- China

- /

- Communications

- /

- SZSE:300548

High Growth Tech Stocks to Watch in July 2025

Reviewed by Simply Wall St

As we head into July 2025, the global markets are witnessing robust momentum with major U.S. stock indexes like the S&P 500 and Nasdaq Composite reaching record highs for consecutive weeks, while smaller-cap indexes such as the S&P MidCap 400 and Russell 2000 have also shown impressive gains. In this thriving environment, high growth tech stocks are capturing attention due to their potential to capitalize on favorable economic conditions and resilient job growth, making them noteworthy contenders in an investor's portfolio.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 30.26% | 44.76% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.44% | 23.48% | ★★★★★★ |

| KebNi | 20.56% | 94.46% | ★★★★★★ |

| Pharma Mar | 29.61% | 44.92% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.53% | 96.08% | ★★★★★★ |

| JNTC | 55.45% | 94.52% | ★★★★★★ |

We'll examine a selection from our screener results.

Broadex Technologies (SZSE:300548)

Simply Wall St Growth Rating: ★★★★★☆

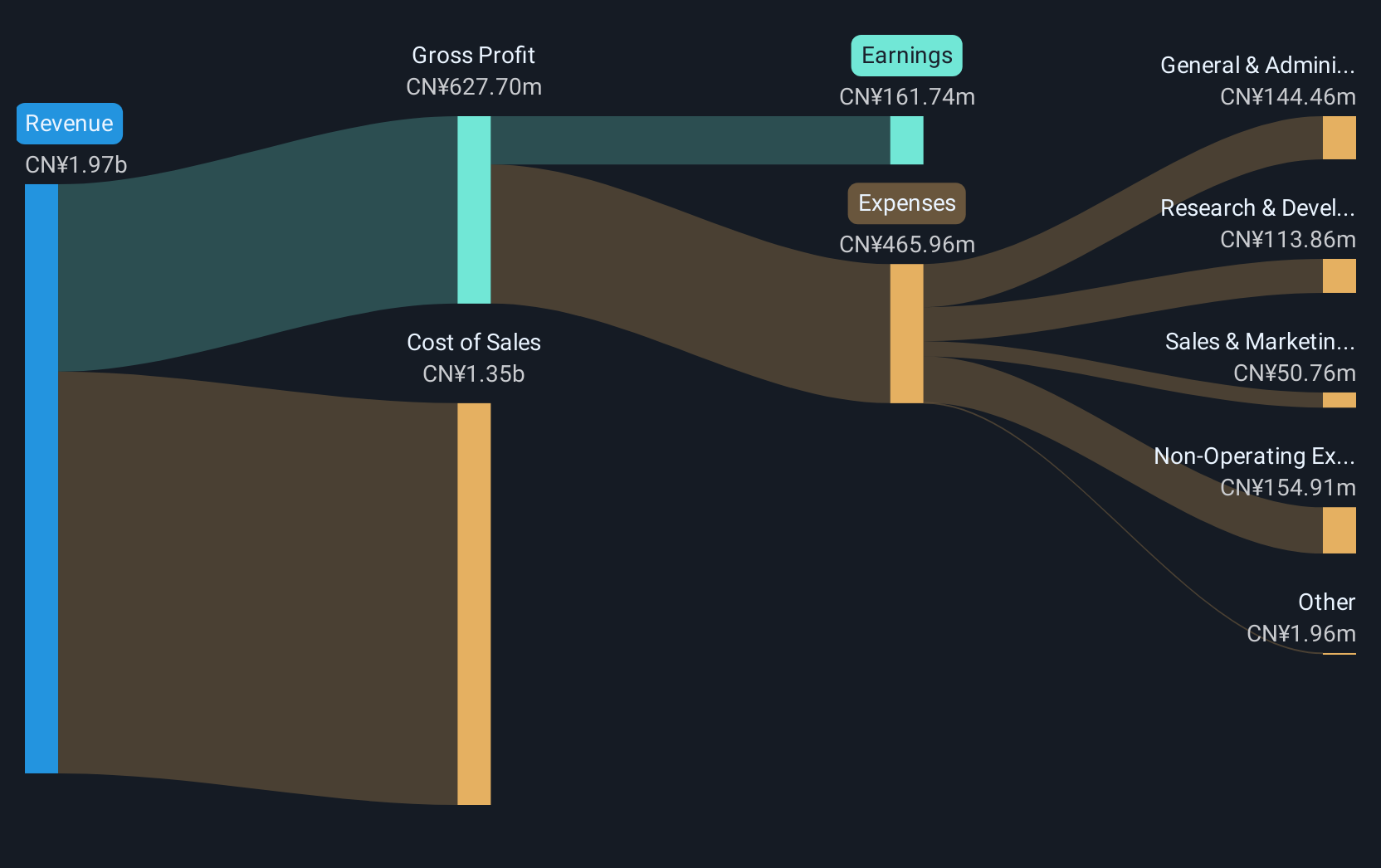

Overview: Broadex Technologies Co., Ltd. engages in the research, development, production, and sale of integrated optoelectronic devices for optical communications both in China and internationally, with a market cap of CN¥18.88 billion.

Operations: The company focuses on the development and sale of integrated optoelectronic devices for optical communications, catering to both domestic and international markets.

Broadex Technologies has demonstrated robust growth, with a staggering 309.9% increase in earnings over the past year, outpacing its industry's average. The firm's commitment to innovation is evident from its R&D spending, which has consistently aligned with revenue increases, maintaining a strategic focus on enhancing technological capabilities. Recent corporate adjustments include amending company bylaws and a dividend affirmation of CNY 0.80 per share, reflecting both governance adaptiveness and shareholder value focus. With earnings projected to grow by 40.88% annually, Broadex is navigating the competitive tech landscape effectively, leveraging substantial revenue growth of 23.1% per year to potentially outstrip market averages.

- Navigate through the intricacies of Broadex Technologies with our comprehensive health report here.

Understand Broadex Technologies' track record by examining our Past report.

GMO internet (TSE:4784)

Simply Wall St Growth Rating: ★★★★★☆

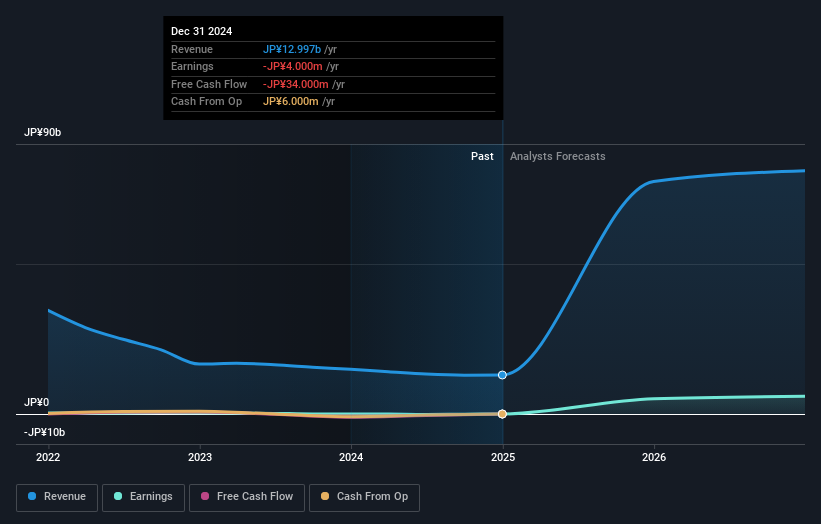

Overview: GMO Internet, Inc. operates in the internet infrastructure sector in Japan and has a market capitalization of ¥456.72 billion.

Operations: The company generates revenue primarily from its internet infrastructure services in Japan. It focuses on providing a range of online solutions, including domain registration, web hosting, and cloud services. The business model is supported by diverse digital offerings that cater to both individual users and enterprises.

GMO Internet has shown a dynamic financial trajectory with an expected annual revenue growth of 47.4% and earnings anticipated to surge by 67.3%. This robust growth is underpinned by strategic R&D investments, which have been essential in maintaining its competitive edge in the tech sector. Recent corporate actions include a special dividend announcement and adjustments to capital investment plans, reflecting its agility in responding to market conditions while enhancing shareholder value. With projected substantial gains in both top-line and bottom-line metrics, GMO Internet is poised to capitalize on market opportunities, leveraging its innovative capabilities and recent strategic decisions.

- Take a closer look at GMO internet's potential here in our health report.

Review our historical performance report to gain insights into GMO internet's's past performance.

Kraken Robotics (TSXV:PNG)

Simply Wall St Growth Rating: ★★★★★☆

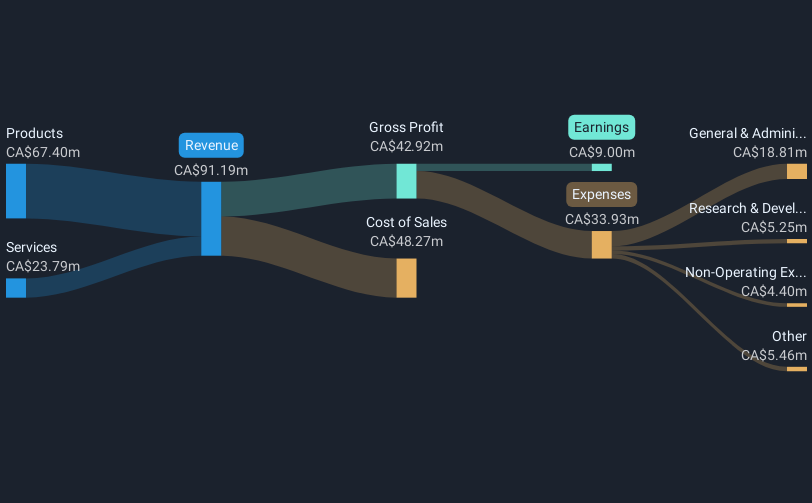

Overview: Kraken Robotics Inc. is a marine technology company that designs, manufactures, and sells sonar and optical sensors, batteries, and underwater robotic equipment for unmanned underwater vehicles used in military and commercial applications globally, with a market cap of CA$1.03 billion.

Operations: The company generates revenue primarily through its Products segment, accounting for CA$59.67 million, and a Services segment contributing CA$26.88 million.

Kraken Robotics has recently completed a significant follow-on equity offering, raising CAD 100 million to fuel its expansion and R&D initiatives. This move coincides with robust financial performance, as evidenced by a 136.1% surge in earnings over the past year, outpacing the electronic industry's average. With revenue projected to grow at an annual rate of 24.2%, Kraken is strategically investing in technology that enhances its competitive edge in subsea robotics. The appointment of Kristin Robertson to the board adds valuable aerospace and defense expertise, potentially steering the company towards innovative integrated space solutions for global defense and commercial sectors. These strategic decisions are set against a backdrop of increasing demand for Kraken's specialized underwater technologies, notably its SeaPower batteries which have garnered $45 million in orders this year alone, underscoring its growth trajectory within high-tech sectors.

Make It Happen

- Embark on your investment journey to our 745 Global High Growth Tech and AI Stocks selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EverProX Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300548

EverProX Technologies

Researches and develops, produces, and sells integrated optoelectronic devices in the field of optical communications in China and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives