A Look at Cargojet (TSX:CJT) Valuation Following New CEO Appointment and Europe Expansion Plans

Reviewed by Simply Wall St

Cargojet (TSX:CJT) is making headlines with two key updates: a major leadership transition and new air cargo service into Europe. Longtime executive Pauline Dhillon will step up as sole CEO as the company pursues further international expansion.

See our latest analysis for Cargojet.

The past year has been challenging for Cargojet shareholders, with a 1-year total shareholder return of -48.16% and the share price down 36.87% year-to-date. Recent results and leadership transitions have set the stage for strategic shifts. However, short-term momentum remains weak as the market processes mixed quarterly performance and uncertainty about sector recovery.

If you’re watching for companies with strong leadership and growth potential, this could be a great moment to broaden your search and explore fast growing stocks with high insider ownership

With shares trading at a substantial discount to analyst targets and new strategies on the table, the key question for investors is whether Cargojet is currently undervalued or if the market has already factored in future growth prospects.

Most Popular Narrative: 42.9% Undervalued

Cargojet's most widely followed narrative sees considerable upside, with a fair value significantly above the last closing price of CA$68.81. This narrative brings optimism amid recent price drops and uncertain short-term sentiment.

The company's dominant overnight air network in Canada and an expanding international footprint, including China-scheduled charters and growth agreements with DHL, position Cargojet to capitalize on shifting global trade patterns and new route opportunities. This helps diversify and potentially increase revenue streams over the long term.

What hidden variables could justify such a high fair value? This narrative leans on bold shifts in revenue mix, far-reaching partnerships, and aggressive margin evolution. The real question is whether you are ready to uncover the critical financial levers driving this bullish target.

Result: Fair Value of $120.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Cargojet’s dependence on major contracts and ongoing profitability pressures could quickly derail this outlook if conditions deteriorate or if key partnerships falter.

Find out about the key risks to this Cargojet narrative.

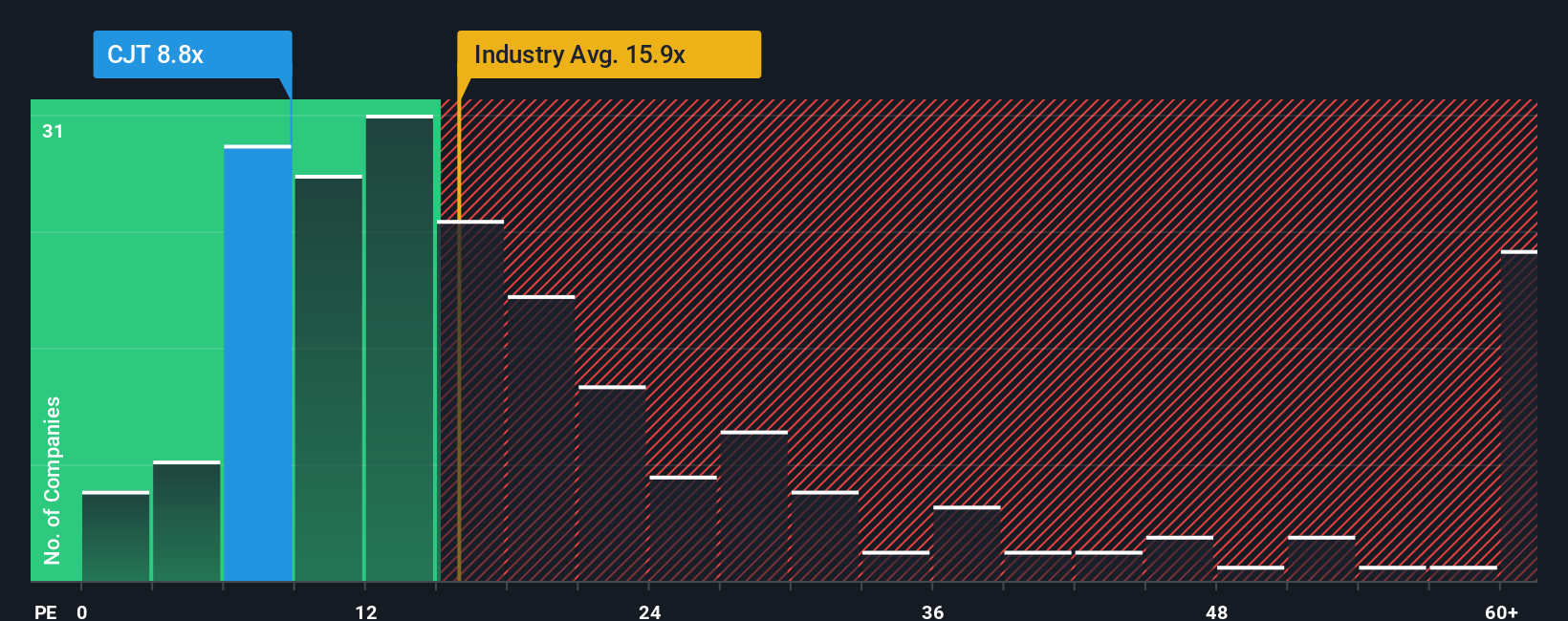

Another View: Market Ratios Signal Caution

While the earlier valuation points to significant upside, a closer look at the company's price-to-earnings ratio offers a different angle. Cargojet trades at 8.3x, which is a much better value than both the industry average (16.2x) and its peers (16.8x). However, it is still expensive if the market pivots toward its fair ratio of 5.6x. This gap could represent either an opportunity or a warning sign. Will the market keep rewarding Cargojet’s current multiple, or will it revert to a fairer value?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cargojet for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 857 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cargojet Narrative

If you see the numbers differently or want to dive into your own analysis, you can easily craft your personal thesis in just a few minutes. Do it your way

A great starting point for your Cargojet research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Give yourself an edge by branching out into new sectors and themes. The smartest investors jump on fresh trends before most even notice them. Don’t get left behind by missing out on these handpicked opportunities:

- Tap into high-yield potential with these 15 dividend stocks with yields > 3% delivering consistent returns even when markets get choppy.

- Seize your chance to invest in market innovation by reviewing these 25 AI penny stocks at the forefront of artificial intelligence breakthroughs.

- Capitalize on hidden value and strengthen your portfolio by evaluating these 857 undervalued stocks based on cash flows that other investors haven’t spotted yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CJT

Cargojet

Provides time-sensitive overnight air cargo services and carries in Canada.

Solid track record average dividend payer.

Market Insights

Community Narratives