Air Canada (TSX:AC): Does the Market Undervalue the Airline’s Growth Potential?

Reviewed by Simply Wall St

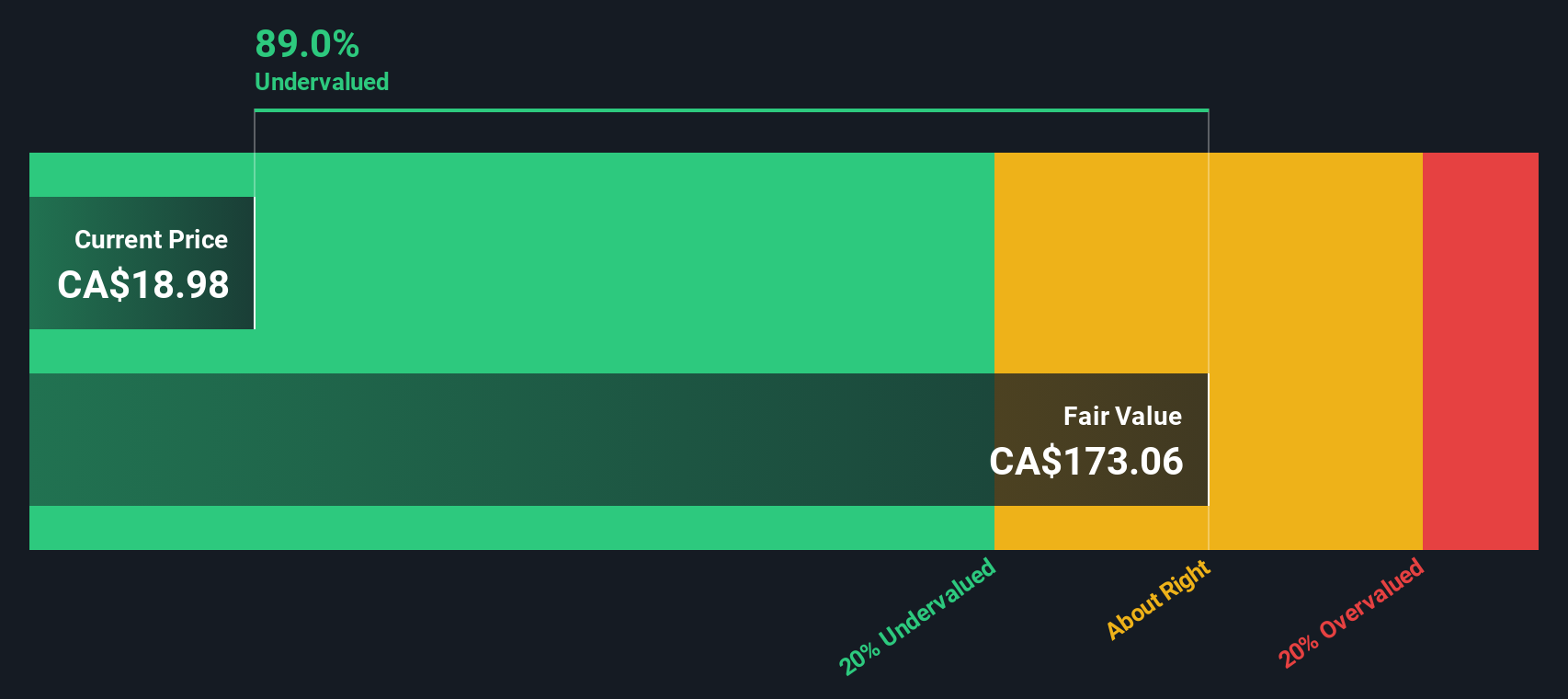

Most Popular Narrative: 25% Undervalued

According to the most widely followed valuation narrative, Air Canada is currently trading at a significant discount to its fair value. This suggests that the market may be underestimating the company’s potential or overlooking key drivers of future growth.

Aggressive international long-haul network expansion, notably into Latin America, Europe, and Southeast Asia, along with successful development of sixth freedom traffic, positions Air Canada to capture a larger share of connecting global passengers. This supports both top-line growth and load factor resilience.

Curious what’s fueling such a bold fair value gap? Analysts’ projections rely on a growth blueprint that could drastically reshape Air Canada’s profit engine in a few short years. Interested in which pieces of the puzzle have the biggest impact on that price target? Find out what assumptions make this valuation stand out from the market’s view.

Result: Fair Value of $25.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent labor cost increases and intense competition on international routes could quickly weaken the case for Air Canada being undervalued.

Find out about the key risks to this Air Canada narrative.Another View: What Does Our DCF Model Say?

Looking at Air Canada through the lens of our DCF model paints an even starker picture of undervaluation. This approach weighs future cash flows rather than just today's multiples, which highlights what the market might be missing. Is the market mispricing Air Canada's potential, or does it know something the numbers don’t?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Air Canada for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Air Canada Narrative

If you see things differently or want to put your own view to the test, you can craft a custom narrative using our simple tools in just a few minutes. Do it your way

A great starting point for your Air Canada research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take the reins on your portfolio and access the market's next big winners. If you’re serious about staying ahead, these powerful screens are where you start:

- Pinpoint undervalued opportunities by using our tool for undervalued stocks based on cash flows and ensure you never miss stocks trading below their real worth.

- Target reliable income streams with dividend stocks with yields > 3% and spot companies offering strong dividend yields above 3 percent for your portfolio’s growth and stability.

- Tap into the future of medicine with healthcare AI stocks, where innovation in healthcare meets artificial intelligence to reveal leaders in cutting-edge treatments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AC

Air Canada

Provides domestic, U.S. transborder, and international airline services.

Very undervalued with low risk.

Similar Companies

Market Insights

Community Narratives