- Canada

- /

- Marine and Shipping

- /

- TSX:ALC

3 Promising Undervalued Small Caps With Insider Action In Global Markets

Reviewed by Simply Wall St

In a week marked by the Federal Reserve's decision to cut interest rates for the first time this year, small-cap stocks experienced a notable rally, with the Russell 2000 Index gaining 2.16%. This shift in monetary policy has created an environment where smaller companies, often more sensitive to interest rate changes, may present intriguing opportunities for investors. In such a dynamic market landscape, identifying promising small-cap stocks involves looking for those with solid fundamentals and potential growth catalysts that align well with current economic conditions.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 17.4x | 4.4x | 11.45% | ★★★★☆☆ |

| East West Banking | 3.3x | 0.8x | 14.42% | ★★★★☆☆ |

| GDI Integrated Facility Services | 18.8x | 0.3x | 1.94% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 44.39% | ★★★★☆☆ |

| Sagicor Financial | 7.6x | 0.4x | -80.82% | ★★★★☆☆ |

| Daiwa House Logistics Trust | 13.4x | 7.0x | 10.46% | ★★★★☆☆ |

| GURU Organic Energy | NA | 4.4x | 48.18% | ★★★☆☆☆ |

| Pizu Group Holdings | 13.9x | 1.3x | 34.10% | ★★★☆☆☆ |

| Morguard North American Residential Real Estate Investment Trust | 6.7x | 1.8x | 19.09% | ★★★☆☆☆ |

| CVS Group | 46.9x | 1.4x | 35.63% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

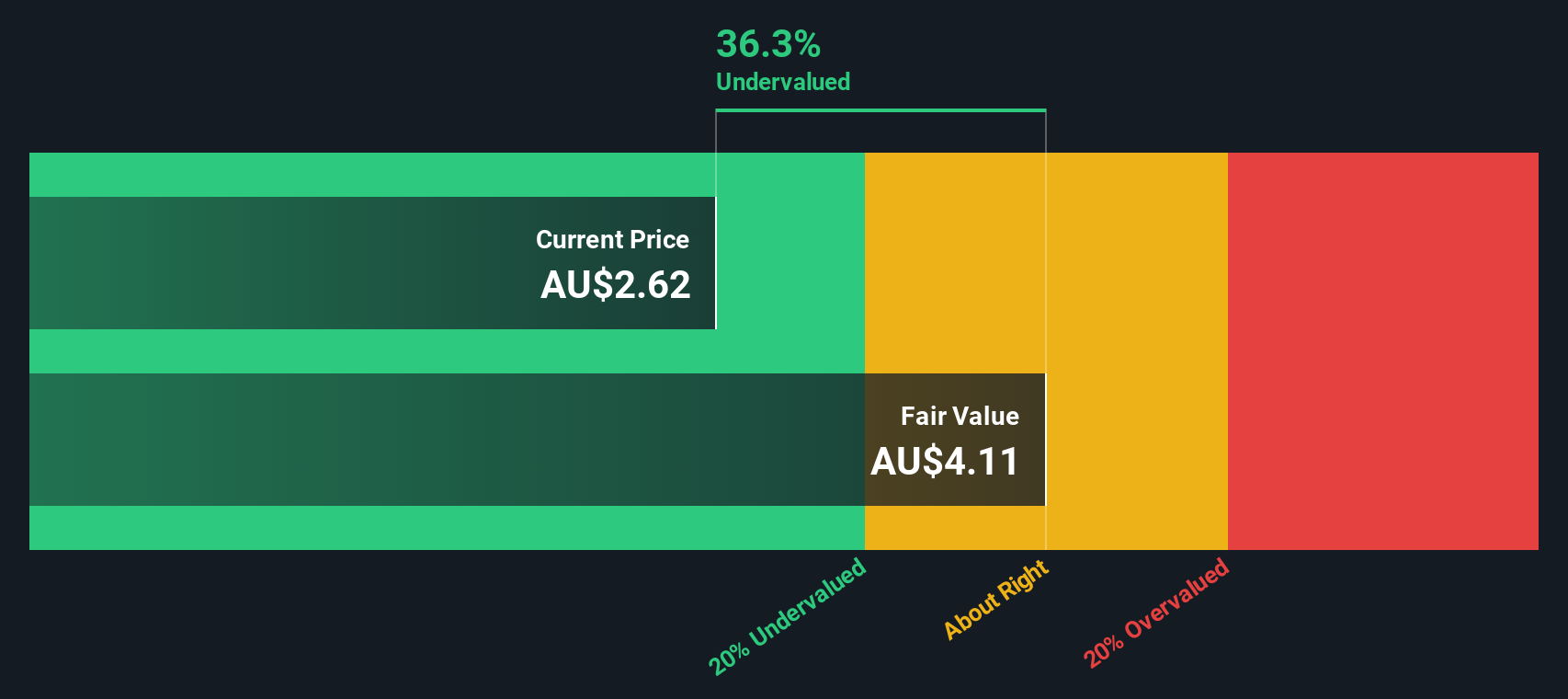

Waypoint REIT (ASX:WPR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Waypoint REIT is a real estate investment trust focusing on fuel and convenience retail investment properties, with a market cap of A$2.57 billion.

Operations: The company generates revenue primarily from its fuel and convenience retail investment properties, with a recent gross profit margin reaching 100%. Operating expenses have been consistently low, while non-operating expenses have shown significant fluctuations over the periods.

PE: 10.4x

Waypoint REIT, a smaller player in the real estate sector, recently raised its earnings guidance for 2025, expecting distributable earnings per security of A$0.1664. Despite a slight dip in sales to A$81.9 million for H1 2025 compared to last year, net income surged to A$137.1 million from A$93.3 million due to improved operational efficiency. Insider confidence is evident with recent share purchases by executives earlier this year, signaling potential value recognition amidst forecasted earnings declines over the next three years.

- Unlock comprehensive insights into our analysis of Waypoint REIT stock in this valuation report.

Examine Waypoint REIT's past performance report to understand how it has performed in the past.

Hays (LSE:HAS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Hays is a global recruitment company specializing in qualified, professional, and skilled recruitment services with a market cap of approximately £1.86 billion.

Operations: Hays generates revenue primarily from its Qualified, Professional and Skilled Recruitment segment, amounting to £6.61 billion as of the latest reporting period. The company's cost structure includes a significant portion allocated to Cost of Goods Sold (COGS), which was £6.36 billion in the most recent data point. Notably, Hays' gross profit margin has shown variability over time, with a recent figure at 3.78%.

PE: -109.3x

Hays, a smaller company in the recruitment industry, recently reported a decline in sales to £6.6 billion for the year ending June 30, 2025, with a net loss of £7.8 million. Despite these challenges, insider confidence is evident as Dirk Hahn increased their shareholding by 124%, purchasing shares worth approximately £224K. This move suggests belief in future growth prospects, supported by an anticipated earnings growth of over 82% annually despite reliance on higher-risk external funding sources.

