How a CA$2 Billion Fibre Investment at TELUS (TSX:T) Has Changed Its Investment Story

Reviewed by Simply Wall St

- Earlier this month, TELUS announced a CA$2 billion investment to expand its fibre-optic broadband infrastructure across Ontario and Quebec, aiming to accelerate connectivity and network reliability following regulatory confirmation of a new wholesale framework.

- This latest initiative is intended to serve as the digital backbone for both broadband and 5G wireless services, underlining TELUS' long-term focus on sustainable growth, energy efficiency, and national-scale digital transformation.

- We’ll examine how TELUS’ substantial infrastructure investment could reinforce its efforts to boost long-term growth and improve service quality.

TELUS Investment Narrative Recap

To be a TELUS shareholder, an investor needs to believe in the long-term value of large-scale infrastructure expansion and its potential to drive consistent service improvements and sustainable growth. The CA$2 billion broadband investment aligns with this vision and supports a key near-term catalyst, retaining and attracting customers through network reliability, though concerns remain around elevated debt levels as a key risk for financial flexibility in the short term. Among recent announcements, TELUS' approval to deploy a submarine fibre optic cable between Sept-Îles and the Gaspé Peninsula ties directly to its broader fibre strategy, enhancing network resilience and redundancy. This project further supports ongoing customer retention and growth initiatives, reinforcing the importance of connectivity as a fundamental business driver. However, despite these expansion efforts, higher financing costs and leverage remain risks investors should be aware of, especially if...

Read the full narrative on TELUS (it's free!)

TELUS' outlook anticipates CA$22.1 billion in revenue and CA$2.0 billion in earnings by 2028. This assumes annual revenue growth of 3.2% and a CA$1.0 billion increase in earnings from the current CA$993.0 million.

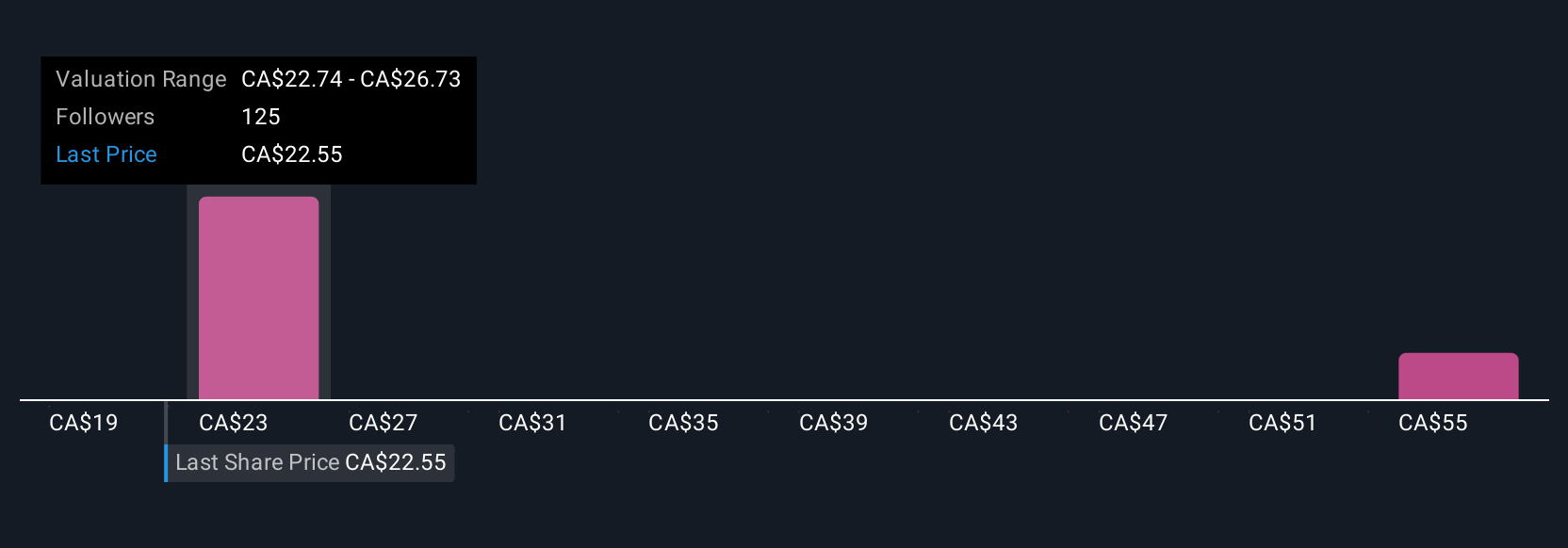

Uncover how TELUS' forecasts yield a CA$22.78 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community member fair value estimates for TELUS range widely from CA$18.74 to CA$58.71, across six perspectives. While you weigh these different outlooks, consider how ongoing debt reduction targets could affect TELUS' ability to invest in future growth and maintain financial health.

Build Your Own TELUS Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TELUS research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free TELUS research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TELUS' overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 26 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TELUS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:T

TELUS

Provides a range of telecommunications and information technology products and services in Canada.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives