- Canada

- /

- Telecom Services and Carriers

- /

- TSX:BCE

**BCE (TSX:BCE) Leverages Strategic Alliance With MacLean to Drive Sustainable Mining Innovations**

Reviewed by Simply Wall St

Delve into the full analysis report here for a deeper understanding of BCE.

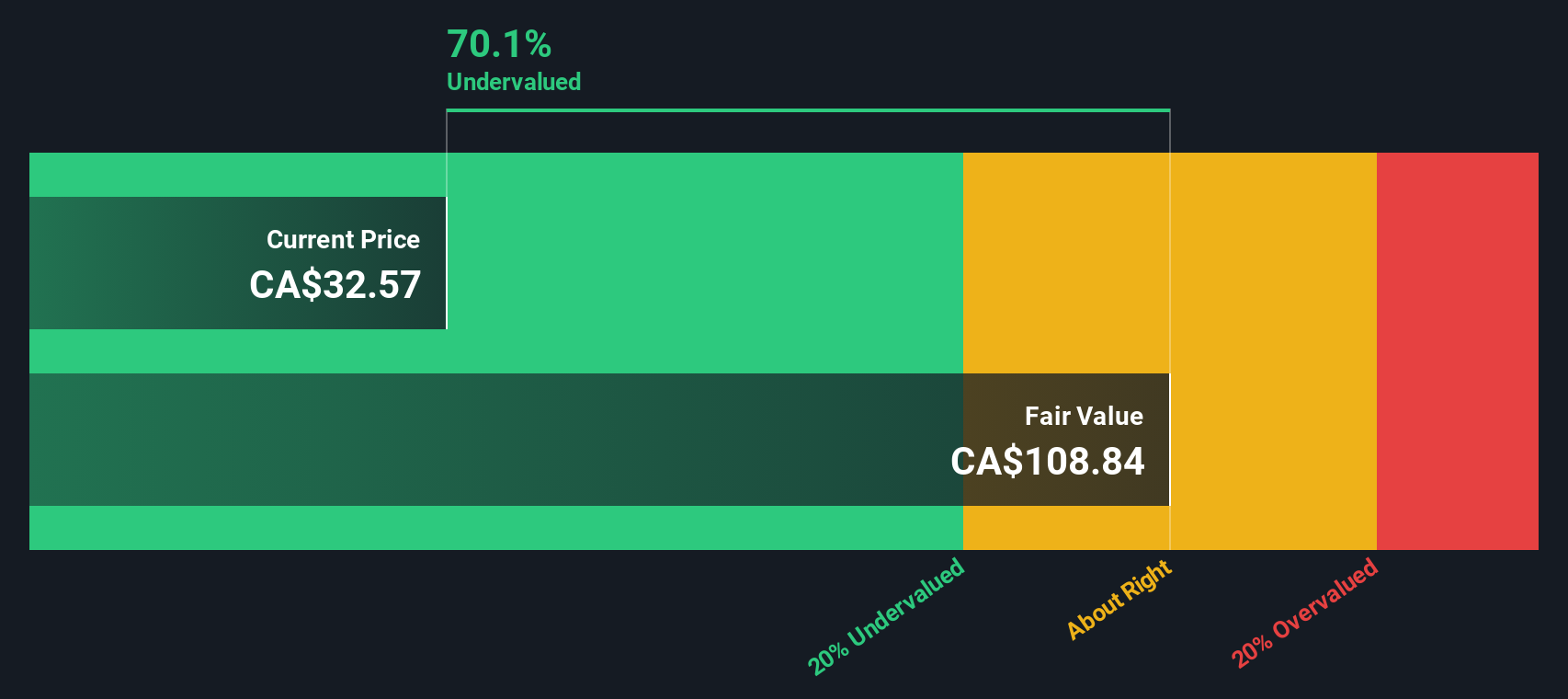

Strengths: Core Advantages Driving Sustained Success For BCE

BCE has demonstrated robust financial performance, with CEO Mirko Bibic highlighting disciplined execution in a competitive market. The company reported $1.1 billion in free cash flow for Q2, an 8% increase over the previous year, indicating strong EBITDA growth. Subscriber growth is another key strength, with total postpaid and prepaid mobile phone net additions up 4.4% to 131,043. BCE's market leadership is evident in its fiber network's performance, achieving the highest Q2 consumer retail Internet net additions in 17 years. The company's digital transformation efforts, particularly in Bell Media, are positioning it as a leader in digital media and content. Despite these strengths, BCE is currently considered expensive based on its Price-To-Earnings Ratio (22.6x) compared to peers and the global telecom industry, despite trading below the estimated fair value of CA$103.17.

Weaknesses: Critical Issues Affecting BCE's Performance and Areas For Growth

BCE faces several financial challenges, including a 1% decline in total revenue, attributed to an 8.7% decrease in low-margin wireless and wireline product sales, as noted by CFO Curtis Millen. The company also struggles with elevated churn rates and a 1.9% year-over-year decrease in ARPU. Store closures have further impacted performance, with 70% of new customer activations in Q2 being BYOD subscriptions. Additionally, BCE's earnings have declined by 5.7% per year over the past five years, and its current net profit margins (8%) are lower than last year (9.3%).

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

BCE has several strategic opportunities to enhance its market position. The company can capitalize on robust Canadian population growth projections and focus on bundling wireless and consumer Internet services for continued growth. Advanced AI and machine learning capabilities are already improving the Bell customer experience, presenting further opportunities for operational efficiencies. Recent acquisitions, such as Stratejm and CloudKettle, can bolster BCE's technical services and digital transformation initiatives. Additionally, a 35% increase in digital advertising revenues highlights the potential for further growth in this area.

Threats: Key Risks and Challenges That Could Impact BCE's Success

BCE faces significant threats from competitive pricing pressures, which continue to impact consolidated top-line growth. Economic pressures and the need for profitable, margin-accretive subscriber growth are ongoing challenges. Regulatory challenges also pose a risk, with the company needing to adapt to changing pricing environments and macroeconomic conditions. Operational risks are another concern, particularly BCE's elevated debt position and the focus on reducing its leverage ratio over time, as emphasized by CFO Curtis Millen. These external factors could threaten BCE's growth and market share if not managed effectively.

Conclusion

BCE's strong financial performance, marked by significant free cash flow and subscriber growth, underscores its market leadership and successful digital transformation initiatives. However, the company faces challenges such as declining revenue, elevated churn rates, and lower net profit margins, which need to be addressed to sustain its competitive edge. Strategic opportunities like leveraging AI, machine learning, and recent acquisitions can drive future growth, but competitive pricing pressures and regulatory challenges remain significant threats. Although BCE's Price-To-Earnings Ratio of 22.6x suggests it is currently expensive relative to peers, its trading below the estimated fair value of CA$103.17 indicates potential for future appreciation if the company can effectively navigate these challenges and capitalize on growth opportunities.

Seize The Opportunity

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if BCE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSX:BCE

BCE

A communications company, provides wireless, wireline, internet, streaming services, and television (TV) services to residential, business, and wholesale customers in Canada.

Slight with moderate growth potential.

Similar Companies

Market Insights

Community Narratives