TELUS (TSX:T) Valuation in Focus as Share Performance Remains Flat

Reviewed by Kshitija Bhandaru

TELUS (TSX:T) shares have shown modest movement this week, edging up about 0.6% in the latest session. Investors appear to be weighing recent price changes alongside the company’s longer-term performance, particularly as the telecom sector faces ongoing shifts.

See our latest analysis for TELUS.

While TELUS’s share price has seen limited movement recently, the company’s momentum has been slower overall, with a flat trajectory this year and a 1-year total shareholder return of just 0.07%. That signals investors remain cautious amid sector-wide change and ongoing questions about future growth rates.

If you’re exploring other opportunities while telecoms recalibrate, consider broadening your view with fast growing stocks with high insider ownership.

With shares trading just below analyst price targets and only modest gains this year, the question remains: is TELUS undervalued at current levels, or is the market already accounting for its future prospects?

Most Popular Narrative: 6% Undervalued

With TELUS’s narrative fair value set at CA$23.38, which is roughly 6% above the last close, investors see just enough upside to provoke debate about the company’s next phase. Supporters cite new business lines and digital expansion as key to future value, but this comes with bold assumptions, as the quote below reveals.

Sustained investment in network modernization, with a $2B commitment to expand broadband in key markets and asset monetization through the Terrion tower partnership, should drive high incremental returns, operational efficiencies, and deleveraging, resulting in improving free cash flow and net margin expansion as capital intensity moderates.

Want to know the growth blueprint behind this high valuation? The key element is betting on a profit transformation as network modernization unlocks new levels of earnings efficiency. Wondering what numbers drive this target? Dive in and uncover the intriguing forecasts and assumptions the narrative is built on.

Result: Fair Value of $23.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent competitive pressures or heavier-than-expected capital requirements could quickly challenge TELUS's growth narrative and affect its future profitability expectations.

Find out about the key risks to this TELUS narrative.

Another View: Multiples Suggest a Steep Price

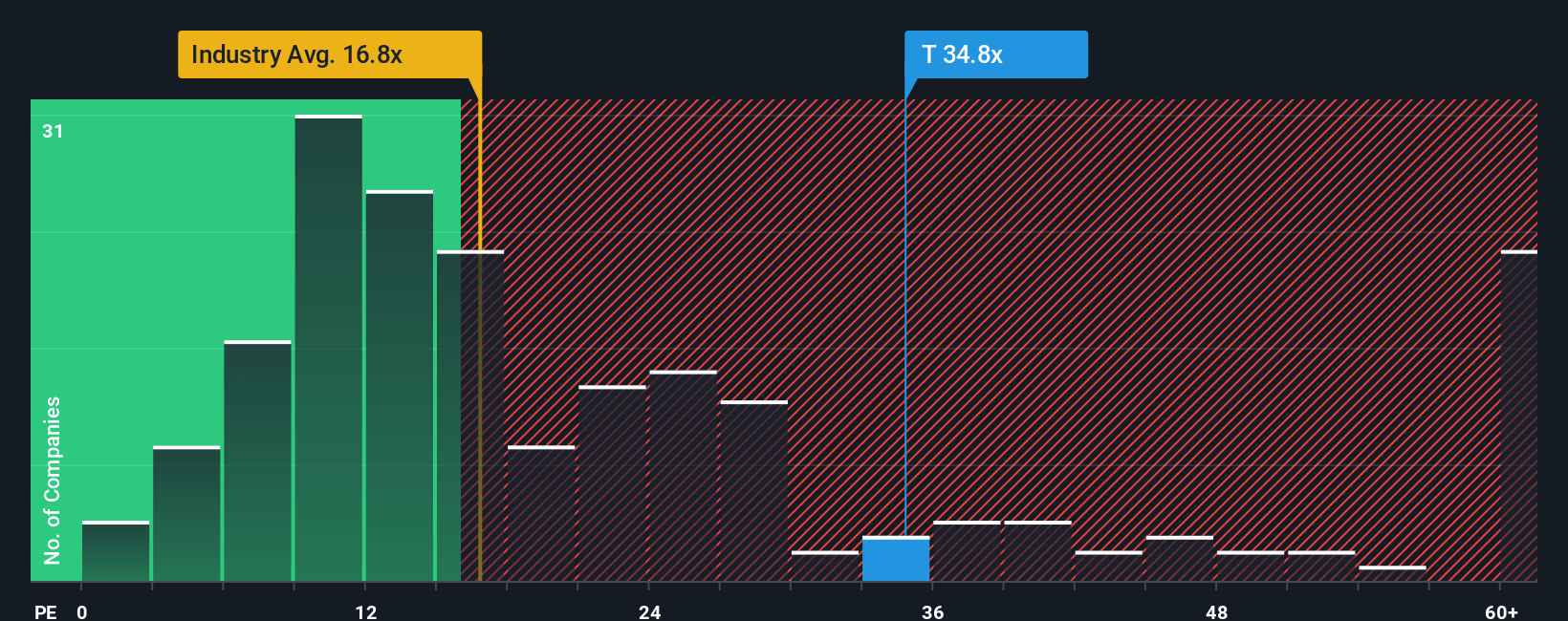

Looking at TELUS through the lens of the price-to-earnings ratio reveals a different picture. At 34.6 times earnings, TELUS trades well above the global telecom industry’s 16.8 times and even its peer average of 24.6. The fair ratio for TELUS could be closer to 17.8, which highlights a notable valuation risk if the market shifts expectations. Could the current premium unravel, or is TELUS set to keep justifying it?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TELUS Narrative

If you see things differently or have your own perspective, you can dive into the numbers and craft your own story in just a few minutes with Do it your way.

A great starting point for your TELUS research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't stop at TELUS. Set yourself up for smarter decisions by checking out new opportunities guided by unique themes and in-depth data just a step away.

- Capitalize on market shifts by investigating these 900 undervalued stocks based on cash flows that show strong upside potential based on cash flow fundamentals.

- Boost your income strategy with these 19 dividend stocks with yields > 3% offering reliable yields over 3% to help strengthen your portfolio.

- Ride the future of medicine and technology by researching these 31 healthcare AI stocks making breakthroughs in AI-driven healthcare innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TELUS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:T

TELUS

Provides a range of telecommunications and information technology products and services in Canada.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives