- Canada

- /

- Transportation

- /

- TSX:CP

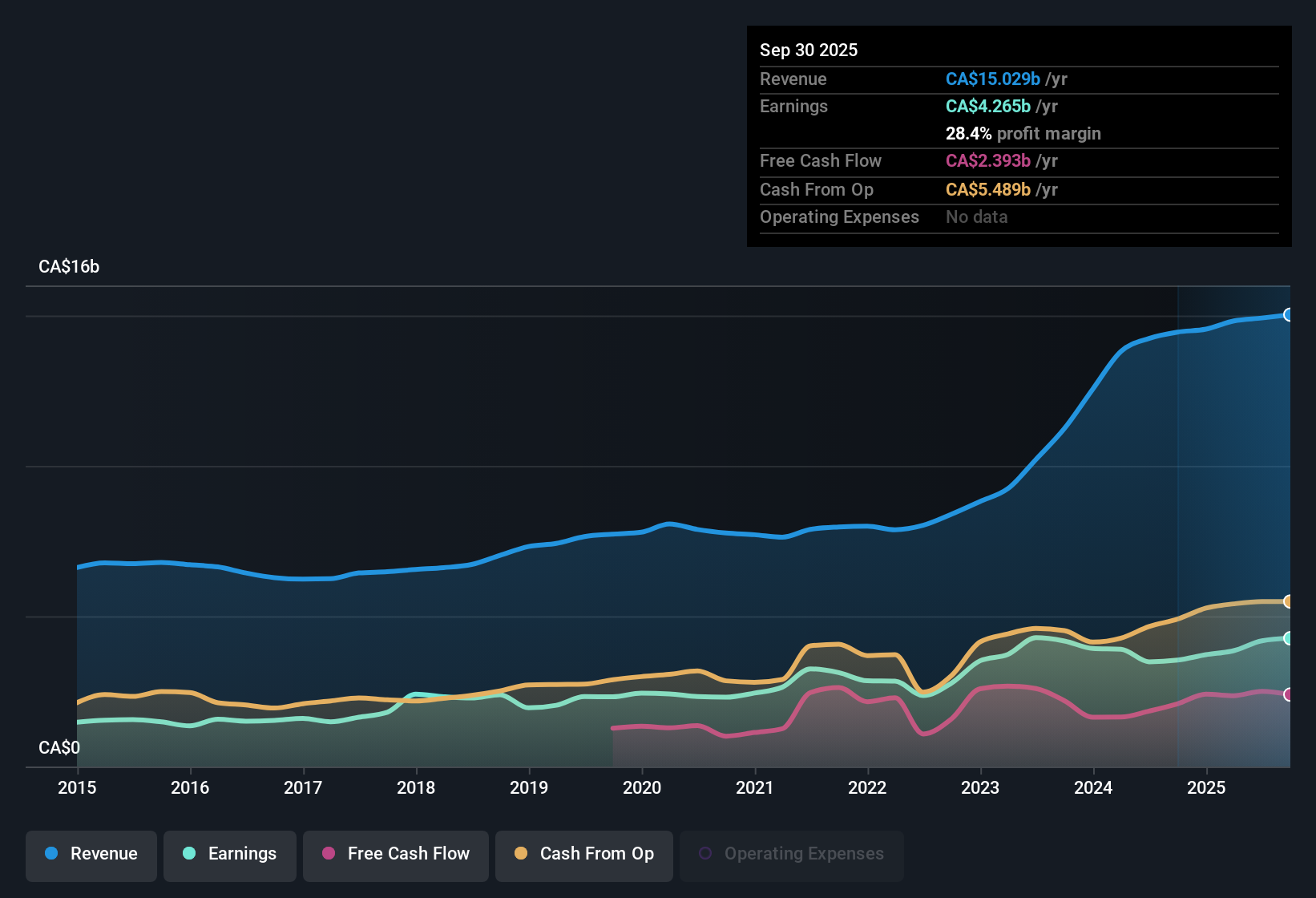

Canadian Pacific Kansas City (TSX:CP) Profit Margin Jump Reinforces Bullish Narratives

Reviewed by Simply Wall St

Canadian Pacific Kansas City (TSX:CP) posted a net profit margin of 28.4%, a notable jump from last year’s 24.5%. Earnings for the year surged by 20.5%, doubling the pace of the company’s own five-year average growth. With profit margins climbing higher and earnings growth outpacing historical trends, investors may see this as a sign of an improving outlook supported by steady expansion and a valuation that stands below the broader North American Transportation industry benchmark.

See our full analysis for Canadian Pacific Kansas City.Next, we will review how these new results compare with market narratives and what the community is saying about Canadian Pacific Kansas City’s performance.

Curious how numbers become stories that shape markets? Explore Community Narratives

Forecasts Point to Moderate Revenue and Earnings Expansion

- Annual revenue is projected to grow by 5.5% with earnings expected to rise at 6.34% per year. Both forward estimates, although positive, suggest that earnings expansion could trail broader Canadian market averages.

- Bulls highlight the value of ongoing profit and revenue growth supported by the company’s unique North American rail footprint.

- The projected earnings growth rate of 6.34% outpaces historical averages, reinforcing the positive case that profit expansion is sustainable beyond just a one-off year.

- However, consensus notes the growth rate is not as aggressive as some sector peers, potentially tempering the more ambitious bullish expectations for outsized upside.

Profit Margins Remain Favorable Versus History

- Net profit margin has climbed to 28.4% compared to 24.5% last year. This sharp annual improvement deepens the company’s buffer for future investments and operational volatility.

- The prevailing market view underscores how these resilient margins back up the strategic narrative built around North American integration.

- Investors see the high margins as providing a margin of safety and flexibility to navigate cross-border operational changes.

- What stands out is that this progress in profitability comes even as overall earnings growth is projected to moderate slightly, showing the ability to defend strong margin levels in a shifting landscape.

Valuation Offers Selective Discount to Industry and Peers

- The current Price-to-Earnings Ratio of 21.9x places Canadian Pacific Kansas City below the North American Transportation industry average (22.6x), but modestly above the peer average (20.4x). This suggests investors may see a relative value opportunity compared to the broader industry.

- The prevailing market view notes that while valuation is at a slight premium to peers, the discount versus the wider industry could reflect market confidence in the company’s cross-border trade positioning.

- This pricing aligns with the company trading below its estimated fair value, an additional marker that may appeal to value-oriented investors tracking both industry and peer group benchmarks.

- Still, the premium to direct peers signals the market is watching for the company to convert strategic advantages into steady, above-average growth.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Canadian Pacific Kansas City's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Canadian Pacific Kansas City’s projected earnings growth lags sector peers, some investors may want faster-growing opportunities. If you want stronger profit expansion and market-beating growth rates, check out high growth potential stocks screener (57 results) for established companies set to deliver robust results over the coming years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CP

Canadian Pacific Kansas City

Owns and operates a transcontinental freight railway in Canada, the United States, and Mexico.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives