Kraken Robotics (TSXV:PNG): Assessing Valuation After $13M in Global Orders and New Industry Partnerships

Reviewed by Simply Wall St

Kraken Robotics (TSXV:PNG) is back on investors’ radar after announcing $13 million in new orders for its synthetic aperture sonar and subsea batteries from clients in the United States, Norway, and Turkey. What makes this event particularly interesting for shareholders is not just the headline number, but that these systems will be integrated across multiple classes of uncrewed underwater vehicles and showcased at a significant industry exercise in Portugal. This could go beyond a short-term sales bump, hinting at deeper demand for Kraken’s tech in high-stakes, multinational naval scenarios.

The news comes as Kraken Robotics has seen strong stock momentum this year. It is up 33% so far with an impressive 125% gain over the past year, outpacing many tech peers. The company has been delivering on revenue growth and profitability, with annual sales rising 26% and net income jumping 48%. After a minor pullback in the past month, the surge in new orders could be a signal that recent softness was just a pause in a much bigger growth story.

After such a powerful run and fresh business wins, the big question is whether Kraken Robotics is undervalued right now or if markets are already looking ahead and pricing in more good news.

Price-to-Earnings of 71.9x: Is it justified?

Kraken Robotics is currently valued at a price-to-earnings (P/E) ratio of 71.9x, which means investors are paying a high premium compared to its earnings. This multiple is substantially higher than both the estimated fair P/E ratio of 47.9x and peer averages, as well as the broader North American Electronic industry average of 23.4x.

The price-to-earnings ratio is a key metric for evaluating how much investors are willing to pay for each dollar of company earnings. A high P/E typically indicates that the market expects significant growth ahead or that the stock is expensive relative to industry benchmarks. For a tech-focused company like Kraken Robotics, rapid revenue and profit growth can help justify a premium valuation. However, the sizeable gap versus industry means market expectations are especially high.

Given Kraken's fast-paced growth, the market may be betting on continued outperformance. Still, with a P/E far above peers and fair value estimates, any disappointment on execution or slowing growth could trigger higher volatility in the share price.

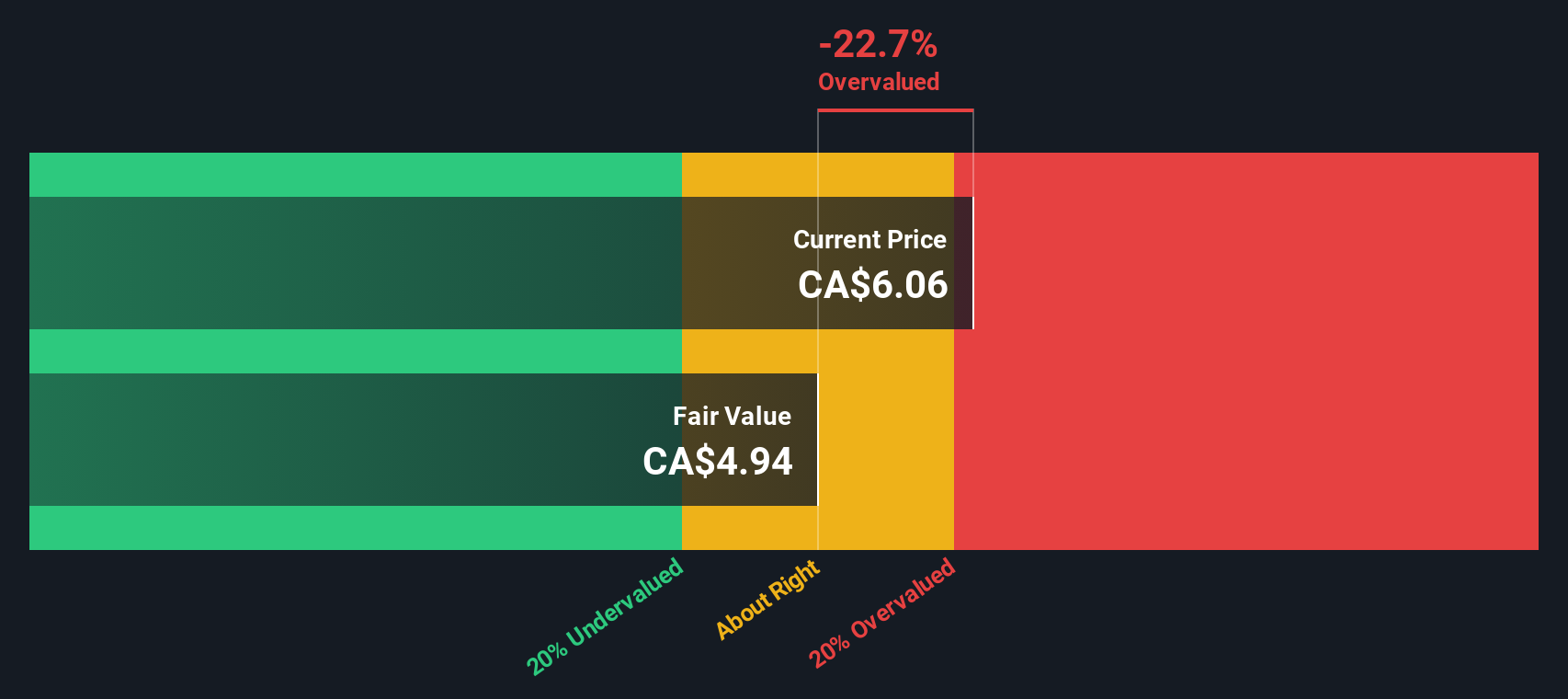

Result: Fair Value of $3.35 (OVERVALUED)

See our latest analysis for Kraken Robotics.However, slowing growth or missed projections could quickly reverse sentiment, considering Kraken’s lofty valuation and recent investor optimism.

Find out about the key risks to this Kraken Robotics narrative.Another View: What Does Our DCF Model Say?

Looking from a different angle, the SWS DCF model gives us a fresh perspective on Kraken Robotics’ value. This approach also points to the shares being overvalued. Could both methods have missed something?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Kraken Robotics Narrative

If you have your own perspective or want to dig into the details yourself, building a personal investment thesis is quick and straightforward. Do it your way.

A great starting point for your Kraken Robotics research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always widen their search. The Simply Wall Street Screener gives you access to exceptional opportunities that you might otherwise miss and can help boost your investing edge today.

- Capture opportunities among companies generating stable returns when you use our tool to find dividend stocks with yields > 3% that can add income power to your portfolio.

- Capitalize on the future of medicine by zeroing in on healthcare AI stocks, where breakthroughs in healthcare and artificial intelligence are changing how we live and invest.

- Seize growth in tomorrow's finance by tracking cryptocurrency and blockchain stocks and blockchain innovators building next-generation digital economies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kraken Robotics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSXV:PNG

Kraken Robotics

A marine technology company, engages in the design, manufacture, and sale of sonar and optical sensors, batteries, and underwater robotic equipment for unmanned underwater vehicles used in military and commercial applications in Canada, the Asia Pacific, Europe, the Middle East, Africa, North America, and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives