We Wouldn't Be Too Quick To Buy TELUS Corporation (TSE:T) Before It Goes Ex-Dividend

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that TELUS Corporation (TSE:T) is about to go ex-dividend in just four days. The ex-dividend date is usually set to be one business day before the record date which is the cut-off date on which you must be present on the company's books as a shareholder in order to receive the dividend. The ex-dividend date is important as the process of settlement involves two full business days. So if you miss that date, you would not show up on the company's books on the record date. This means that investors who purchase TELUS' shares on or after the 9th of December will not receive the dividend, which will be paid on the 4th of January.

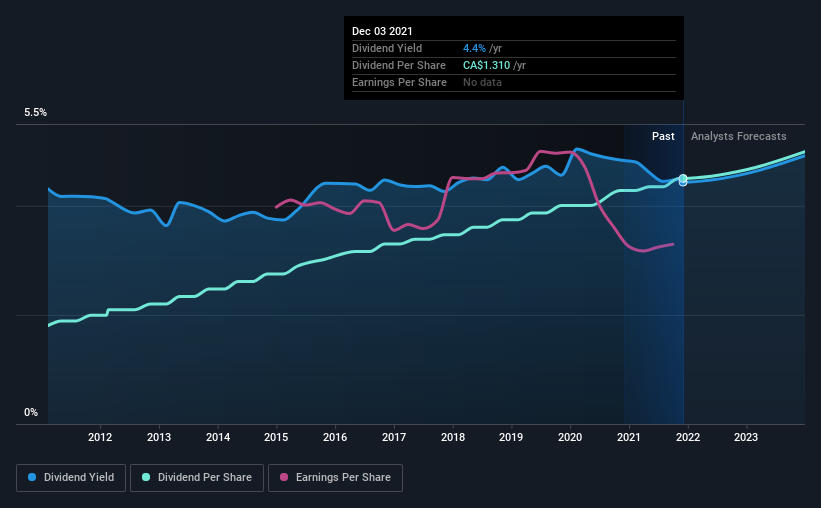

The company's next dividend payment will be CA$0.33 per share. Last year, in total, the company distributed CA$1.31 to shareholders. Based on the last year's worth of payments, TELUS stock has a trailing yield of around 4.4% on the current share price of CA$29.53. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

See our latest analysis for TELUS

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. TELUS distributed an unsustainably high 131% of its profit as dividends to shareholders last year. Without extenuating circumstances, we'd consider the dividend at risk of a cut. A useful secondary check can be to evaluate whether TELUS generated enough free cash flow to afford its dividend. The company paid out 105% of its free cash flow over the last year, which we think is outside the ideal range for most businesses. Companies usually need cash more than they need earnings - expenses don't pay themselves - so it's not great to see it paying out so much of its cash flow.

Cash is slightly more important than profit from a dividend perspective, but given TELUS's payments were not well covered by either earnings or cash flow, we are concerned about the sustainability of this dividend.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. So we're not too excited that TELUS's earnings are down 4.0% a year over the past five years.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. TELUS has delivered 9.6% dividend growth per year on average over the past 10 years. That's intriguing, but the combination of growing dividends despite declining earnings can typically only be achieved by paying out a larger percentage of profits. TELUS is already paying out 131% of its profits, and with shrinking earnings we think it's unlikely that this dividend will grow quickly in the future.

To Sum It Up

Is TELUS worth buying for its dividend? It's looking like an unattractive opportunity, with its earnings per share declining, while, paying out an uncomfortably high percentage of both its profits (131%) and cash flow as dividends. This is a clearly suboptimal combination that usually suggests the dividend is at risk of being cut. If not now, then perhaps in the future. It's not an attractive combination from a dividend perspective, and we're inclined to pass on this one for the time being.

With that in mind though, if the poor dividend characteristics of TELUS don't faze you, it's worth being mindful of the risks involved with this business. We've identified 3 warning signs with TELUS (at least 1 which doesn't sit too well with us), and understanding these should be part of your investment process.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

Valuation is complex, but we're here to simplify it.

Discover if TELUS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:T

TELUS

Provides a range of telecommunications and information technology products and services in Canada.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026