- Canada

- /

- Metals and Mining

- /

- TSXV:CRE

Critical Elements Lithium Leads 3 Promising Penny Stocks On TSX

Reviewed by Simply Wall St

The Canadian market has been navigating a period of uncertainty, with the Bank of Canada cutting rates amid concerns over potential U.S. tariffs, while the economy showed signs of contraction in November. Despite these challenges, opportunities remain for investors seeking growth potential in smaller or newer companies. Penny stocks, a term that may seem outdated but still relevant, can offer surprising value when backed by strong financial health and stability.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$5.00 | CA$180.96M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.73 | CA$1.03B | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.68 | CA$439.49M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.38 | CA$120.49M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.36 | CA$236.24M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.50 | CA$14.9M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.70 | CA$628.96M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.00 | CA$26.06M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| DIRTT Environmental Solutions (TSX:DRT) | CA$1.14 | CA$226.29M | ★★★★☆☆ |

Click here to see the full list of 934 stocks from our TSX Penny Stocks screener.

We'll examine a selection from our screener results.

Critical Elements Lithium (TSXV:CRE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Critical Elements Lithium Corporation focuses on acquiring, exploring, and developing mining properties in Canada with a market cap of CA$82.21 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$82.21M

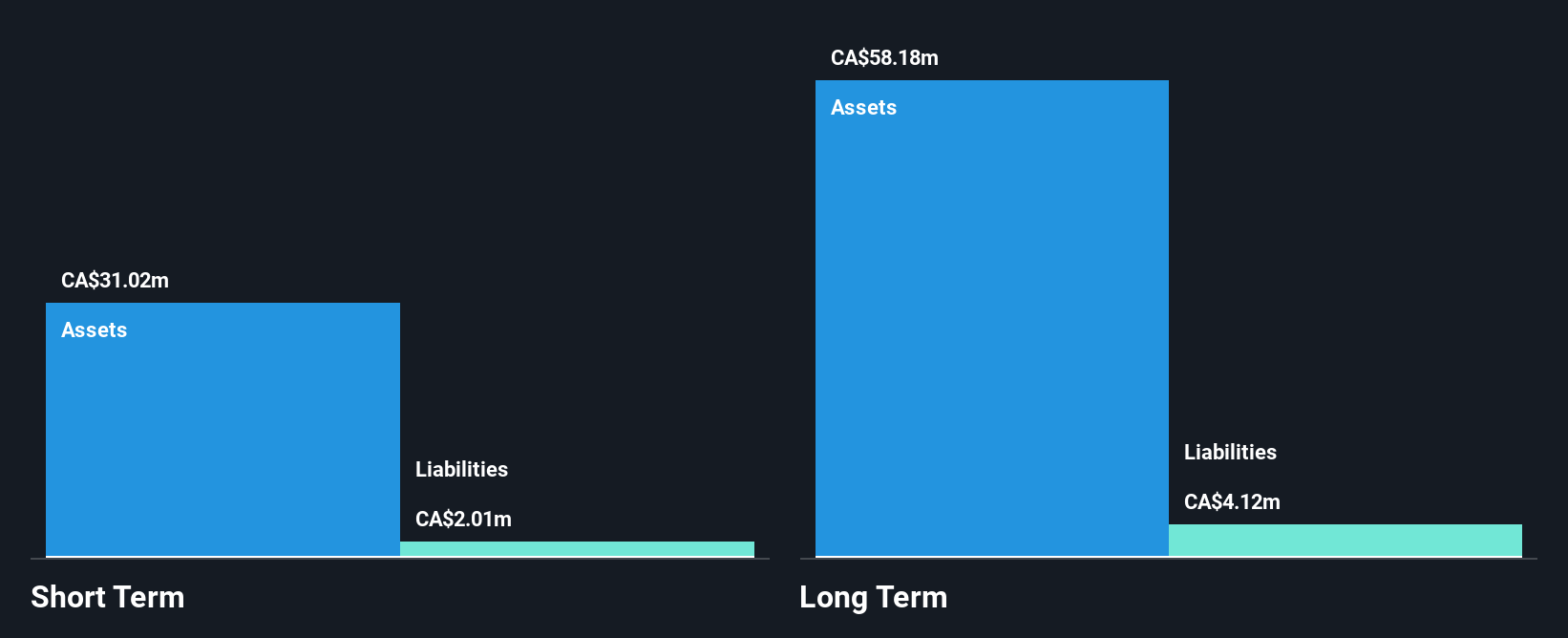

Critical Elements Lithium Corporation, with a market cap of CA$82.21 million, has recently transitioned to profitability, reporting a net income of CA$1.01 million for the first quarter ending November 2024. The company is pre-revenue with less than US$1m in revenue but has shown significant improvement from a net loss position in previous periods. Its short-term assets significantly exceed both short and long-term liabilities, and it operates debt-free, reducing financial risk. Despite trading at 89.7% below estimated fair value and having stable weekly volatility over the past year, its return on equity remains low at 2.1%.

- Click to explore a detailed breakdown of our findings in Critical Elements Lithium's financial health report.

- Explore Critical Elements Lithium's analyst forecasts in our growth report.

Gatekeeper Systems (TSXV:GSI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Gatekeeper Systems Inc. designs, manufactures, markets, and sells video security solutions for mobile and transportation environments focused on children, passengers, and public safety in Canada and the United States with a market cap of CA$49.67 million.

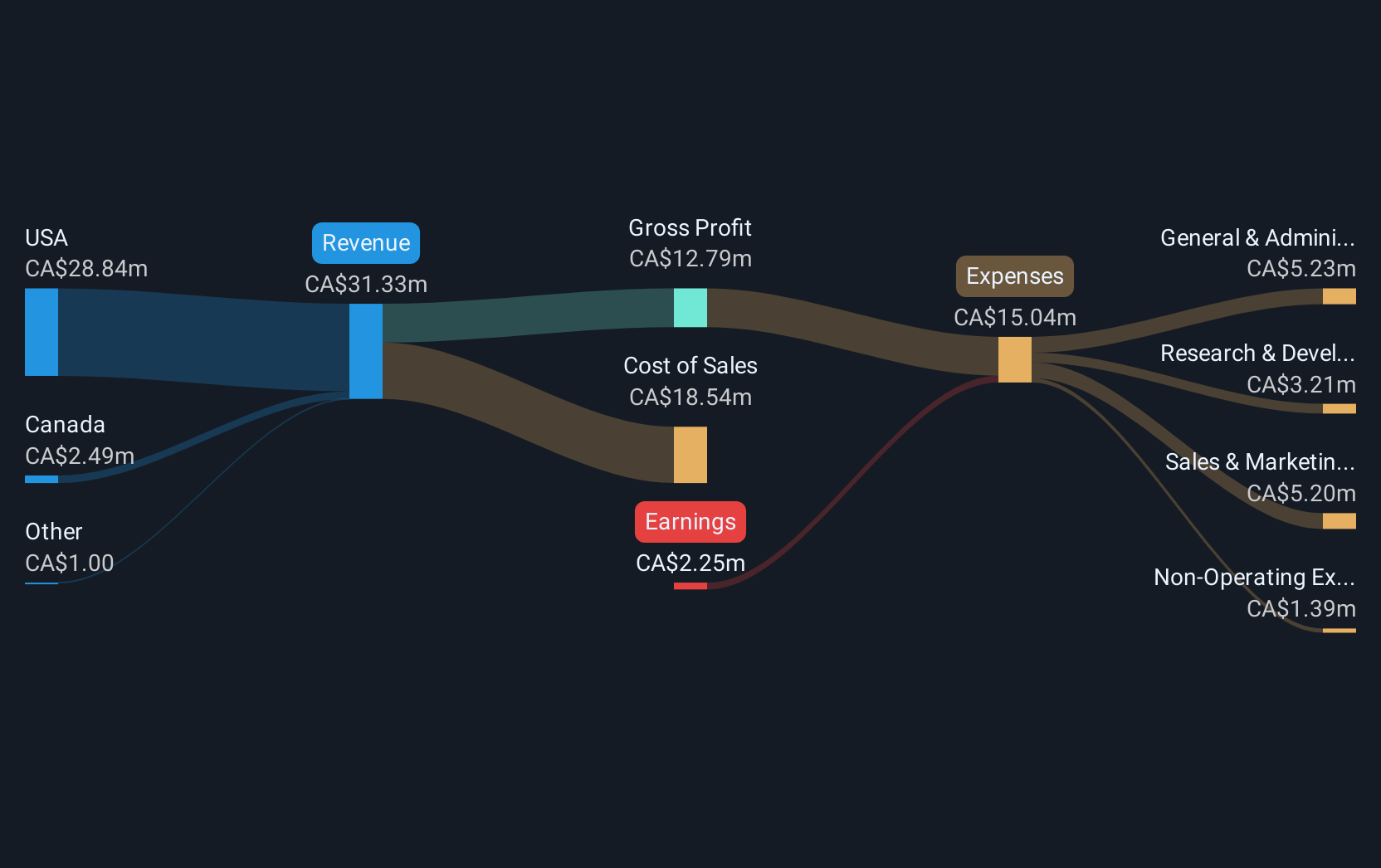

Operations: The company generates CA$35.27 million in revenue from its electronic security devices segment.

Market Cap: CA$49.67M

Gatekeeper Systems Inc., with a market cap of CA$49.67 million, reported Q1 2025 sales of CA$7.28 million, down from CA$9.82 million the previous year, and net income of CA$0.36 million compared to CA$2.39 million a year ago, reflecting its ongoing unprofitability despite reducing losses over five years by 16.5% annually. The company stands out for its debt-free status and robust short-term assets (CA$19.7M) exceeding both long-term liabilities (CA$625K) and short-term liabilities (CA$2.5M). Recent contract completions bolster its position in the electronic security devices sector amidst stable weekly volatility.

- Jump into the full analysis health report here for a deeper understanding of Gatekeeper Systems.

- Explore historical data to track Gatekeeper Systems' performance over time in our past results report.

High Tide (TSXV:HITI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: High Tide Inc. operates in the cannabis retail sector across Canada, the United States, and internationally, with a market cap of CA$326.83 million.

Operations: The company's revenue is primarily derived from its Bricks and Mortar segment, contributing CA$484.44 million, while the E-commerce segment accounts for CA$37.86 million.

Market Cap: CA$326.83M

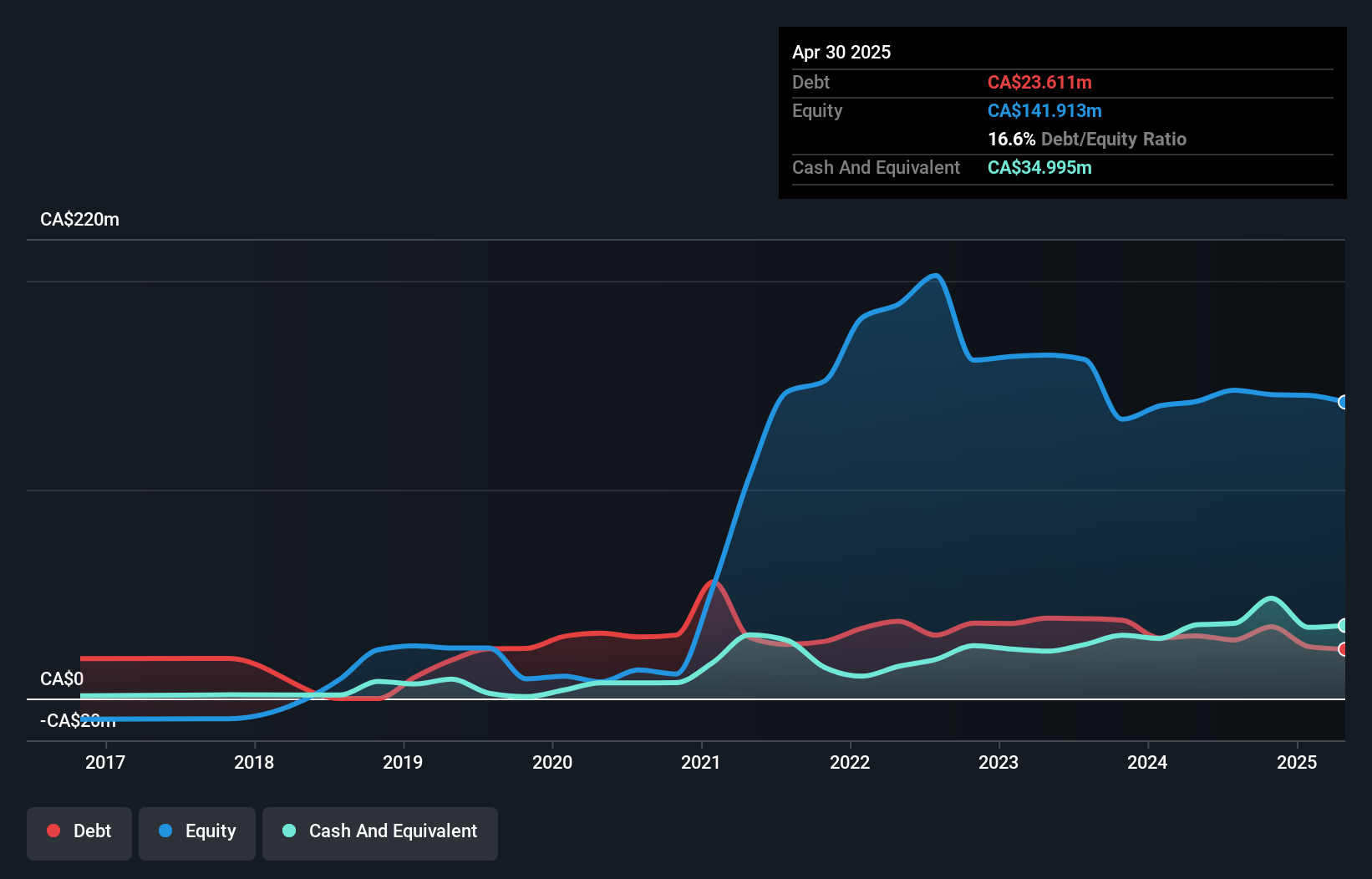

High Tide Inc., with a market cap of CA$326.83 million, has shown revenue growth in its recent earnings report, achieving CA$522.31 million for the full year ending October 2024, up from CA$487.67 million the previous year. Despite being unprofitable with a net loss of CA$4.34 million, this is a significant improvement from the prior year's loss of CA$39.31 million. The company maintains over three years' cash runway due to positive free cash flow and reduced debt levels over five years from 255.1% to 23.6%. High Tide's expansion strategy includes opening new retail locations under its Canna Cabana brand across Canada.

- Click here and access our complete financial health analysis report to understand the dynamics of High Tide.

- Assess High Tide's future earnings estimates with our detailed growth reports.

Seize The Opportunity

- Unlock our comprehensive list of 934 TSX Penny Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:CRE

Critical Elements Lithium

Engages in the acquisition, exploration, evaluation, development, and processing of critical minerals mining properties in Canada.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion