- Canada

- /

- Communications

- /

- TSX:HAI

Optimistic Investors Push Haivision Systems Inc. (TSE:HAI) Shares Up 26% But Growth Is Lacking

Haivision Systems Inc. (TSE:HAI) shareholders have had their patience rewarded with a 26% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 47% in the last year.

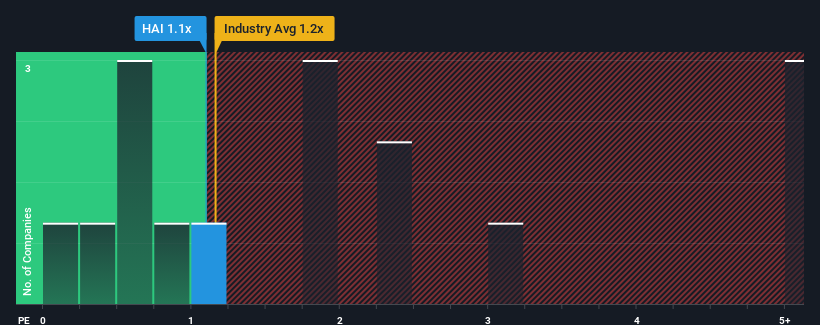

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Haivision Systems' P/S ratio of 1.1x, since the median price-to-sales (or "P/S") ratio for the Communications industry in Canada is also close to 1.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Haivision Systems

What Does Haivision Systems' P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Haivision Systems has been relatively sluggish. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Haivision Systems will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Haivision Systems?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Haivision Systems' to be considered reasonable.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. However, a few strong years before that means that it was still able to grow revenue by an impressive 60% in total over the last three years. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 2.5% per year over the next three years. That's shaping up to be materially lower than the 9.2% each year growth forecast for the broader industry.

With this in mind, we find it intriguing that Haivision Systems' P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What We Can Learn From Haivision Systems' P/S?

Its shares have lifted substantially and now Haivision Systems' P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look at the analysts forecasts of Haivision Systems' revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

Before you settle on your opinion, we've discovered 1 warning sign for Haivision Systems that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Haivision Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:HAI

Haivision Systems

Provides mission-critical, real-time video networking, and visual collaboration solutions in Canada, the United States, and internationally.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives