company in the restaurant industry, operating primarily through franchising and corporate-owned locations across Canada and internationally, with a market cap of approximately CA$1.17 billion.

Operations: MTY Food Group generates its revenue primarily through corporate operations and franchising, both domestically in Canada and internationally. The company has shown a notable gross profit margin trend, peaking at 1.16% in the second quarter of 2022, indicative of its operational efficiency in managing the cost of goods sold relative to sales.

PE: 11.4x

MTY Food Group, reflecting a cautious yet strategic approach, reported a slight dip in net income to CAD 27.28 million for Q2 2024 from CAD 30.36 million the previous year, amidst stable sales figures. Recently purchased by insiders, shares signal confidence in the company's future despite its reliance on higher-risk external borrowing as its sole funding source. Additionally, MTY actively repurchased shares worth CAD 12.8 million between March and May 2024, underscoring its commitment to enhancing shareholder value while navigating financial complexities with prudence.

- Dive into the specifics of MTY Food Group here with our thorough valuation report.

Assess MTY Food Group's past performance with our detailed historical performance reports.

Russel Metals (TSX:RUS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Russel Metals is a metals distribution and processing company with operations primarily in steel distribution, metals service centers, and energy products, boasting a market capitalization of approximately CA$1.57 billion.

Operations: The gross profit margin for the company has shown a notable increase from 17.09% in late 2013 to approximately 21.32% by mid-2024, reflecting improved profitability over the period. Revenue streams are primarily derived from Metals Service Centers, contributing CA$2.95 billion, followed by Energy Field Stores and Steel Distributors generating CA$982.20 million and CA$429 million respectively.

PE: 9.3x

Russel Metals, reflecting a strategic growth trajectory, recently expanded by acquiring seven service centers from Samuel, set to finalize in Q3 2024. This move underlines its market adaptability and potential for expansion. Despite a dip in Q1 2024 earnings with sales at CAD 1.06 billion and net income of CAD 49.7 million, the company showed resilience by boosting its quarterly dividend by 5%, enhancing shareholder returns. Notably, insider confidence is evident as they recently purchased shares; combined with a steady share repurchase program completing the acquisition of 1.2 million shares for CAD 52.3 million signals strong belief in the company’s value proposition.

- Delve into the full analysis valuation report here for a deeper understanding of Russel Metals.

Explore historical data to track Russel Metals' performance over time in our Past section.

Summing It All Up

- Dive into all 32 of the Undervalued TSX Small Caps With Insider Buying we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MTY

MTY Food Group

Operates and franchises quick-service, fast-casual, and casual dining restaurants in Canada, the United States, and internationally.

Solid track record, good value and pays a dividend.