TELUS (TSX:T) Reports Strong Q1 Earnings and Raises Quarterly Dividend by 7%

Reviewed by Simply Wall St

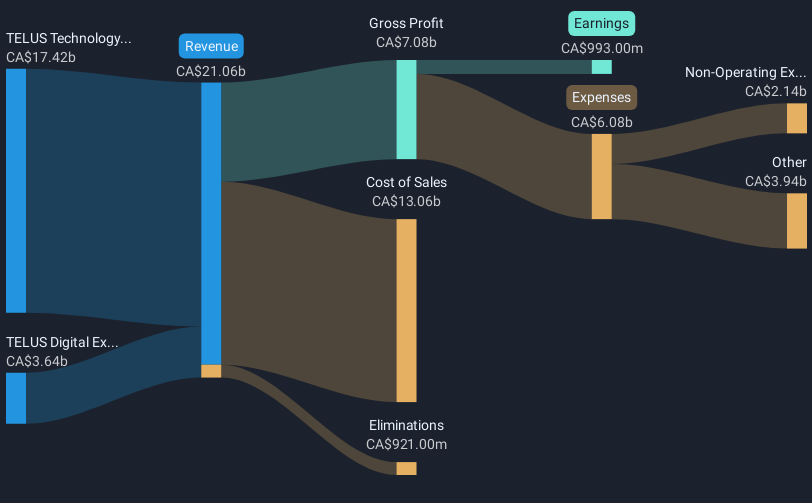

TELUS (TSX:T) recently announced strong Q1 2025 earnings, showing a significant rise in revenue and net income, along with a 7% dividend increase—all indicative of the company's positive performance trajectory. A key factor in TELUS's 12% price increase over the last month may include these announcements, which signal robust organizational health. Further, TELUS's expansion of its PureFibre services and a partnership with Fillip Fleet underscore its commitment to growth and innovation, aligning well with the broader market's increasing trend over the past year, thereby reinforcing investor confidence amid a flat market environment.

Every company has risks, and we've spotted 2 risks for TELUS you should know about.

The recent announcements by TELUS, including strong Q1 2025 earnings and a dividend increase, are likely to bolster the company's growth narrative. The company's efforts in expanding PureFibre services and its partnership with Fillip Fleet align with its strategic initiatives in mobility and fixed services, which are expected to drive future revenue and earnings growth. This news suggests a positive outlook, enhancing forecasts of TELUS's revenue reaching CA$22.1 billion and earnings increasing to CA$2.0 billion with a net margin improvement over the next few years.

Over the past five years, TELUS's total shareholder return, which includes both share price appreciation and dividends, was 29.63%. However, over the past year, TELUS underperformed the Canadian market, which returned 11.2%, indicating some challenges relative to broader market dynamics. In comparison, TELUS outperformed the Canadian Telecom industry, which experienced a 12.5% decline over the same one-year period.

Despite a recent 12% increase in TELUS's share price, the current price of CA$20.99 remains close to the analyst consensus price target of CA$22.78, indicating the market's view of the company as fairly valued. The relatively small gap between the current share price and the target may reflect a consensus expectation of moderate growth. Continued focus on cost efficiency and broadband expansion may still influence TELUS's future performance, but competitive pressures and financial factors could pose risks to achieving forecasted growth targets.

Learn about TELUS' historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade TELUS, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if TELUS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:T

TELUS

Provides a range of telecommunications and information technology products and services in Canada.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives