- Canada

- /

- Telecom Services and Carriers

- /

- TSX:BCE

Assessing BCE’s Value Amid 14.3% Stock Slide and Rising Canadian Telecom Competition

Reviewed by Bailey Pemberton

- Curious whether BCE is a hidden value or a value trap? You’re not alone. With so much noise in today’s market, figuring it out can make a big difference for your portfolio.

- The stock has had a bumpy ride lately, dipping 4.3% in the last week and down 14.3% over the past year. This might have investors questioning if sentiment is changing for better or worse.

- Recent headlines around increased competition in the Canadian telecom sector and regulatory changes are fueling market jitters. Many investors are reassessing their exposure, and there has been speculation that cost pressures could challenge BCE’s margins, adding another layer of uncertainty to its share price performance.

- BCE currently scores a 2 out of 6 on our valuation checks, indicating it passes just a couple of the key undervaluation tests. Here is how this score stacks up across different valuation approaches. At the end of this article, there is a discussion of what really matters when judging BCE’s fair value.

BCE scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: BCE Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by forecasting its future cash flows and then discounting them to today's value. This is a common approach for valuing stable, income-generating companies because it focuses on the underlying cash a business is expected to generate.

For BCE, the DCF is based on the "2 Stage Free Cash Flow to Equity" method. Currently, BCE generates CA$2.71 Billion in free cash flow. Analyst estimates project steady growth, with free cash flow expected to reach CA$3.90 Billion by 2028. Beyond that point, Simply Wall St has extrapolated further growth, projecting free cash flow to rise above CA$4.9 Billion by 2035.

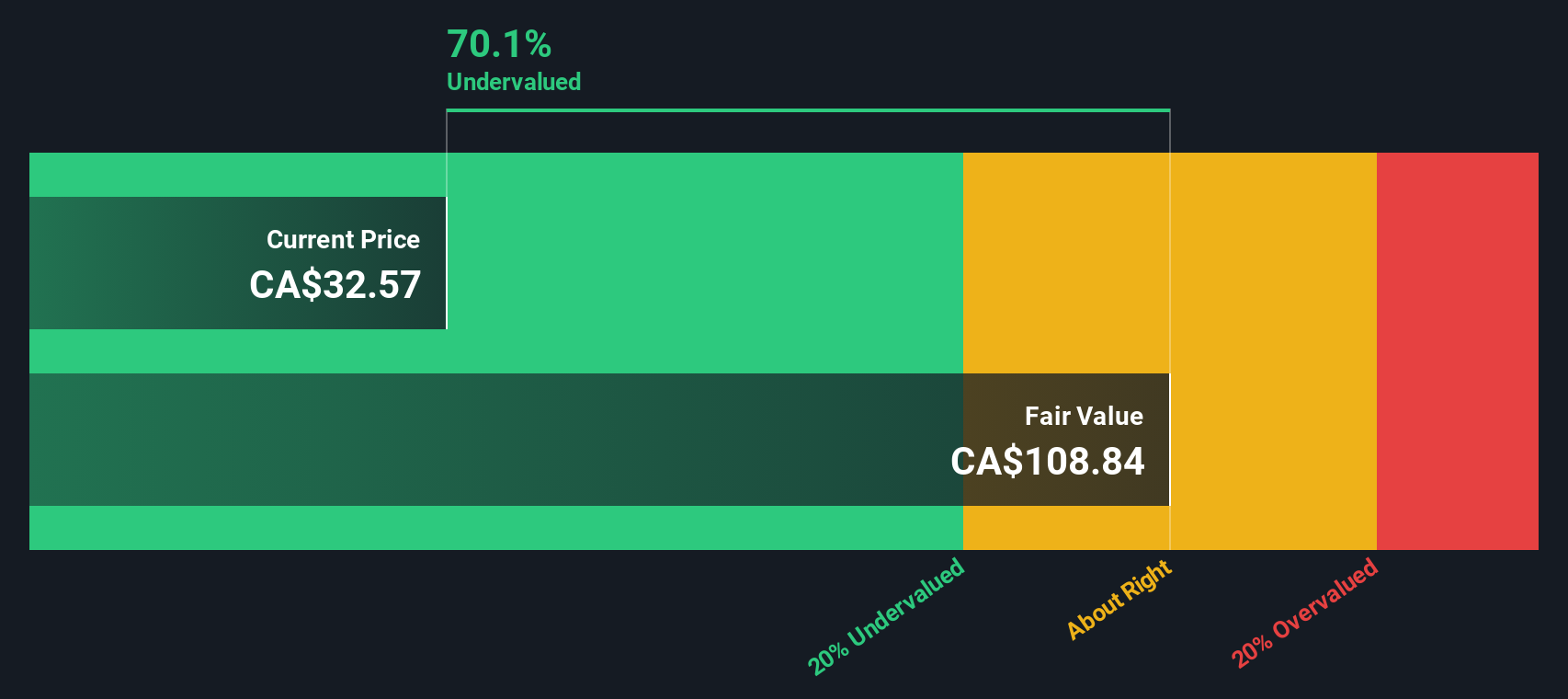

The main idea is simple: cash flows expected over the next decade are discounted to reflect today's value. After running the numbers, the DCF model estimates an intrinsic value for BCE of CA$89.53 per share. With the stock trading at a significant discount of 64.9% to this calculated fair value, the model indicates that BCE is currently undervalued on a fundamental basis.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests BCE is undervalued by 64.9%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: BCE Price vs Earnings

For established, profitable companies like BCE, the price-to-earnings (PE) ratio is a widely used valuation measure. It compares the share price to the company’s earnings per share, making it a straightforward way to gauge how much investors are willing to pay for each dollar of earnings. Investors generally expect higher PE ratios for companies with stronger growth prospects and lower risk, while those facing challenges or slower growth tend to trade at lower multiples.

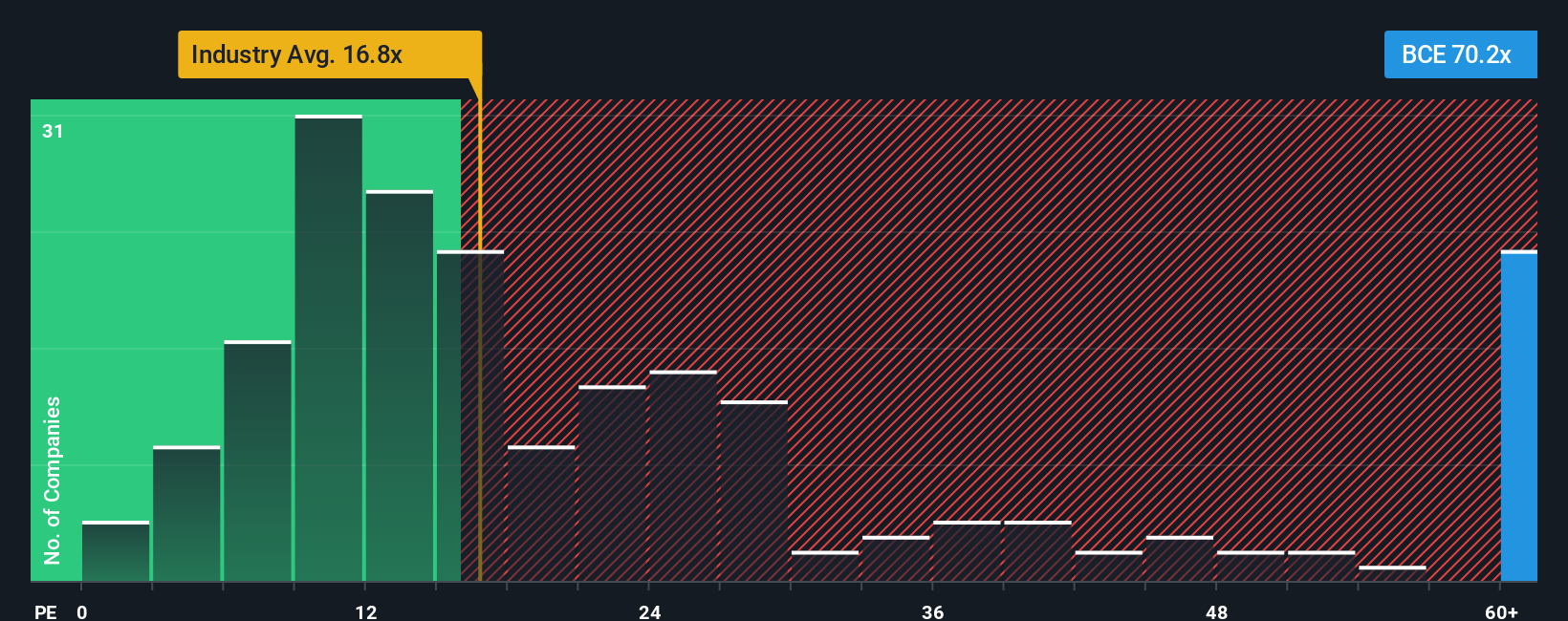

BCE currently trades on a PE ratio of 67.7x. In contrast, the Canadian telecom sector averages a PE of 16.4x, and BCE’s peer group sits at 15.1x. Both benchmarks suggest BCE trades at a much higher earnings multiple than its industry peers and sector as a whole.

Simply Wall St’s proprietary “Fair Ratio” offers a deeper perspective. Instead of just comparing with peers or industry averages, the Fair Ratio takes into account BCE’s growth expectations, business risks, profit margins, industry dynamics, and market capitalization to estimate what an appropriate PE multiple should be for BCE. This makes it a more tailored and representative benchmark than simple comparisons.

With BCE’s fair PE ratio at 20.1x, well below its current 67.7x, this signals the stock is trading well above its risk-adjusted, growth-adjusted fair valuation. Judged on this basis, BCE appears overvalued on a PE multiple approach.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

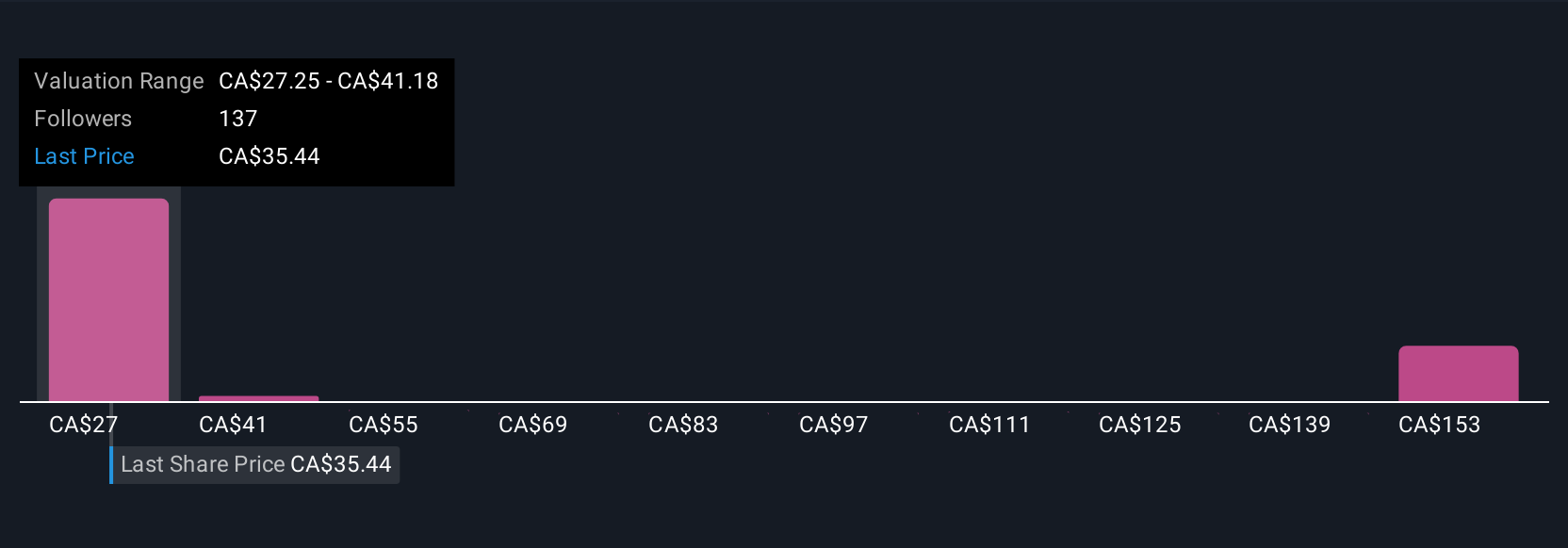

Upgrade Your Decision Making: Choose your BCE Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is your personal investment story for a company. It is your perspective that connects financial forecasts, fair value estimates, and your views on what will drive a business’s future performance.

Unlike relying solely on big data or fixed valuation models, Narratives help you build a meaningful link between what is happening in the company, how that might impact growth or margins, and what you believe BCE is truly worth. They combine your insights and expectations with investment models to create your version of a company’s fair value, providing context and conviction beyond the numbers.

At Simply Wall St, Narratives are available for millions of investors on the Community page, making them easy and accessible to use. When you set your Narrative, you instantly see your own fair value compared to BCE’s actual share price, so you can make confident buy or sell decisions based on your unique outlook.

Narratives update automatically as new information arrives, whether it is a big news story or the latest earnings. For BCE, one investor might have a bullish Narrative backed by analyst forecasts of CA$45.0, seeing margin expansion and new business lines as key. Another investor could hold a more cautious view with a target closer to CA$30.0, focusing on regulatory and competitive risks.

Do you think there's more to the story for BCE? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if BCE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BCE

BCE

A communications company, provides wireless, wireline, internet, streaming services, and television (TV) services to residential, business, and wholesale customers in Canada.

Good value with slight risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion