TELUS (TSX:T) Announces Cash Purchase Terms for Outstanding Notes Worth Over C$5 Billion

Reviewed by Simply Wall St

TELUS (TSX:T) recently announced pricing terms for purchasing its outstanding notes, marking a proactive step in managing its debt and financing strategy, which could have added weight to broader market movements. Over the last quarter, TELUS experienced a 7% increase in its share price, aligning with the market's overall upward momentum. The company reported strong earnings growth, with revenue and net income rising year-over-year, and announced a dividend increase, both contributing positively to investor sentiment. Meanwhile, its strategic network expansions and partnerships potentially bolstered investor confidence, reinforcing the upward trend seen in market indices.

We've identified 2 possible red flags for TELUS that you should be aware of.

Find companies with promising cash flow potential yet trading below their fair value.

The recent announcement by TELUS regarding the pricing terms for purchasing its outstanding notes could influence the company's narrative by reinforcing its proactive debt management. Such financial maneuvers may enhance TELUS's creditworthiness, enabling more favorable conditions for future financing. Given the company's strategic focus on mitigating debt, this action could positively impact its future revenue and earnings forecasts by offering greater financial flexibility, although competitive and macroeconomic challenges remain. The company's efforts in expanding its network and diversifying through health and agriculture sectors are expected to support long-term growth, albeit with execution risks.

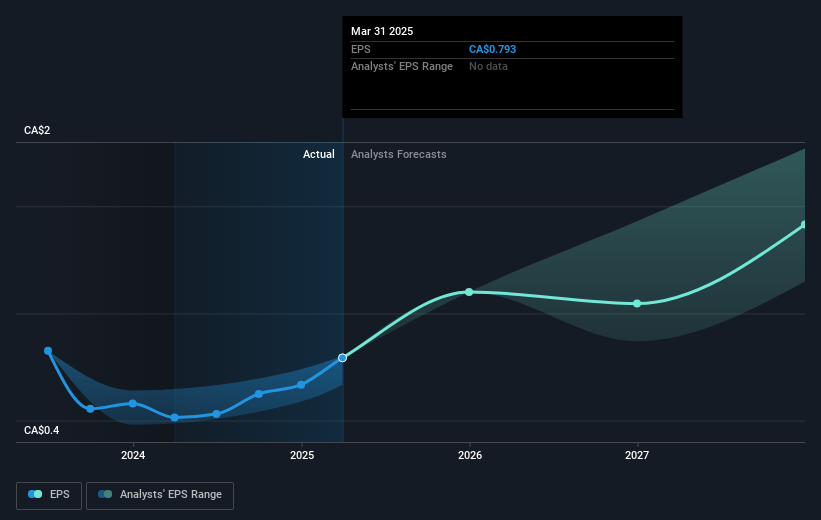

Over a five-year period, TELUS's total returns, including share price and dividends, rose by 28.57%, suggesting a robust long-term performance. In the past year, TELUS surpassed the Canadian Telecom industry's disappointing return of 9.2% while falling short of the Canadian market's 19.7% increase. The company's price stands at CA$20.99, closely mirroring analyst consensus price target of CA$22.78, a marginal 7.9% increase that indicates analysts, on average, view the stock as near fair value presently. Investors are advised to weigh these insights against their perspectives, considering the company's competitive pressures and high debt levels that could constrain profit growth.

Explore historical data to track TELUS' performance over time in our past results report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TELUS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:T

TELUS

Provides a range of telecommunications and information technology products and services in Canada.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives