The Kraken Robotics (CVE:PNG) Share Price Is Up 167% And Shareholders Are Boasting About It

Kraken Robotics Inc. (CVE:PNG) shareholders might be concerned after seeing the share price drop 20% in the last month. But that doesn't undermine the rather lovely longer-term return, if you measure over the last three years. The share price marched upwards over that time, and is now 167% higher than it was. It's not uncommon to see a share price retrace a bit, after a big gain. Only time will tell if there is still too much optimism currently reflected in the share price.

View our latest analysis for Kraken Robotics

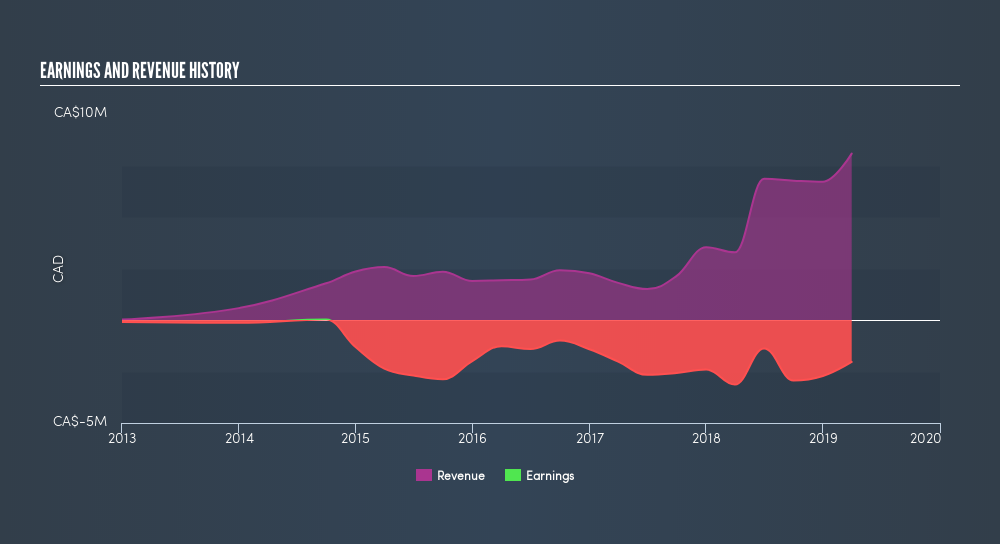

Kraken Robotics isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last 3 years Kraken Robotics saw its revenue grow at 56% per year. That's well above most pre-profit companies. Meanwhile, the share price performance has been pretty solid at 39% compound over three years. But it does seem like the market is paying attention to strong revenue growth. That's not to say we think the share price is too high. In fact, it might be worth keeping an eye on this one.

This free interactive report on Kraken Robotics's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that Kraken Robotics rewarded shareholders with a total shareholder return of 33% over the last year. But the three year TSR of 39% per year is even better. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

We will like Kraken Robotics better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSXV:PNG

Kraken Robotics

A marine technology company, engages in the design, manufacture, and sale of sonar and optical sensors, batteries, and underwater robotic equipment for unmanned underwater vehicles used in military and commercial applications in Canada, the Asia Pacific, Europe, the Middle East, Africa, North America, and internationally.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives