- Canada

- /

- Transportation

- /

- TSX:CP

Strong Earnings and Buyback Completion Could Be a Game Changer for Canadian Pacific Kansas City (TSX:CP)

Reviewed by Sasha Jovanovic

- Canadian Pacific Kansas City Limited recently reported third-quarter 2025 earnings, posting revenue of C$3.66 billion and net income of C$920 million, alongside a quarterly dividend declaration and completion of a significant share buyback program.

- The company’s public opposition to the pending Union Pacific–Norfolk Southern merger underscores its active involvement in shaping North American rail competition.

- We’ll explore how Canadian Pacific Kansas City’s strong financial results and capital returns strengthen its investment narrative amid industry consolidation risks.

We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Canadian Pacific Kansas City's Investment Narrative?

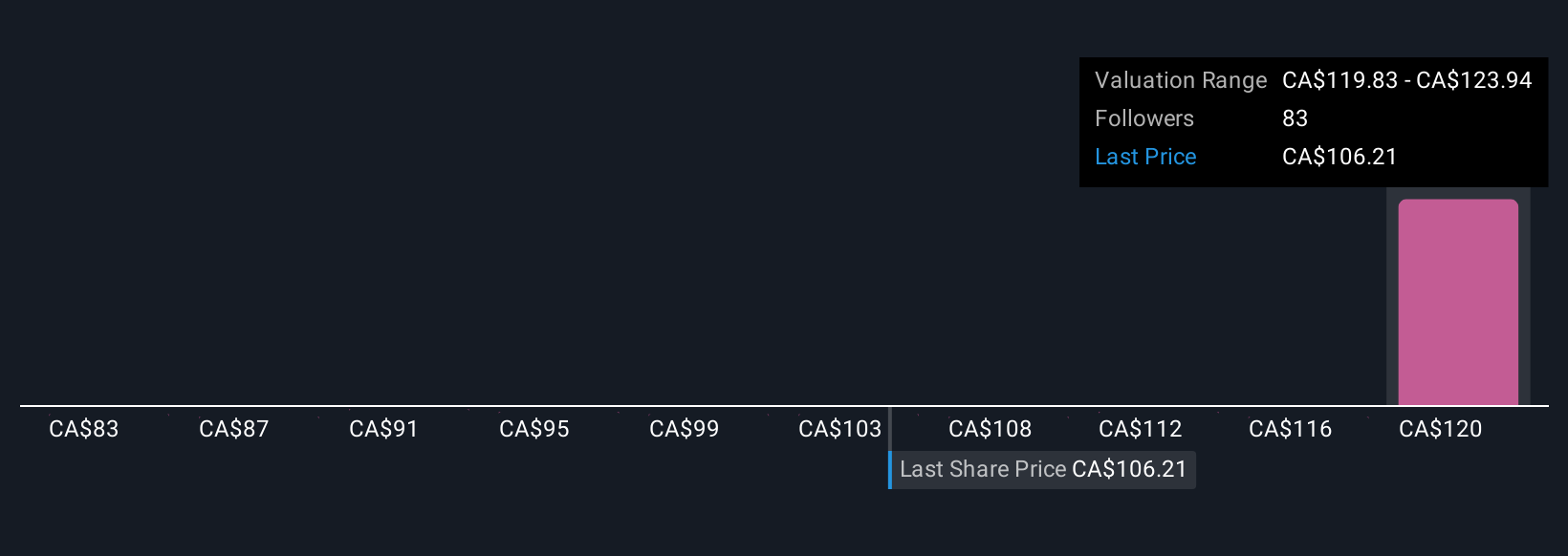

To be a shareholder in Canadian Pacific Kansas City (CPKC), you need to believe in its role as a North American rail freight leader and its ability to leverage a unique cross-border network between Canada, the US, and Mexico. The latest earnings showed solid revenue and net income growth, with rising EPS and the completion of a multi-billion dollar share buyback program. These results reinforce CPKC’s capital discipline and suggest the short-term catalysts remain centered on operating efficiency, volume growth, and network integration, none of which appear meaningfully affected by the recent news. However, the company’s vocal opposition to the pending Union Pacific–Norfolk Southern merger makes the competitive environment a risk worth watching. While new investments like the Kansas City hub could help counter industry headwinds, elevated competition and execution risk could shape outcomes in the months ahead.

But while recent performance builds confidence, shifting industry dynamics could challenge even established players.

Exploring Other Perspectives

Explore 6 other fair value estimates on Canadian Pacific Kansas City - why the stock might be worth 8% less than the current price!

Build Your Own Canadian Pacific Kansas City Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Canadian Pacific Kansas City research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Canadian Pacific Kansas City research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Canadian Pacific Kansas City's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CP

Canadian Pacific Kansas City

Owns and operates a transcontinental freight railway in Canada, the United States, and Mexico.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives