Market Participants Recognise Tantalus Systems Holding Inc.'s (TSE:GRID) Revenues Pushing Shares 27% Higher

Tantalus Systems Holding Inc. (TSE:GRID) shares have continued their recent momentum with a 27% gain in the last month alone. The annual gain comes to 104% following the latest surge, making investors sit up and take notice.

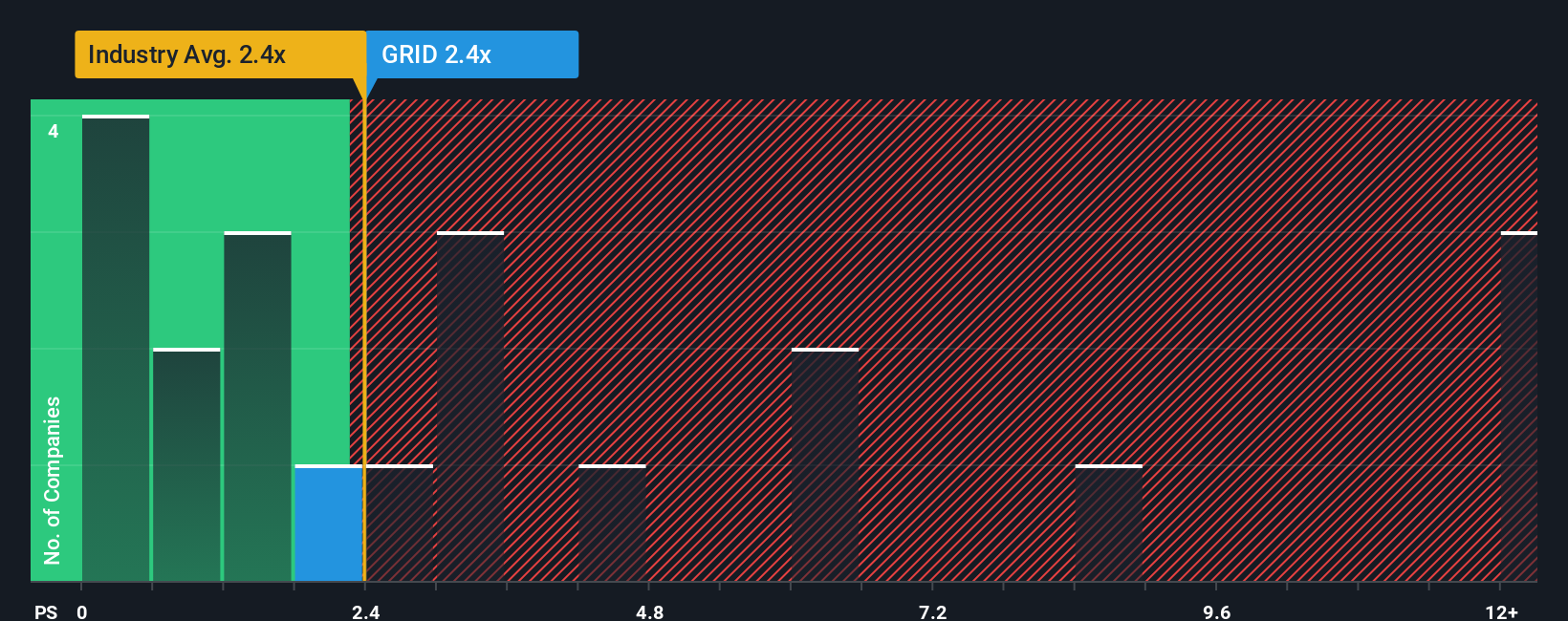

Although its price has surged higher, there still wouldn't be many who think Tantalus Systems Holding's price-to-sales (or "P/S") ratio of 2.4x is worth a mention when the median P/S in Canada's Electronic industry is similar at about 2.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Tantalus Systems Holding

What Does Tantalus Systems Holding's Recent Performance Look Like?

Recent times haven't been great for Tantalus Systems Holding as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Tantalus Systems Holding's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Tantalus Systems Holding would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a decent 14% gain to the company's revenues. Pleasingly, revenue has also lifted 40% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 16% over the next year. Meanwhile, the rest of the industry is forecast to expand by 15%, which is not materially different.

With this in mind, it makes sense that Tantalus Systems Holding's P/S is closely matching its industry peers. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What Does Tantalus Systems Holding's P/S Mean For Investors?

Its shares have lifted substantially and now Tantalus Systems Holding's P/S is back within range of the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

A Tantalus Systems Holding's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Electronic industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

You always need to take note of risks, for example - Tantalus Systems Holding has 1 warning sign we think you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Tantalus Systems Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:GRID

Tantalus Systems Holding

A technology company, provides smart grid solutions in Canada and the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026