- Canada

- /

- Telecom Services and Carriers

- /

- TSX:BCE

BCE (TSX:BCE) Is Up 5.3% After Earnings Beat and Rising Profitability—Has The Bull Case Changed?

Reviewed by Simply Wall St

- BCE Inc. recently reported its second quarter 2025 earnings, posting sales of CA$6.09 billion and net income of CA$619 million, both higher than the same quarter last year.

- Notably, basic and diluted earnings per share from continuing operations also increased year-over-year, indicating improved operational efficiency and profitability.

- We’ll consider how BCE’s higher net income and earnings per share influence its investment outlook and future growth prospects.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

BCE Investment Narrative Recap

To be a BCE shareholder, it’s important to believe in the long-term value of its advanced fiber and wireless networks, despite regulatory friction and the need for heavy, ongoing capital investment. The latest earnings report, with modest revenue and net income gains, does not materially change the biggest short-term catalyst (fiber network expansion through the Ziply Fiber acquisition) or mitigate the most pressing risk: tighter regulatory controls potentially hampering future growth.

Of BCE’s recent announcements, the partnership with PSP Investments to create Network FiberCo stands out, as it directly targets the expansion of fiber infrastructure in the U.S., a move closely tied to the company’s growth ambitions and central to near-term investor expectations about new revenue sources and improved margins.

However, investors should be aware that, in contrast to the positive operating trends, regulatory challenges could still force BCE to limit fiber rollout, which would mean…

Read the full narrative on BCE (it's free!)

BCE's narrative projects CA$26.1 billion in revenue and CA$3.1 billion in earnings by 2028. This requires 2.3% yearly revenue growth and an increase in earnings of about CA$2.67 billion from current earnings of CA$433.0 million.

Uncover how BCE's forecasts yield a CA$35.12 fair value, in line with its current price.

Exploring Other Perspectives

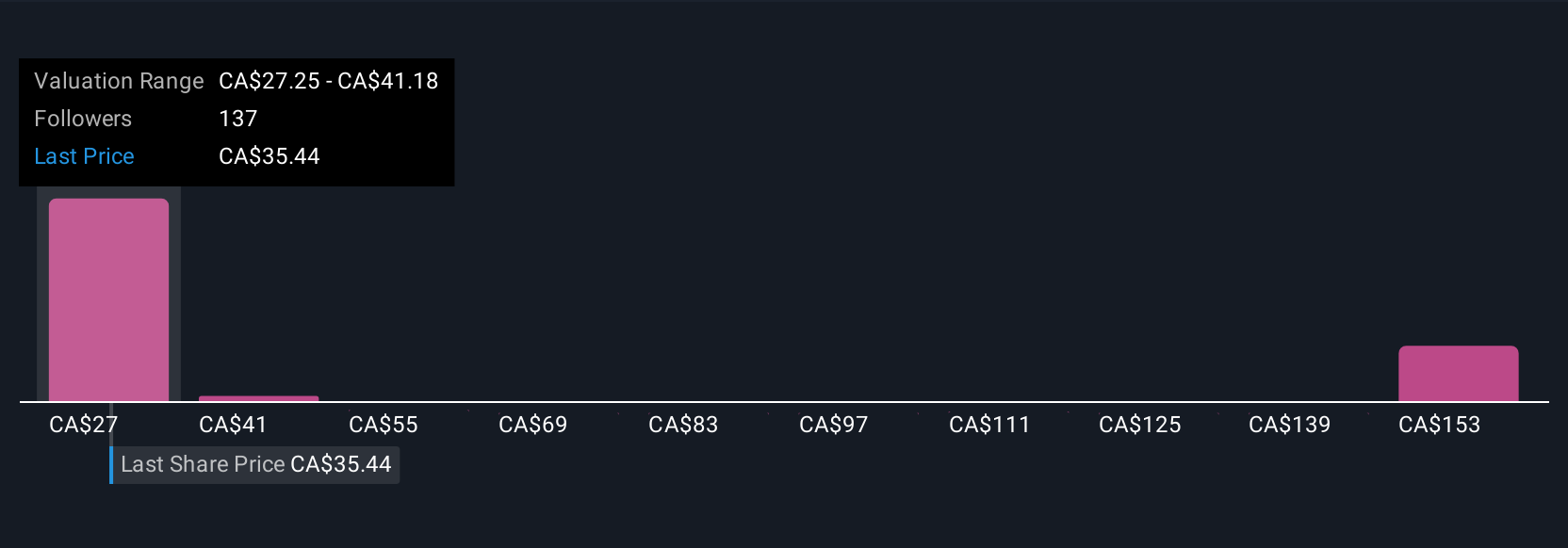

Sixteen retail investors in the Simply Wall St Community currently estimate BCE’s fair value anywhere from CA$27.25 up to CA$156.45 per share. Intense competition and regulatory hurdles remain key variables that could influence whether the company meets the optimistic forecasts seen in some of these community views.

Explore 16 other fair value estimates on BCE - why the stock might be worth over 4x more than the current price!

Build Your Own BCE Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BCE research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free BCE research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BCE's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 28 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BCE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BCE

BCE

A communications company, provides wireless, wireline, internet, streaming services, and television (TV) services to residential, business, and wholesale customers in Canada.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives