- Canada

- /

- Telecom Services and Carriers

- /

- TSX:CCA

Cogeco Communications (TSX:CCA) Margin Slips as Earnings Decline Challenges Bullish Valuation Narratives

Reviewed by Simply Wall St

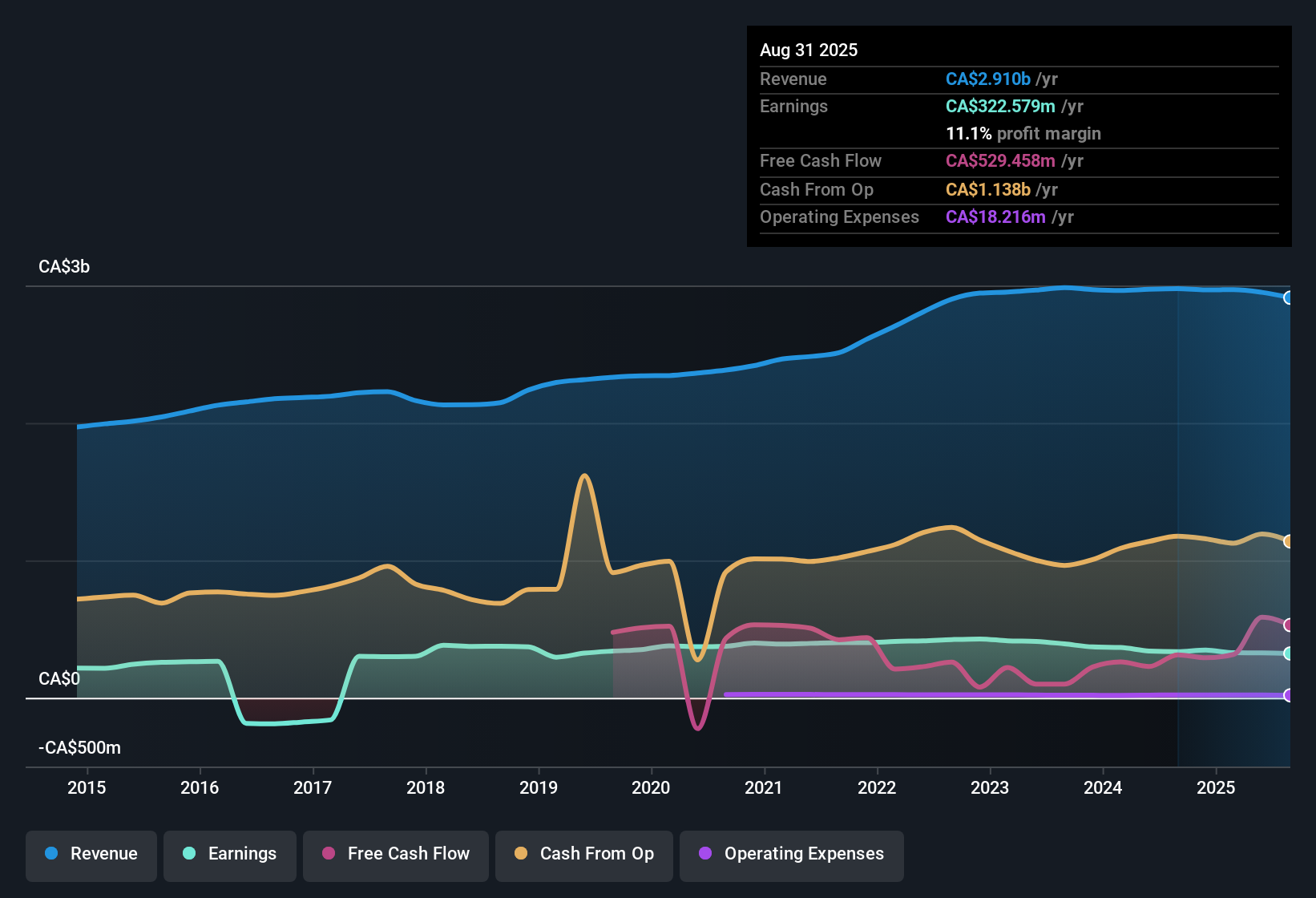

Cogeco Communications (TSX:CCA) posted a net profit margin of 11.1%, slightly down from 11.4% the previous year. Over the last five years, the company’s earnings have declined at an average annual rate of 3.9%. Despite an expected 4.89% rate of earnings growth ahead, this is well below the Canadian market’s 11.7% average. Revenues are forecast to decline by about 0.3% annually for the next three years. While the stock trades at a relatively low PE of 7.9x and below its estimated fair value, investors are weighing the slower growth against the appeal of the company’s dividend and discounted valuation.

See our full analysis for Cogeco Communications.The big question now is how these latest numbers stack up against the dominant market narratives, and whether investor sentiment will shift as the story develops.

See what the community is saying about Cogeco Communications

Free Cash Flow Set to Rise Amid End of Investment Cycle

- The company expects a significant boost in free cash flow over the next two years as its major rural network build and modernization investments wind down. This is expected to free up capital for debt reduction or share buybacks.

- According to analysts' consensus view, the anticipated cash flow increase supports the thesis that Cogeco can absorb slower top-line growth while still improving net margin and future earnings capacity.

- Completion of Ontario network expansion by 2026 and expansion of fiber-to-the-home connections are cited as key drivers for long-term revenue stability.

- Consensus narrative notes that the push toward higher-margin services like faster internet and digital advertising could help offset the risk to profitability from competitive market pressures.

- Bulls and bears both monitor how successfully Cogeco converts post-investment free cash flow into higher returns. The next two years are considered critical for either narrative.

- The consensus target price of CA$74.91 implies about 22% potential upside from the current CA$61.33 share price if these cash flow improvements materialize.

- Any delays or under-delivery on expected cost efficiencies could renew skepticism around long-term growth.

See how analysts expect free cash flow gains to play into the full narrative with the latest Consensus Narrative for Cogeco Communications. 📊 Read the full Cogeco Communications Consensus Narrative.

Trading at a Deep Discount to DCF Fair Value

- Cogeco Communications' share price of CA$61.33 sits far below the DCF fair value estimate of CA$395.50, and is also substantially cheaper than analyst consensus price targets.

- Consensus narrative highlights that, despite a discounted Price-to-Earnings ratio of 7.9x compared to industry and peer averages, broader concerns remain about whether soft revenue and profit trends fully justify such a large valuation gap.

- The price gap versus both analyst targets and DCF fair value reflects worries over slow expected annual earnings growth of just 4.89%, well below the Canadian market's 11.7%.

- Nonetheless, the market pricing sets a low bar for expectations. Any upside surprise on margins, subscriber growth, or capital returns could be swiftly priced in.

Margins Poised to Edge Higher Despite Soft Revenue

- Analysts estimate that the company's profit margin will increase from 11.1% today to 11.6% in three years, even as revenues are projected to decline by 0.3% annually over that period.

- The consensus narrative argues these margin gains should be driven by efficiency improvements, synergies between U.S. and Canadian operations, and a strategic shift toward high-margin digital and wireless services.

- Operating cost pressures and competitive intensity, especially in Canada, remain the biggest risks to seeing those margins actually flow through to net earnings.

- Bears point out that foreign exchange volatility and U.S. segment churn could offset much of these operational gains, keeping overall profitability under pressure.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Cogeco Communications on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do the figures tell a different story to you? Share your take and build your own narrative quickly; your perspective can be brought to life in just a few minutes. Do it your way

A great starting point for your Cogeco Communications research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Cogeco Communications is struggling with declining revenues and earnings growth rates that lag well behind the broader Canadian market, raising questions about long-term momentum.

If sluggish top-line expansion is a concern, focus on stable growth stocks screener (2112 results) to find companies delivering more reliable revenue and earnings growth year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CCA

Cogeco Communications

Operates as a telecommunications corporation in Canada and the United States.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion