- Canada

- /

- Metals and Mining

- /

- TSX:FAR

3 Promising TSX Penny Stocks With Under CA$200M Market Cap

Reviewed by Simply Wall St

As Canada grapples with a recent economic contraction, marked by a 1.6% decline in GDP during the second quarter, investors are keenly watching for opportunities amid shifting monetary policies and market dynamics. Despite their vintage connotation, penny stocks remain an intriguing investment area for those willing to explore beyond established names. In this article, we spotlight three Canadian penny stocks that stand out for their financial resilience and potential growth prospects.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.20 | CA$56.14M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.80 | CA$22.99M | ✅ 2 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.295 | CA$2.34M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.295 | CA$45.06M | ✅ 2 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.28 | CA$791.7M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.01 | CA$20.02M | ✅ 2 ⚠️ 4 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.29 | CA$377.89M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.80 | CA$195.41M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.97 | CA$184.63M | ✅ 3 ⚠️ 1 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.50 | CA$5.66M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 406 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Foraco International (TSX:FAR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Foraco International SA, with a market cap of CA$199.72 million, offers drilling services across North America, South America, the Asia Pacific, the Middle East, Africa, and Europe.

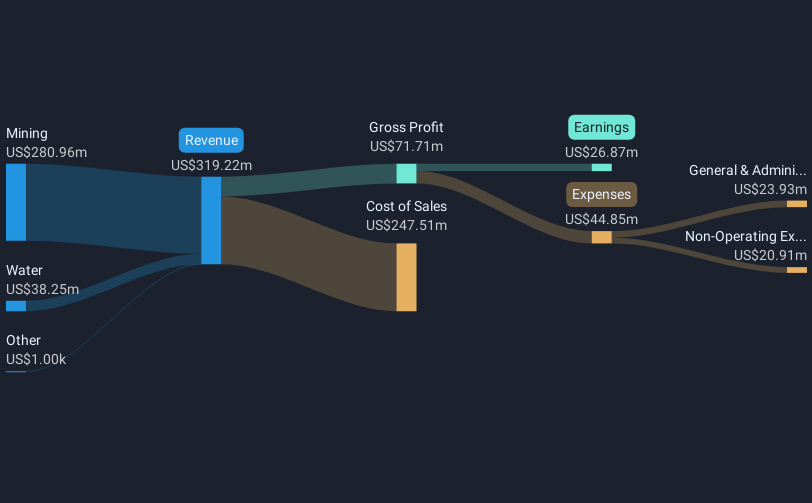

Operations: Foraco International's revenue is primarily derived from its mining segment, which generated $218.16 million, complemented by its water segment with $44.39 million.

Market Cap: CA$199.72M

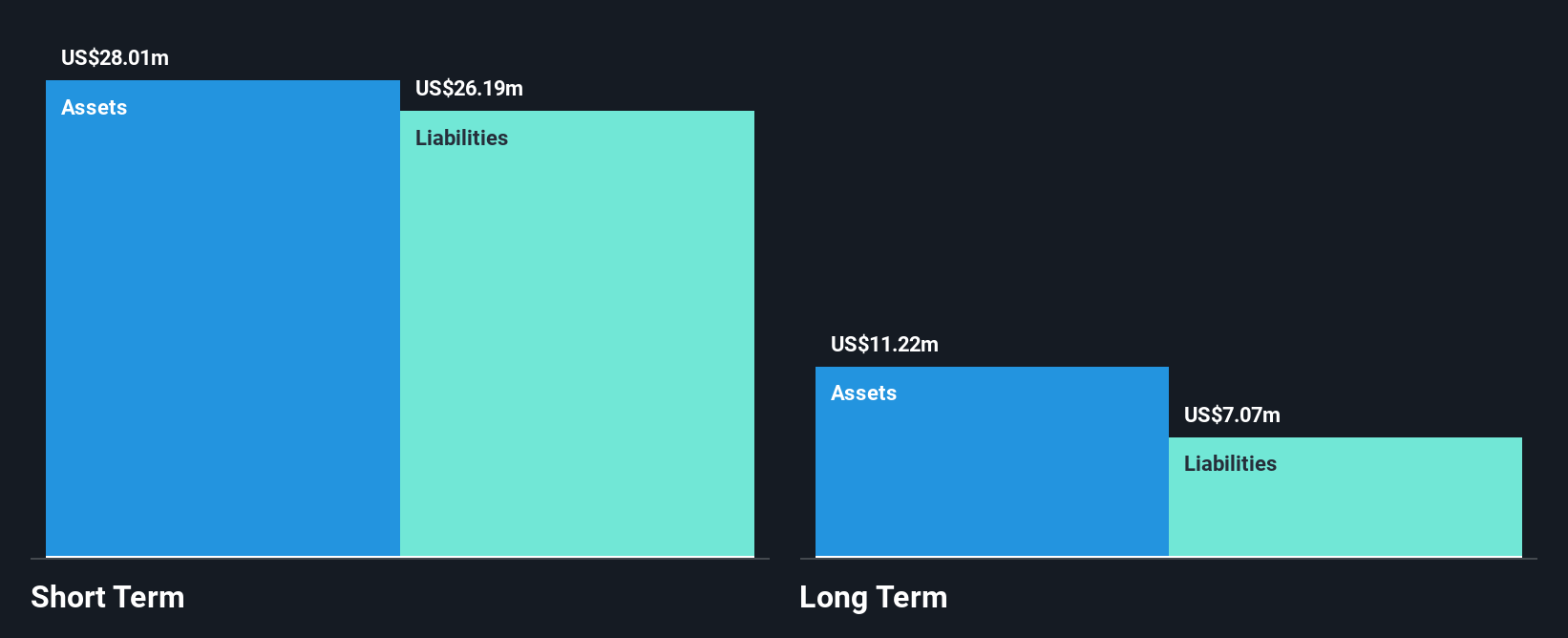

Foraco International SA, with a market cap of CA$199.72 million, has shown resilience despite challenges in the past year. The company reported a decline in Q2 2025 sales to US$69.06 million from US$77.88 million the previous year, with net income also decreasing to US$6.34 million from US$7.76 million. However, Foraco's strategic moves include securing a significant three-year contract worth approximately US$34 million with Glencore for drilling services in Chile, enhancing its regional presence and potential revenue streams. Despite high debt levels, Foraco's interest payments are well-covered by EBIT and its debt is well-managed by operating cash flow.

- Unlock comprehensive insights into our analysis of Foraco International stock in this financial health report.

- Understand Foraco International's earnings outlook by examining our growth report.

Tantalus Systems Holding (TSX:GRID)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tantalus Systems Holding Inc. is a technology company that offers smart grid solutions in Canada and the United States, with a market cap of CA$150.61 million.

Operations: Tantalus Systems Holding generates revenue through two primary segments: Connected Devices and Infrastructure, which accounts for $31.51 million, and Utility Software Applications and Services, contributing $17.66 million.

Market Cap: CA$150.61M

Tantalus Systems Holding Inc., with a market cap of CA$150.61 million, is navigating the penny stock landscape by leveraging its smart grid solutions across Canada and the U.S. Recent earnings show sales growth to US$13.09 million in Q2 2025, up from US$10.74 million a year prior, while net losses narrowed slightly. Despite being unprofitable with negative return on equity, Tantalus maintains robust cash reserves exceeding debt levels and has not diluted shareholders recently. Strategic partnerships with entities like EPB of Chattanooga highlight its commitment to grid modernization through advanced technologies like TRUSense Gateways and AI-powered analytics platforms such as TRUGrid.

- Click to explore a detailed breakdown of our findings in Tantalus Systems Holding's financial health report.

- Learn about Tantalus Systems Holding's future growth trajectory here.

Roots (TSX:ROOT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Roots Corporation, along with its subsidiaries, designs, markets, and sells apparel, leather goods, footwear, and accessories under the Roots brand both in Canada and internationally with a market cap of CA$122.78 million.

Operations: Roots generates revenue primarily through its Direct-To-Consumer segment, accounting for CA$226.46 million, and its Partners and Other segment, contributing CA$38.98 million.

Market Cap: CA$122.78M

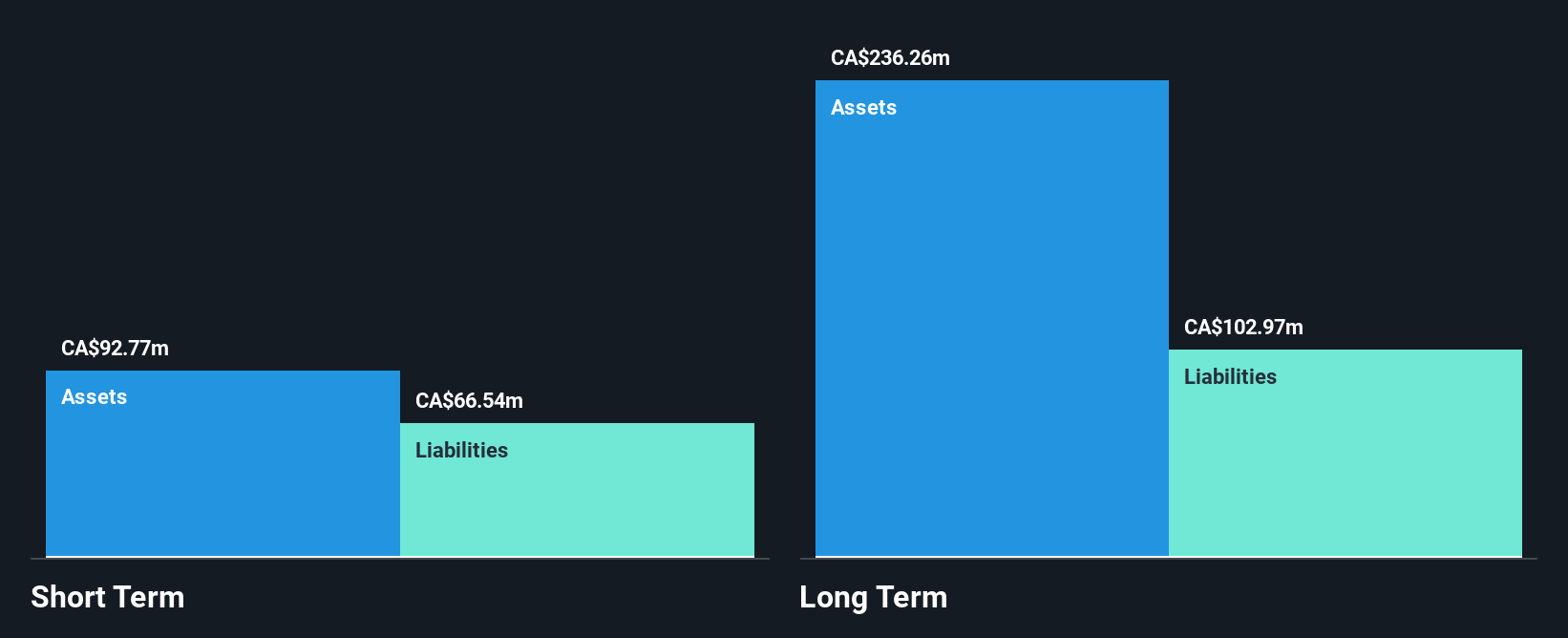

Roots Corporation, with a market cap of CA$122.78 million, continues to operate in the penny stock domain by focusing on its Direct-To-Consumer and Partners segments, generating significant revenue. Despite being unprofitable with a negative return on equity of -22.03%, Roots maintains a positive free cash flow and has reduced losses over the past five years at an 11% annual rate. Recent initiatives include launching the Canada Dry x Roots Summer Collection, showcasing its brand collaboration capabilities. The company has also managed debt effectively, reducing its debt to equity ratio from 71.3% to 24.1% over five years without meaningful shareholder dilution recently.

- Navigate through the intricacies of Roots with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Roots' future.

Where To Now?

- Unlock more gems! Our TSX Penny Stocks screener has unearthed 403 more companies for you to explore.Click here to unveil our expertly curated list of 406 TSX Penny Stocks.

- Seeking Other Investments? We've found 17 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FAR

Foraco International

Provides drilling services in North America, South America, the Asia Pacific, the Middle East, Africa, and Europe.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives