- Canada

- /

- Telecom Services and Carriers

- /

- CNSX:ADMT

This Is The Reason Why We Think Upco International Inc.'s (CSE:UPCO) CEO Might Be Underpaid

The solid performance at Upco International Inc. (CSE:UPCO) has been impressive and shareholders will probably be pleased to know that CEO Andrea Pagani has delivered. This would be kept in mind at the upcoming AGM on 22 April 2021 which will be a chance for them to hear the board review the financial results, discuss future company strategy and vote on resolutions such as executive remuneration and other matters. We think the CEO has done a pretty decent job and probably deserves a well-earned pay rise.

Check out our latest analysis for Upco International

Comparing Upco International Inc.'s CEO Compensation With the industry

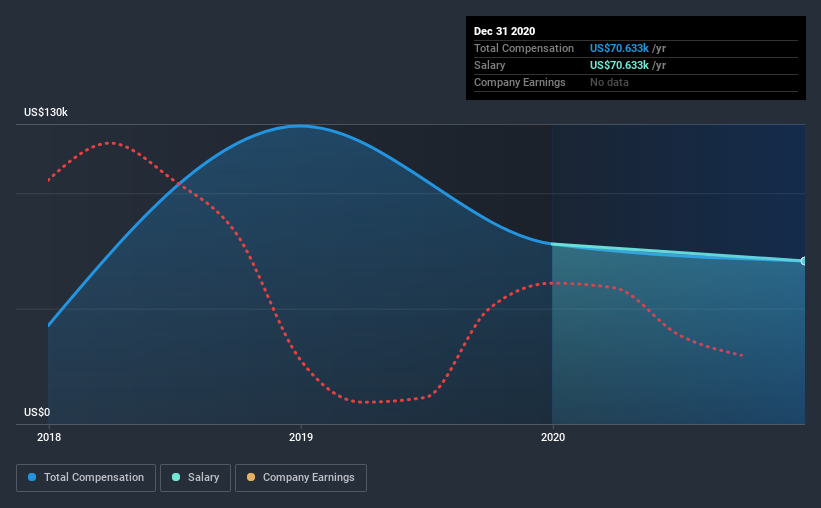

Our data indicates that Upco International Inc. has a market capitalization of CA$25m, and total annual CEO compensation was reported as US$71k for the year to December 2020. We note that's a decrease of 9.4% compared to last year. Notably, the salary of US$71k is the entirety of the CEO compensation.

On comparing similar-sized companies in the industry with market capitalizations below CA$251m, we found that the median total CEO compensation was US$521k. That is to say, Andrea Pagani is paid under the industry median. Moreover, Andrea Pagani also holds CA$1.3m worth of Upco International stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$71k | US$78k | 100% |

| Other | - | - | - |

| Total Compensation | US$71k | US$78k | 100% |

On an industry level, roughly 24% of total compensation represents salary and 76% is other remuneration. Speaking on a company level, Upco International prefers to tread along a traditional path, disbursing all compensation through a salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Upco International Inc.'s Growth

Upco International Inc. has seen its earnings per share (EPS) increase by 13% a year over the past three years. It has seen most of its revenue evaporate over the past year.

This demonstrates that the company has been improving recently and is good news for the shareholders. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Upco International Inc. Been A Good Investment?

Boasting a total shareholder return of 156% over three years, Upco International Inc. has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Upco International pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. Given the improved performance, shareholders may be more forgiving of CEO compensation in the upcoming AGM. Seeing that earnings growth and share price performance seems to be on the right path, the more pressing focus for shareholders at the AGM may be how the board and management plans to turn the company into a sustainably profitable one.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 7 warning signs for Upco International (of which 5 don't sit too well with us!) that you should know about in order to have a holistic understanding of the stock.

Switching gears from Upco International, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

When trading Upco International or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About CNSX:ADMT

Adequate balance sheet with weak fundamentals.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion