The Bull Case For Air Canada (TSX:AC) Could Change Following New Free Inflight Perks and Route Expansion

Reviewed by Sasha Jovanovic

- In recent weeks, Air Canada has unveiled new complimentary beer, wine, and Canadian snacks for economy class passengers and announced expanded non-stop and transborder routes, including year-round Ottawa-London Heathrow flights and increased U.S.-Canada connectivity beginning in Summer 2026.

- This move makes Air Canada the only North American legacy airline to offer free alcohol in economy class on all flights, highlighting a push to distinguish its offerings and enhance customer loyalty as competition intensifies across key international and transborder markets.

- We'll explore how Air Canada's distinctive focus on inflight perks and expanded global routes could influence its long-term investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Air Canada Investment Narrative Recap

Investors interested in Air Canada’s long-term story need to believe the company can sustain growth through international expansion, operational efficiency, and differentiated passenger experience despite ongoing profit pressures. The recent earnings guidance, which factors in significant one-time pension and labor charges, does not appear to materially change the central short-term catalyst for the stock, growing international connectivity and capturing premium travel demand, nor does it mitigate the most pressing risk, which is continued margin pressure from rising labor costs.

Among the announcements, the extension of Ottawa-London Heathrow flights to year-round service stands out as particularly consequential, reinforcing Air Canada’s commitment to global connectivity and potentially supporting momentum in high-value international routes. This aligns closely with the focus on international network growth, which remains a primary driver of top-line expansion, but it is worth noting that it does not directly address the challenge of elevated labor expenses eating into profitability.

In contrast, investors should be aware that ongoing labor negotiations remain unresolved and could still pose…

Read the full narrative on Air Canada (it's free!)

Air Canada's outlook anticipates CA$26.3 billion in revenue and CA$869.3 million in earnings by 2028. This scenario is based on a 5.6% annual revenue growth rate, but earnings are expected to decrease by CA$630.7 million from the current CA$1.5 billion.

Uncover how Air Canada's forecasts yield a CA$24.89 fair value, a 36% upside to its current price.

Exploring Other Perspectives

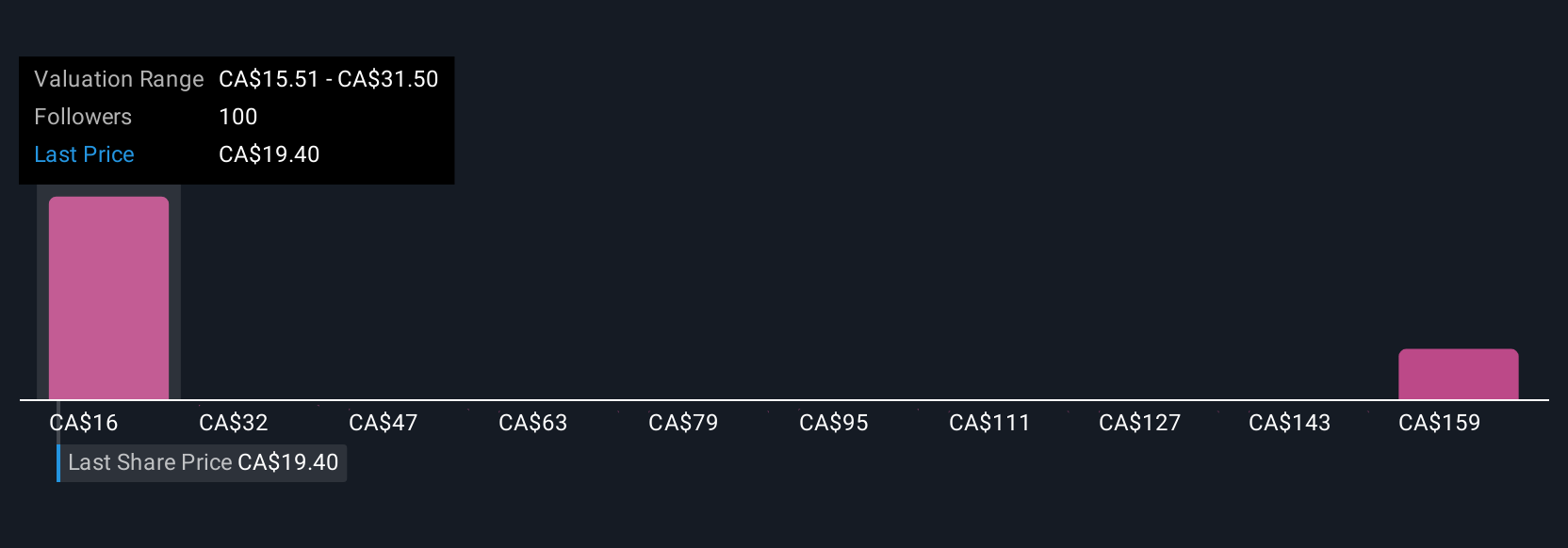

Simply Wall St Community members value Air Canada between CA$15.51 and CA$173.12, based on 11 independent forecasts. With wide-ranging opinions on fair value, many analysts are focused on international expansion as a critical catalyst shaping future performance.

Explore 11 other fair value estimates on Air Canada - why the stock might be worth over 9x more than the current price!

Build Your Own Air Canada Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Air Canada research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Air Canada research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Air Canada's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AC

Air Canada

Provides domestic, U.S. transborder, and international airline services.

Very undervalued with low risk.

Similar Companies

Market Insights

Community Narratives