Undervalued Small Caps With Insider Buying In Global April 2025

Reviewed by Simply Wall St

In April 2025, global markets are navigating significant volatility driven by escalating trade tensions between the U.S. and China, which have led to fluctuating investor sentiment and impacted key indices such as the Russell 2000. Despite these challenges, small-cap stocks have shown resilience, with some investors eyeing opportunities in this segment as consumer sentiment hits a near three-year low and economic indicators suggest cautious optimism amid uncertainty. In this environment, identifying promising small-cap stocks involves looking for companies with strong fundamentals that can weather economic fluctuations and benefit from strategic insider buying—a signal that insiders believe in their company's potential despite broader market turbulence.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Morgan Advanced Materials | 10.3x | 0.5x | 44.13% | ★★★★★★ |

| Tristel | 24.7x | 3.5x | 34.68% | ★★★★★★ |

| Nexus Industrial REIT | 5.1x | 2.6x | 25.84% | ★★★★★★ |

| Bytes Technology Group | 22.7x | 5.8x | 8.35% | ★★★★★☆ |

| Speedy Hire | NA | 0.2x | 28.24% | ★★★★★☆ |

| Chorus Aviation | NA | 0.4x | 18.75% | ★★★★★☆ |

| Sing Investments & Finance | 7.2x | 3.7x | 42.49% | ★★★★☆☆ |

| Saturn Oil & Gas | 5.1x | 0.3x | 0.52% | ★★★★☆☆ |

| Italmobiliare | 10.6x | 1.4x | -248.61% | ★★★☆☆☆ |

| Westshore Terminals Investment | 13.2x | 3.8x | 39.41% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

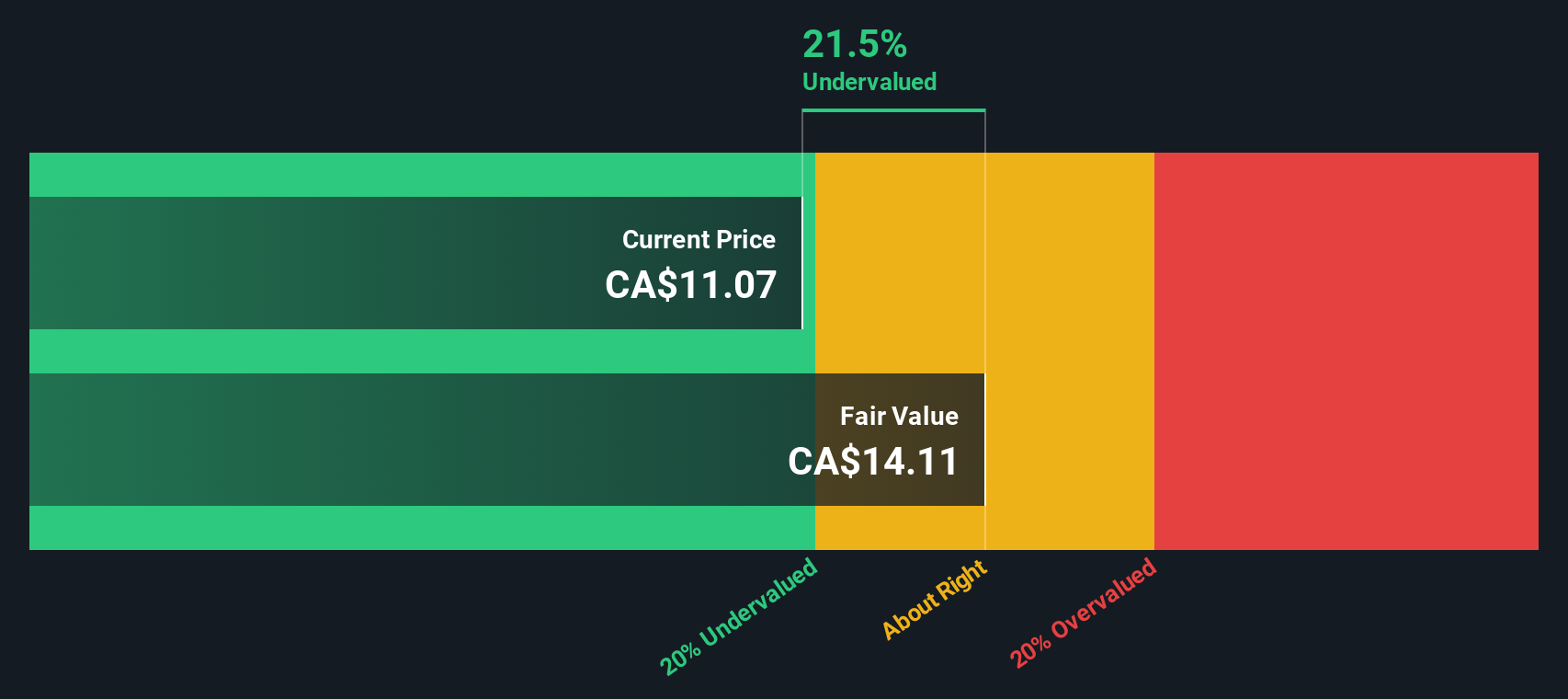

Chemtrade Logistics Income Fund (TSX:CHE.UN)

Simply Wall St Value Rating: ★★★★★★

Overview: Chemtrade Logistics Income Fund operates in the industrial chemicals sector, focusing on electrochemicals and sulphur and water chemicals, with a market capitalization of CA$1.16 billion.

Operations: The company generates its revenue primarily from two segments: Electrochemicals (EC) and Sulphur and Water Chemicals (SWC), with SWC being the larger contributor. Over recent periods, the gross profit margin has shown an upward trend, reaching 24.09% by the end of 2024. Operating expenses are a significant component of costs, including general and administrative expenses.

PE: 8.5x

Chemtrade Logistics Income Fund, a smaller player in the market, has caught attention for its strategic buybacks and insider confidence. Alan Robinson's purchase of 48,175 shares reflects this sentiment. Despite a decline in net income to C$126.91 million from C$249.32 million, Chemtrade continues to prioritize share repurchases over organic growth and M&A opportunities due to its low trading multiple. Recent dividend affirmations and strategic focus on water chemicals underscore potential growth avenues amidst evolving market conditions.

Evertz Technologies (TSX:ET)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Evertz Technologies is a company that designs, manufactures, and distributes video and audio infrastructure solutions for the television broadcast equipment market with a market cap of approximately CA$1.22 billion.

Operations: The company's primary revenue stream is from the Television Broadcast Equipment Market, with recent revenues reaching CA$496.59 million. The gross profit margin has shown a trend around 58.88% as of the latest period, indicating a significant portion of revenue retained after covering the cost of goods sold. Operating expenses are primarily driven by R&D and General & Administrative expenses, which together account for substantial costs impacting profitability.

PE: 12.9x

Evertz Technologies, a small company in the tech sector, has shown steady financial performance with Q3 2025 sales reaching C$136.92 million and net income at C$20.92 million. Despite lower nine-month sales compared to the previous year, insider confidence is evident through recent share purchases. The company's collaboration with intoPIX enhances its AV-over-IP solutions, offering advanced compression technology for seamless interoperability. While reliant on external borrowing for funding, Evertz continues to pay regular dividends of C$0.20 per share as of March 2025.

- Dive into the specifics of Evertz Technologies here with our thorough valuation report.

Evaluate Evertz Technologies' historical performance by accessing our past performance report.

Paramount Resources (TSX:POU)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Paramount Resources is a Canadian energy company engaged in the exploration, development, and production of natural gas and oil with a market capitalization of approximately CA$5.27 billion.

Operations: Paramount Resources generates revenue primarily through its operations, with significant costs attributed to COGS and operating expenses. The company has experienced fluctuations in its gross profit margin, which reached a high of 66.17% in Q3 2022 before declining to 50.32% by Q4 2024.

PE: 6.8x

Paramount Resources, a smaller company in the energy sector, has shown potential for growth despite challenges. The company's net profit margin decreased from 26.1% to 18.1% over the past year, indicating some financial pressure. However, insider confidence is evident with recent share repurchases totaling CAD 177 million for 5.67 million shares from October 2024 to March 2025. The firm continues to pay dividends consistently and expects sales volumes between 37,500 and 42,500 Boe/d in 2025's fourth quarter as new projects come online.

Where To Now?

- Discover the full array of 150 Undervalued Global Small Caps With Insider Buying right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CHE.UN

Chemtrade Logistics Income Fund

Offers industrial chemicals and services in Canada, the United States, and South America.

Very undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success