- Canada

- /

- Telecom Services and Carriers

- /

- TSX:BCE

BCE (TSX:BCE): Exploring Valuation Perspectives After Recent Modest Share Price Gains

Reviewed by Simply Wall St

This week, BCE (TSX:BCE) shares edged up slightly with a 0.2% gain by the close. Over the past month, the stock has delivered a 5% return, which has caught the attention of income-focused investors.

See our latest analysis for BCE.

Despite BCE’s mild share price gains over the past month, the bigger story is that total shareholder return remains deep in the red, down more than 20% over the past year. The short-term momentum appears tepid and hints that the market’s perception of BCE’s risks and growth prospects may still be shifting after last year’s selloff.

If you’re interested in broadening your search beyond BCE, now is a good opportunity to discover fast growing stocks with high insider ownership

With BCE trading modestly above recent lows and a sizable discount still to analyst targets, investors are left to wonder if there is value being overlooked or if the market is accurately factoring in future growth.

Most Popular Narrative: 6.5% Undervalued

BCE’s widely followed narrative sets fair value at CA$35.97, a modest premium to the last close of CA$33.64. This suggests optimism is returning to the shares.

Bullish analysts highlight increased confidence in BCE's growth trajectory and financial outlook, especially in light of improved balance sheet strength compared to previous years. There is consensus that recent strategic moves, including deal activity, will improve the company’s long-term earnings profile and support sustained revenue and EBITDA growth beginning in 2026.

Want to know why this valuation stands apart? The most watched narrative assumes accelerating growth and higher profit margins, but not everyone agrees. Which profit estimates and bold projections push BCE into “undervalued” territory? Unpack the full story behind the numbers; some may surprise you.

Result: Fair Value of $35.97 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory hurdles or slower-than-expected fiber expansion could still challenge BCE’s margin progress and cast doubt on the current optimism regarding its valuation.

Find out about the key risks to this BCE narrative.

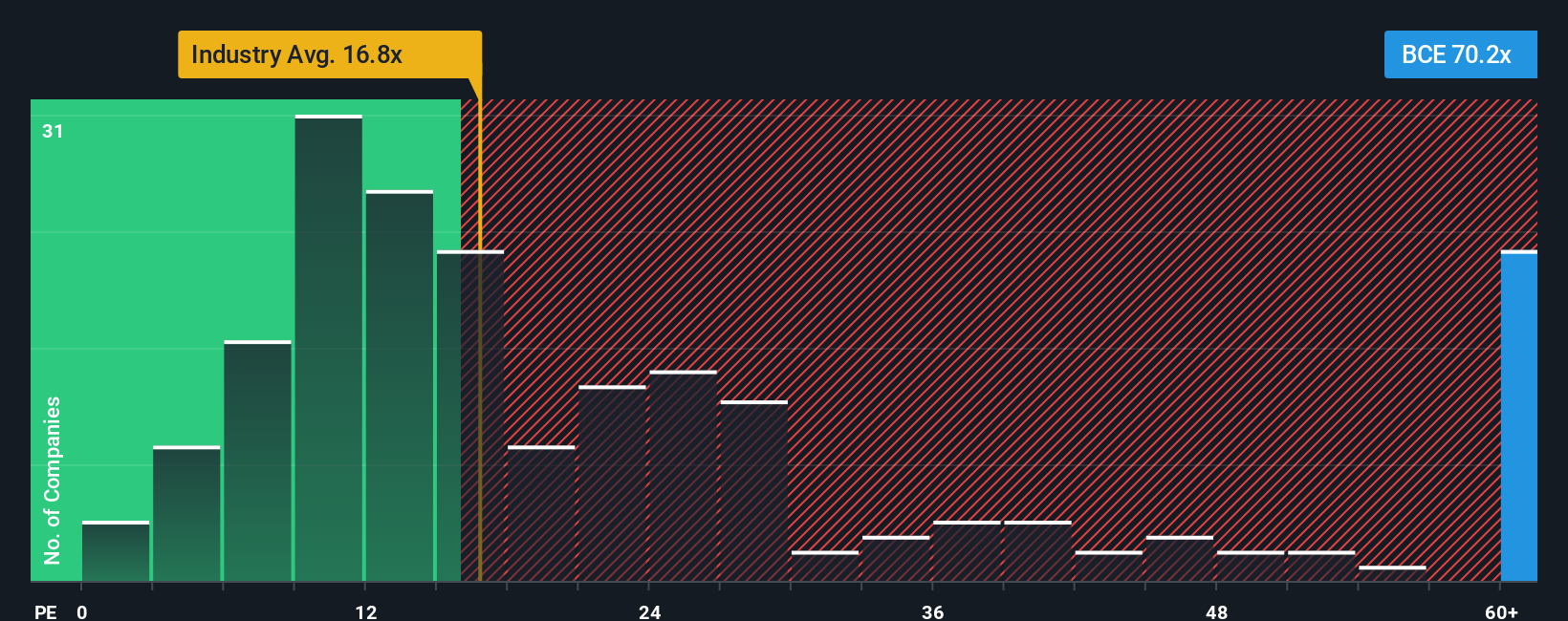

Another View: Looking at Price Ratios

Switching to valuation based on price-to-earnings ratios, BCE appears pricey. Its current ratio sits at 72.4x, well above both the global Telecom average of 16.7x and its peer average of 15.5x. Even the "fair ratio" estimate is 20x. This wide gap raises questions about whether BCE’s shares may be vulnerable if market sentiment shifts.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BCE Narrative

If you want a fresh perspective or would like to dig into the details yourself, it’s easy to shape your own narrative in just a few minutes with Do it your way.

A great starting point for your BCE research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Make your next move count with handpicked stocks that fit specific themes and opportunities. Get ahead of the curve and avoid missing out on these unique possibilities.

- Tap into reliable income streams by checking out these 17 dividend stocks with yields > 3% with generous yields. This can be a good approach for building your financial foundation.

- Ride powerful innovation waves and keep pace with market disruptors by starting with these 26 AI penny stocks, which are fueling advancements in artificial intelligence.

- Energize your portfolio with the growth potential of these 3577 penny stocks with strong financials, and spot tomorrow’s success stories before everyone else does.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BCE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BCE

BCE

A communications company, provides wireless, wireline, internet, streaming services, and television (TV) services to residential, business, and wholesale customers in Canada.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives