TELUS (TSX:T) Launches Wi-Fi 7 With Award-Winning Sustainable Design In Canada

Reviewed by Simply Wall St

TELUS (TSX:T) recently launched its next-generation Wi-Fi 7 technology, boasting significant improvements in speed and environmental responsibility, which aligns with its strategy for future technology readiness. This announcement comes amidst other major events, including a substantial partnership with TransUnion to enhance caller ID security and a collaboration with Cogeco, marking TELUS as a key force in these sectors. These activities may have added further support to the company's 5.61% price increase over the last quarter, consistent with broader market trends, as investors remain attracted to technology companies and their product innovations.

Be aware that TELUS is showing 2 risks in our investment analysis.

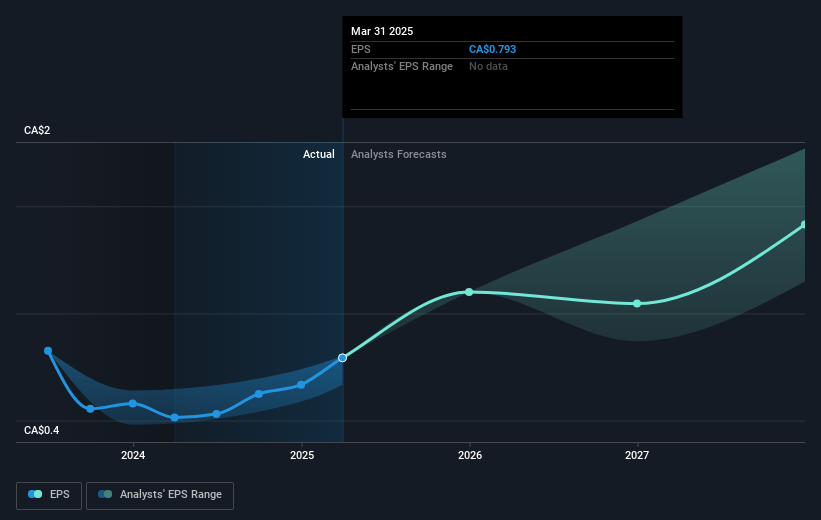

The recent advancements announced by TELUS—including Wi-Fi 7 technology, a partnership with TransUnion, and collaboration with Cogeco—align with the company's diversification strategy and could strengthen its market positioning in technology and security sectors. These developments might further support TELUS's ability to drive future revenue and earnings upwards, continuing the trend of growth in its fixed and mobility services. As these initiatives unfold, analysts' forecasts for revenue growth, previously set at 3.1% annually over the next three years, and an expected increase in profit margins, may see favorable adjustments.

Over a five-year period, TELUS's total shareholder return, which includes share price appreciation and dividends, was 23.38%. This performance provides context to the company's efforts in leveraging its diverse business segments for growth. Comparing to the past year, TELUS has underperformed the broader Canadian market which returned 17.4%, though it has exceeded the Canadian Telecom industry's decline of 11.7% over the same period.

The current share price of CA$22.41 reflects a modest discount to the analyst consensus price target of CA$23.34, indicating a potential upside of about 3.1%. As new projects may bolster analysts' confidence in forecasts, such as achieving CA$2.4 billion in earnings by 2028, the share price movement remains aligned with these future prospects. Investors are advised to consider these developments in context with broader market conditions and industry dynamics.

Review our growth performance report to gain insights into TELUS' future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TELUS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:T

TELUS

Provides a range of telecommunications and information technology products and services in Canada.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives