TELUS (TSX:T) Valuation After Dividend Growth Pause and Balance Sheet Reset Plans

Reviewed by Simply Wall St

TELUS (TSX:T) just made a clear pivot, pausing its dividend growth plan while rolling out ambitious free cash flow targets and fresh debt offerings. This shift directly reframes how investors should think about the stock.

See our latest analysis for TELUS.

The market reaction has been cautious, with the latest share price at about $18.70 and a 30 day share price return of roughly negative 9.5% adding to a deeper 90 day slide. The 1 year total shareholder return near negative 9.6% shows momentum has been fading despite TELUS pushing hard on free cash flow and balance sheet repair.

If this balance sheet reset has you rethinking your portfolio, it could be a good moment to explore fast growing stocks with high insider ownership as potential fresh ideas beyond the big telecom names.

With the share price lagging even as management targets faster free cash flow growth and deleveraging, investors now face a key question: is TELUS quietly drifting into undervalued territory, or is the market already discounting its future?

Most Popular Narrative: 18.9% Undervalued

With TELUS last closing at CA$18.70 against a narrative fair value near CA$23.06, the story hinges on steady growth meeting a higher required return.

Analysts expect earnings to reach CA$1.5 billion (and earnings per share of CA$0.99) by about September 2028, up from CA$966.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting CA$1.9 billion in earnings, and the most bearish expecting CA$1.3 billion.

Want to see what is powering that earnings lift and premium profit multiple? The narrative quietly leans on measured revenue growth and margin upgrades that might surprise cautious telecom investors.

Result: Fair Value of $23.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps in capital intensive projects, or regulatory decisions that pressure pricing power, could quickly challenge this undervaluation narrative.

Find out about the key risks to this TELUS narrative.

Another View: Multiples Paint a Richer Picture

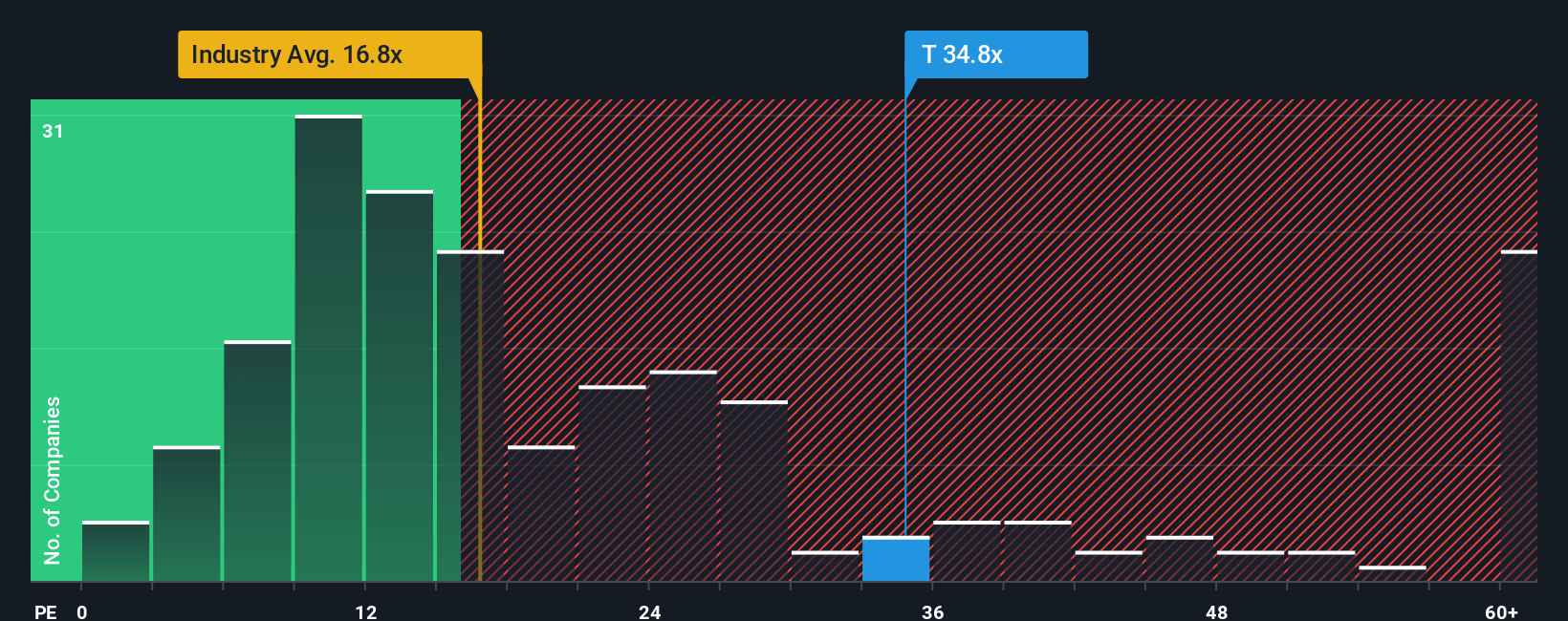

While the narrative fair value suggests TELUS is 18.9% undervalued, its current price to earnings ratio of 24.6 times looks steep beside the global telecom average of 16.3 times, peers at 8.8 times, and a fair ratio of 12.7 times. This raises real valuation risk if sentiment turns.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TELUS Narrative

If the current story does not quite fit your view, dive into the numbers yourself and craft a fresh perspective in minutes, Do it your way.

A great starting point for your TELUS research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider scanning focused, data driven shortlists that surface high conviction stocks in minutes, not months.

- Target potential passive income streams by reviewing these 15 dividend stocks with yields > 3% that can help support your portfolio’s cash flow profile.

- Explore the next wave of innovation by assessing these 26 AI penny stocks positioned at the forefront of intelligent automation and data driven products.

- Identify possible mispriced opportunities by reviewing these 906 undervalued stocks based on cash flows where market expectations may differ from underlying fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TELUS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:T

TELUS

Provides a range of telecommunications and information technology products and services in Canada.

Average dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026