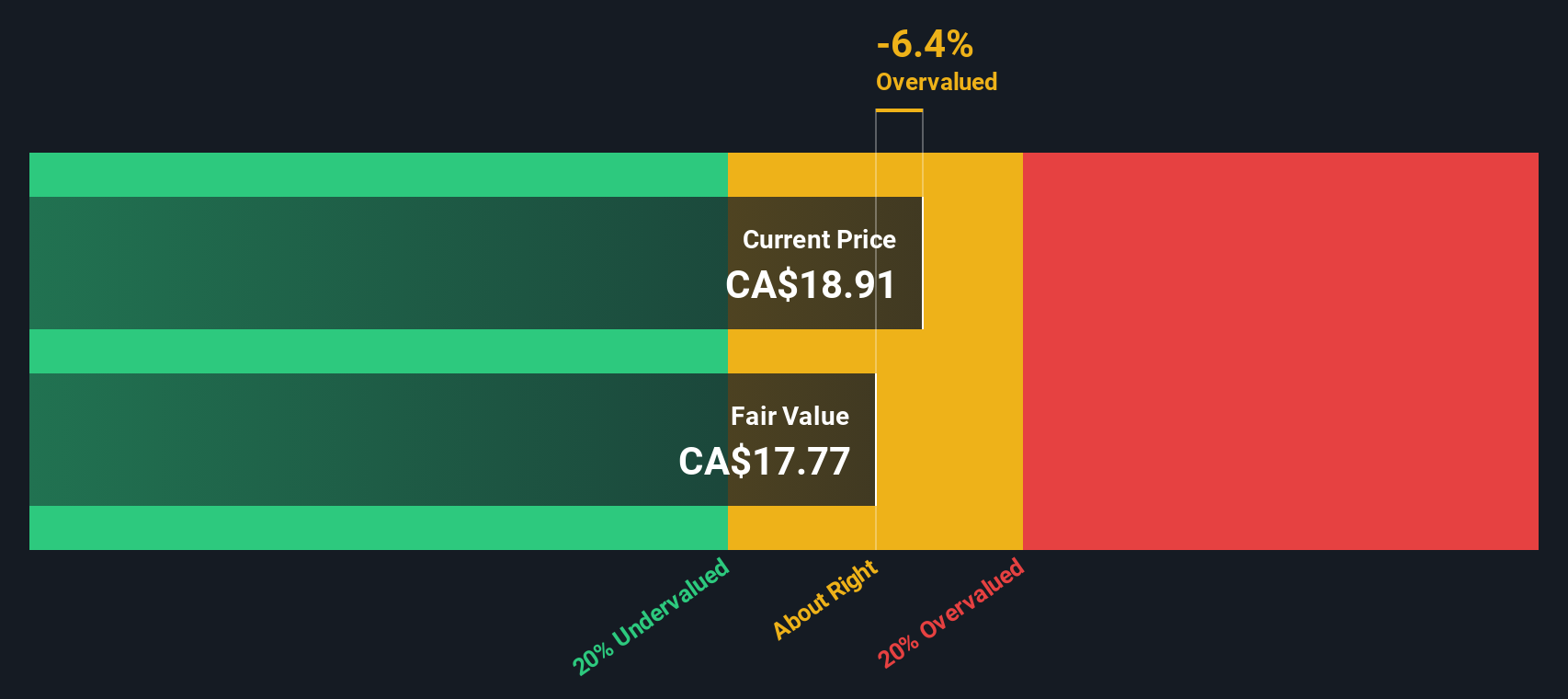

Algoma Central (TSX:ALC)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Algoma Central operates in the shipping industry, focusing on product tankers, domestic dry-bulk, and ocean self-unloaders, with a market capitalization of CA$0.75 billion.

Operations: Algoma Central's revenue is primarily derived from its Domestic Dry-Bulk and Ocean Self-Unloaders segments, with additional contributions from Product Tankers. The company's gross profit margin has shown variability, reaching as high as 33.71% in recent periods. Operating expenses are a significant cost component, consistently exceeding CA$100 million each quarter.

PE: 6.7x

Algoma Central, a smaller company in the shipping industry, recently showcased promising financial performance. For Q2 2025, sales reached C$211.72 million, up from C$180.97 million the previous year, while net income rose to C$32.88 million from C$17.46 million. Despite relying on external borrowing for funding—considered higher risk—the company's earnings per share improved significantly to C$0.81 from last year's C$0.44, reflecting strong operational results amidst its financial structure challenges.

- Click here to discover the nuances of Algoma Central with our detailed analytical valuation report.

Evaluate Algoma Central's historical performance by accessing our past performance report.

Summing It All Up

- Navigate through the entire inventory of 106 Undervalued Global Small Caps With Insider Buying here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ALC

Algoma Central

Owns and operates a fleet of dry and liquid bulk carriers activities in Canada.

Solid track record second-rate dividend payer.

Market Insights

Community Narratives