- Canada

- /

- Telecom Services and Carriers

- /

- TSX:BCE

Assessing BCE's (TSX:BCE) Valuation After Recent Weakness in the Telecom Sector

Reviewed by Kshitija Bhandaru

BCE (TSX:BCE) shares continue to draw attention as investors evaluate recent moves in the telecom sector. Over the past month, BCE stock has edged down about 4%, prompting questions about the current valuation and outlook.

See our latest analysis for BCE.

After a generally sluggish year for BCE, its latest share price of CA$32.43 marks a modest step down from last month. However, the momentum has been fading for some time. The stock’s 1-year total shareholder return stands at -23%, with longer-term performance painting a similarly challenging picture, even as the company navigates ongoing sector pressures and shifting investor sentiment.

If BCE’s movement has you rethinking your watchlist, now is a smart time to broaden your search and discover fast growing stocks with high insider ownership

Given BCE’s recent performance and the gap to analyst price targets, is the stock trading below its true value, or are investors already accounting for its future prospects, leaving little room for upside?

Most Popular Narrative: 8.4% Undervalued

With BCE closing at CA$32.43 and the most-followed narrative setting fair value at CA$35.41, the narrative presents a modest margin for upside. Let’s see what’s driving this analyst consensus.

The rapid expansion of BCE's fiber network, further accelerated by the Ziply Fiber acquisition, positions the company to capitalize on rising demand for high-speed broadband amid ongoing digital infrastructure buildout in North America. This supports future revenue growth and margin expansion. Surging data consumption from streaming, cloud, and AI applications is increasing network utilization, which underpins persistent ARPU improvements and generates higher incremental revenues and earnings from both wireless and wireline segments.

Want to see the growth formula behind this price target? The narrative’s fair value hinges on ambitious margin expansion and future profit multiples rarely seen outside high-growth sectors. If you are curious about the bold projections and what makes analysts so confident, explore the full story for numbers that could surprise you.

Result: Fair Value of $35.41 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory changes that threaten fiber rollout and intense wireless competition could quickly undermine the case for lasting margin and revenue growth.

Find out about the key risks to this BCE narrative.

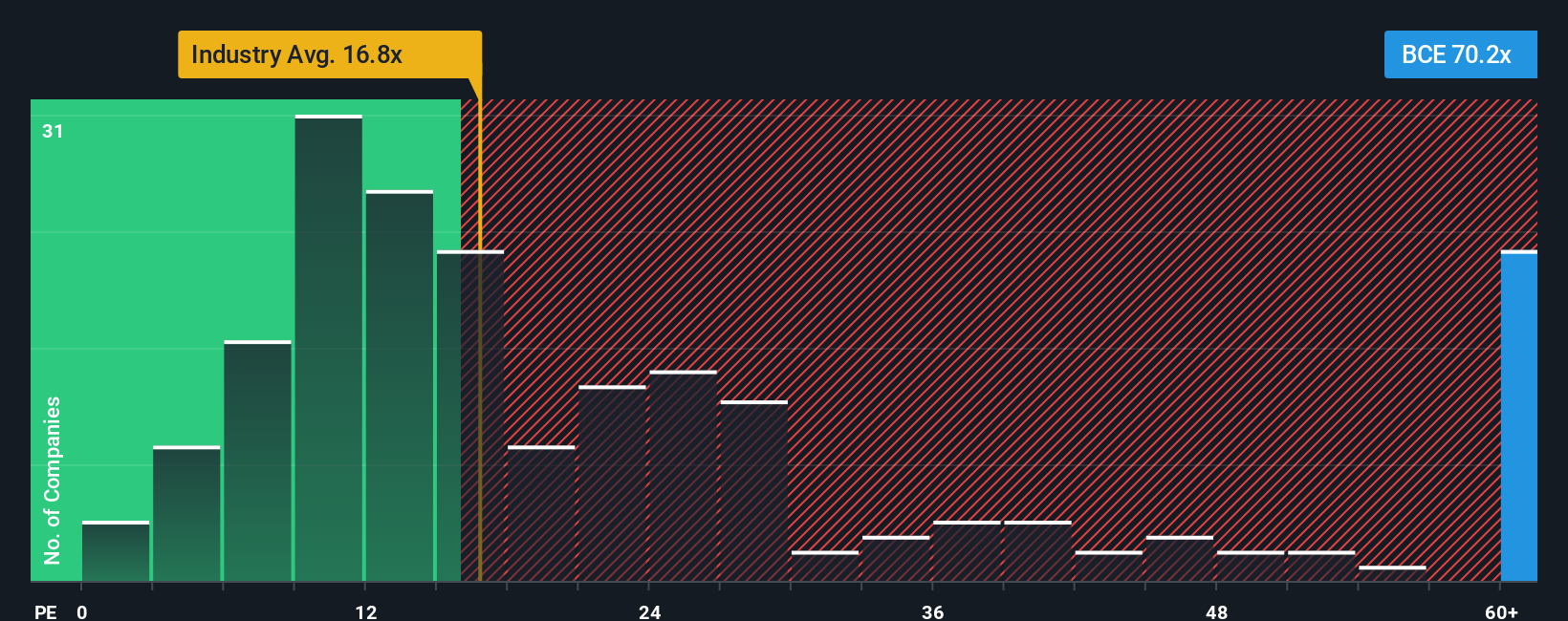

Another View: High PE Ratio Signals a Different Risk

While analysts see BCE as offering some upside, the numbers tell a more cautionary story when you compare its current price-to-earnings ratio of 69.8x to the peer average of 15.8x, the global industry at 16.8x, and a fair ratio of 20x. This wide gap suggests BCE shares command a much higher price than what similar companies or historical trends might justify. This raises questions about future returns and valuation risk.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BCE Narrative

If you think there's a different angle to the BCE story, put your analysis to the test and craft your perspective in just a few minutes. Do it your way

A great starting point for your BCE research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never limit themselves to one story. Take charge of your financial future and discover promising stocks that might be flying under your radar right now.

- Tap into high yields by investigating these 19 dividend stocks with yields > 3%. This option offers steady income potential from companies with robust dividend histories.

- Accelerate your portfolio’s growth by checking out these 900 undervalued stocks based on cash flows. Here you’ll find stocks trading below intrinsic value and ripe for opportunity.

- Ride the AI innovation wave by exploring these 24 AI penny stocks. This screener features businesses reshaping industries with cutting-edge artificial intelligence solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BCE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BCE

BCE

A communications company, provides wireless, wireline, internet, streaming services, and television (TV) services to residential, business, and wholesale customers in Canada.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives