- Canada

- /

- Communications

- /

- TSXV:LTE

Introducing Lite Access Technologies (CVE:LTE), The Stock That Tanked 82%

Lite Access Technologies Inc. (CVE:LTE) shareholders will doubtless be very grateful to see the share price up 227% in the last quarter. But the last three years have seen a terrible decline. To wit, the share price sky-dived 82% in that time. So we're relieved for long term holders to see a bit of uplift. But the more important question is whether the underlying business can justify a higher price still.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

See our latest analysis for Lite Access Technologies

Because Lite Access Technologies made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over three years, Lite Access Technologies grew revenue at 9.7% per year. That's a fairly respectable growth rate. So it's hard to believe the share price decline of 43% per year is due to the revenue. It could be that the losses were much larger than expected. This is exactly why investors need to diversify - even when a loss making company grows revenue, it can fail to deliver for shareholders.

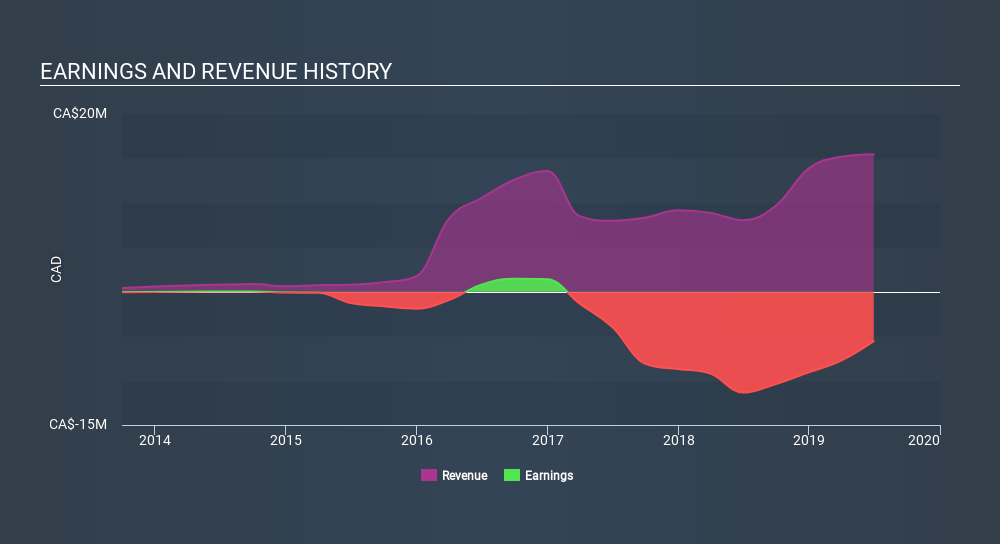

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

While share prices often depend primarily on earnings and revenue, they can be sensitive to an investment's risk level as well. For example, we've discovered 5 warning signs for Lite Access Technologies (of which 2 are major) which any shareholder or potential investor should be aware of.

A Different Perspective

Over the last year, Lite Access Technologies shareholders took a loss of 27%. In contrast the market gained about 17%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, the longer term story isn't pretty, with investment losses running at 43% per year over three years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. Before spending more time on Lite Access Technologies it might be wise to click here to see if insiders have been buying or selling shares.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSXV:LTE

Lite Access Technologies

Manufactures, distributes, sells, and installs fiber optic technology specializing in micro-duct and air-blown fiber in Canada, and the United States.

Slight and slightly overvalued.

Market Insights

Community Narratives