Should Air Canada’s Operational Halt and Forced Arbitration Reshape TSX:AC Investors’ Margin Expectations?

Reviewed by Simply Wall St

- On August 16, 2025, Air Canada suspended all operations of Air Canada and Air Canada Rouge following a strike by its 10,000 flight attendants represented by the Canadian Union of Public Employees, with the federal government intervening just hours later to impose binding arbitration and halt the labor action.

- This unprecedented government intervention highlights the intense labor pressures Air Canada faces and underscores the significant operational and reputational risks tied to unresolved workforce disputes.

- We'll explore how the forced arbitration and network disruption challenge Air Canada's margin outlook and future cost structure.

AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Air Canada Investment Narrative Recap

To have conviction in Air Canada as a shareholder, you need to believe in the airline’s ability to manage continual international travel demand while maintaining cost discipline despite rising labor expenses. The recent government-imposed binding arbitration following a full network shutdown underscores how labor relations have become both the company’s top short-term risk and catalyst, with the potential to materially impact both cost structure and operational stability in the coming quarters.

Of the recent developments, the August 16 suspension of all Air Canada and Rouge flights, affecting 130,000 customers daily, is the most relevant, as it directly reflects the scale of risk presented by labor conflict, overshadowing other product and route expansion catalysts for now. This disruption, combined with government intervention, marks a turning point in how workforce-management challenges might weigh on the company’s cost outlook and reputation moving forward.

In sharp contrast to industry optimism, the company’s high reliance on harmonious labor relations could bring sudden, material downside if disputes escalate or remain unresolved…

Read the full narrative on Air Canada (it's free!)

Air Canada's outlook sees revenues reaching CA$26.3 billion and earnings at CA$877.4 million by 2028. This scenario assumes annual revenue growth of 5.6%, but an earnings decrease of CA$622.6 million from the current CA$1.5 billion.

Uncover how Air Canada's forecasts yield a CA$25.62 fair value, a 30% upside to its current price.

Exploring Other Perspectives

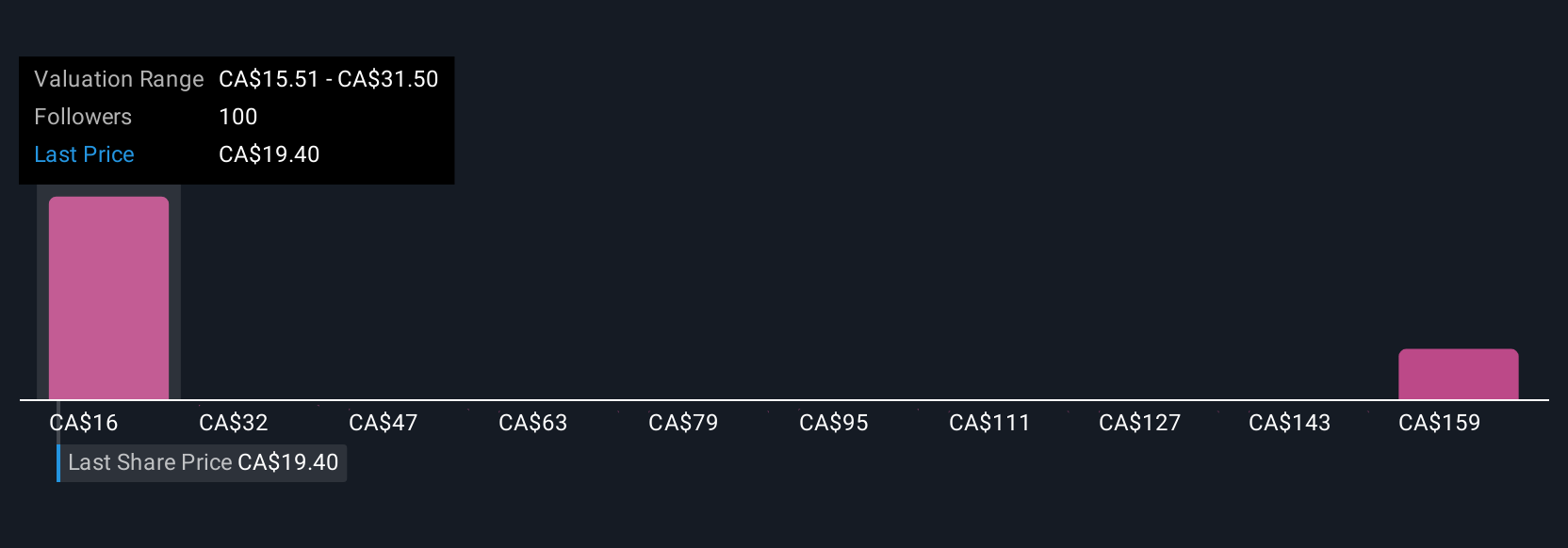

Simply Wall St Community members place Air Canada’s fair value anywhere from CA$15.51 to CA$175.45, drawing from 11 distinct forecasts. With labor costs surging and operational disruptions making headlines, it’s clear opinions on the company’s future can differ as much as CA$160, inviting you to consider alternative outlooks.

Explore 11 other fair value estimates on Air Canada - why the stock might be worth over 8x more than the current price!

Build Your Own Air Canada Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Air Canada research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Air Canada research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Air Canada's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 28 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AC

Air Canada

Provides domestic, U.S. transborder, and international airline services.

Very undervalued with low risk.

Similar Companies

Market Insights

Community Narratives