Does TELUS' Travel Partnership Advance Its Loyalty Strategy or Broaden Its Brand Narrative for TSX:T?

Reviewed by Sasha Jovanovic

- In October 2025, WestJet announced the launch of a major collaboration with TELUS, linking their loyalty programs and rolling out WestJet Wi-Fi presented by TELUS across its mainline 737 fleet, the largest Starlink-equipped 737 fleet globally.

- This marks a unique integration of travel and telecom benefits in Canada, allowing members to earn, transfer, and redeem points across both platforms for more flexible rewards.

- We'll explore how TELUS's partnership with WestJet to create an integrated rewards ecosystem could influence its broader investment narrative.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

TELUS Investment Narrative Recap

To feel confident as a TELUS shareholder, you need to believe in the company's ability to turn its investments in connectivity and digital infrastructure into consistent long-term earnings, while defending wireless ARPU and managing elevated debt. The new WestJet partnership, which ties TELUS’s brand more closely to travel and bundled digital services, could add incremental brand value, but is not likely to shift the company’s near-term financial catalysts or address the most pressing risk: wireless ARPU pressure from competition and regulation.

Of the recent announcements, TELUS's $2 billion investment to expand broadband in Ontario and Quebec over five years stands out as most relevant. This initiative is a core driver supporting earnings and revenue growth potential, but also heightens the importance of capital discipline and successful cost recovery, both of which could be affected by any industry changes like those signaled in the WestJet collaboration.

But on the other hand, TELUS’s continued heavy capital investment program is information investors should be aware of, particularly because...

Read the full narrative on TELUS (it's free!)

TELUS’ outlook anticipates CA$22.7 billion in revenue and CA$1.5 billion in earnings by 2028. This is based on a 3.6% annual revenue growth rate and an earnings increase of CA$534 million from current earnings of CA$966 million.

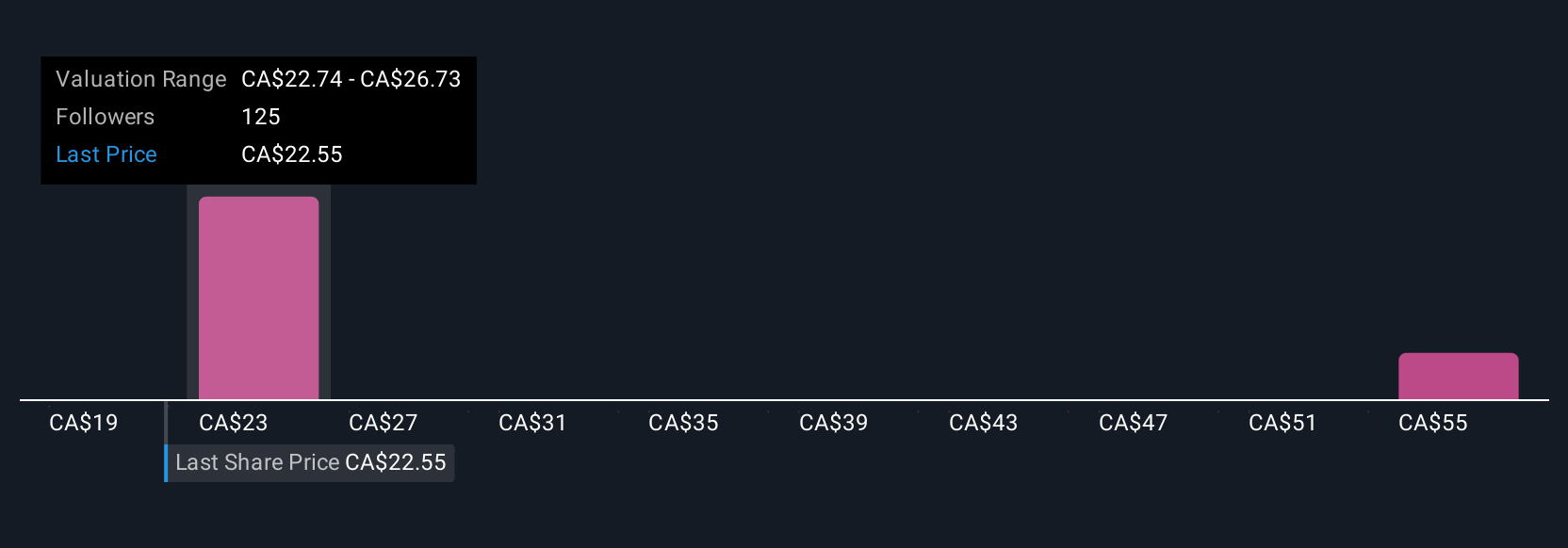

Uncover how TELUS' forecasts yield a CA$23.38 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate TELUS’s fair value between C$17.70 and C$52.09, drawing on nine different revenue and earnings forecasts. While future broadband adoption is a bullish catalyst for many, opinions can differ widely, explore several viewpoints before making decisions.

Explore 9 other fair value estimates on TELUS - why the stock might be worth 17% less than the current price!

Build Your Own TELUS Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TELUS research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free TELUS research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TELUS' overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TELUS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:T

TELUS

Provides a range of telecommunications and information technology products and services in Canada.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives