- Canada

- /

- Telecom Services and Carriers

- /

- TSX:CCA

Can Cogeco Communications (TSX:CCA) Leverage Its Mobile Launch to Strengthen Long-Term Revenue Streams?

Reviewed by Simply Wall St

- Cogeco Communications Inc. has launched its mobile service in Canada, rolling out Cogeco Mobile to new and existing internet subscribers across selected markets in Quebec and Ontario, with full market coverage planned for fall 2025.

- This expansion positions Cogeco to compete in the Canadian wireless sector while broadening its range of services for millions of consumers.

- We'll now examine how Cogeco's entry into mobile reshapes its investment narrative and potential for future revenue diversification.

Find companies with promising cash flow potential yet trading below their fair value.

Cogeco Communications Investment Narrative Recap

To be a shareholder in Cogeco Communications, you need to believe the company can translate its major investments in network and service expansions, like its new Canadian mobile launch, into sustained revenue and profit growth despite heightened competitive pressures and flat to declining revenue guidance. The recent mobile rollout was expected, and while it underpins one of the biggest growth catalysts for the business, wireless diversification, its near-term impact is not likely to immediately offset risks, including increased operating expenses and squeezed net margins as Cogeco ramps up in a crowded market.

The company’s recent revision to its 2025 earnings guidance, now calling for a low single-digit revenue decline instead of stable revenue, is directly relevant as shareholders weigh whether new service launches can offset headwinds from both traditional cable subscriber loss and competitive challenges in key Canadian and US markets.

By contrast, investors must be aware of how rising operating expenses to support the wireless launch could pressure net margins if early customer growth falls short...

Read the full narrative on Cogeco Communications (it's free!)

Cogeco Communications is projected to reach CA$2.9 billion in revenue and CA$426.6 million in earnings by 2028. This assumes a revenue decline of 0.3% per year and an earnings increase of CA$99.5 million from the current earnings of CA$327.1 million.

Uncover how Cogeco Communications' forecasts yield a CA$77.64 fair value, a 24% upside to its current price.

Exploring Other Perspectives

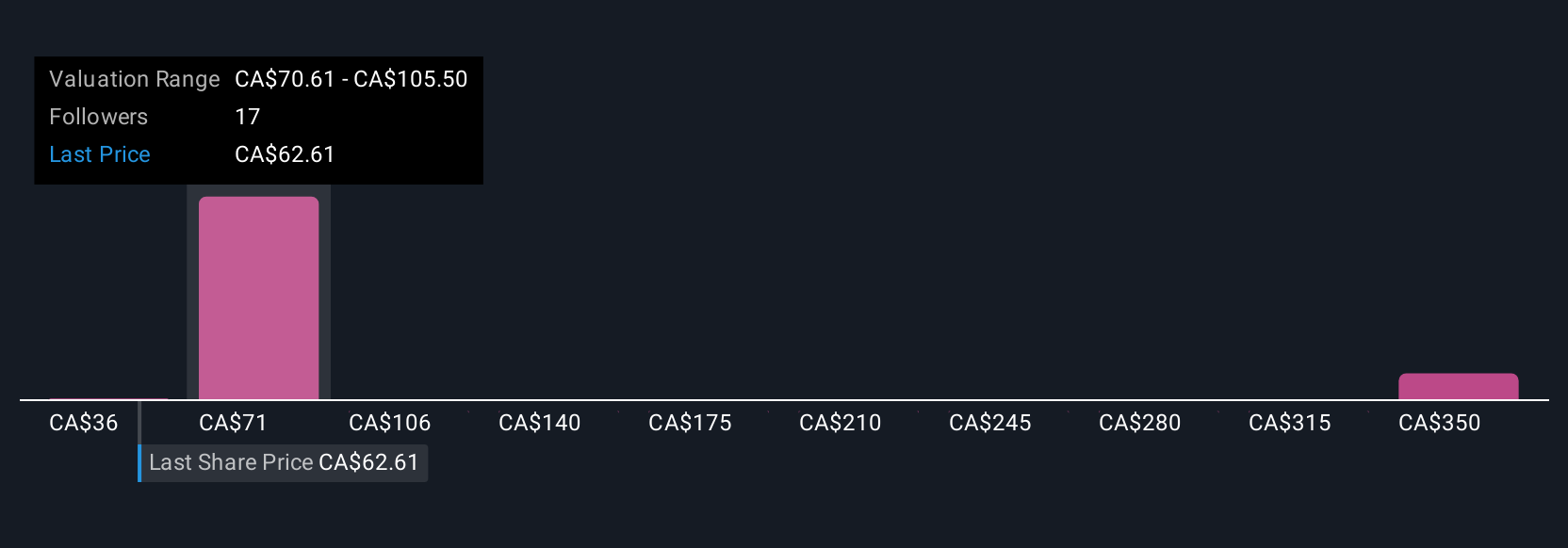

You’ll find three community fair value estimates for Cogeco Communications ranging from CA$35.72 to CA$382.66, illustrating highly varied outlooks among Simply Wall St Community members. With recent revenue guidance revised lower, it's clear that investor opinions can widely differ, making it important to consider several alternative perspectives on future performance.

Explore 3 other fair value estimates on Cogeco Communications - why the stock might be worth over 6x more than the current price!

Build Your Own Cogeco Communications Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cogeco Communications research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cogeco Communications research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cogeco Communications' overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 18 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CCA

Cogeco Communications

Operates as a telecommunications corporation in Canada and the United States.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives