- Canada

- /

- Communications

- /

- TSX:ET

Top 3 TSX Dividend Stocks To Consider

Reviewed by Simply Wall St

As October closed with markets near record highs, investors have been navigating a landscape shaped by central banks' cautious rate cuts and easing trade tensions between the U.S. and China. In this environment of resilient corporate earnings and shifting monetary policies, dividend stocks on the Toronto Stock Exchange (TSX) can offer stability and income potential for those looking to balance growth with reliable returns.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Wajax (TSX:WJX) | 5.59% | ★★★★★☆ |

| Sun Life Financial (TSX:SLF) | 4.07% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.11% | ★★★★★☆ |

| Rogers Sugar (TSX:RSI) | 5.83% | ★★★★☆☆ |

| Pulse Seismic (TSX:PSD) | 15.93% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 3.69% | ★★★★★☆ |

| Pizza Pizza Royalty (TSX:PZA) | 6.10% | ★★★★☆☆ |

| Olympia Financial Group (TSX:OLY) | 6.03% | ★★★★★☆ |

| Canadian Imperial Bank of Commerce (TSX:CM) | 3.30% | ★★★★★☆ |

| Bank of Montreal (TSX:BMO) | 3.77% | ★★★★★☆ |

Click here to see the full list of 19 stocks from our Top TSX Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

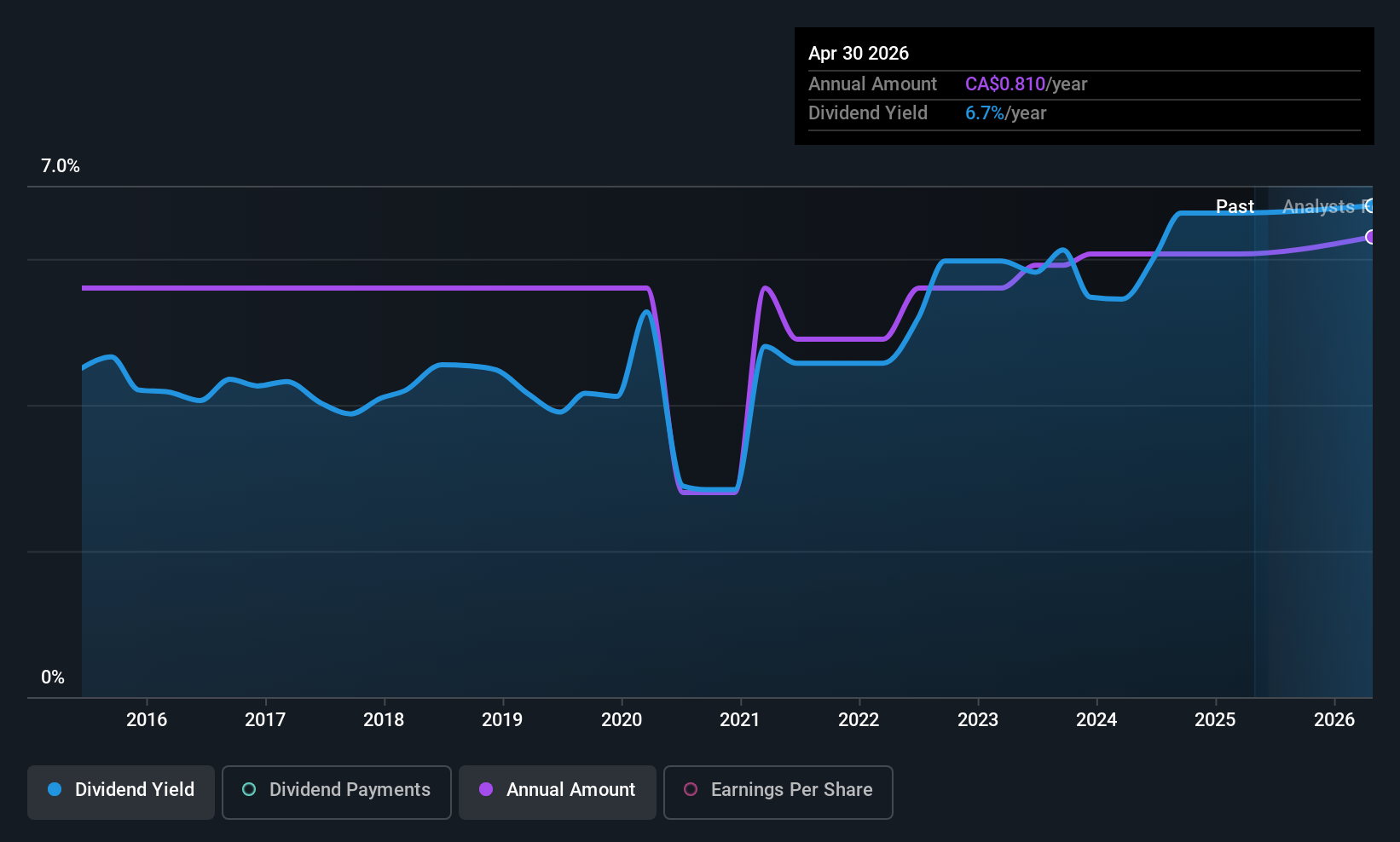

Evertz Technologies (TSX:ET)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Evertz Technologies Limited designs, manufactures, and distributes video and audio infrastructure solutions for production, post-production, broadcast, and telecommunications markets globally, with a market cap of CA$955.47 million.

Operations: Evertz Technologies generates revenue from its Television Broadcast Equipment Market segment, which amounts to CA$502.13 million.

Dividend Yield: 6.3%

Evertz Technologies recently affirmed a quarterly dividend of C$0.20 per share, continuing its pattern of increasing dividends over the past five years. However, despite a high yield in the top 25% of Canadian payers, its payout ratio is concerningly high at 98.6%, indicating dividends are not well covered by earnings. The company shows potential for growth through acquisitions and trades below estimated fair value, but dividend reliability remains an issue due to past volatility.

- Click here and access our complete dividend analysis report to understand the dynamics of Evertz Technologies.

- Our comprehensive valuation report raises the possibility that Evertz Technologies is priced lower than what may be justified by its financials.

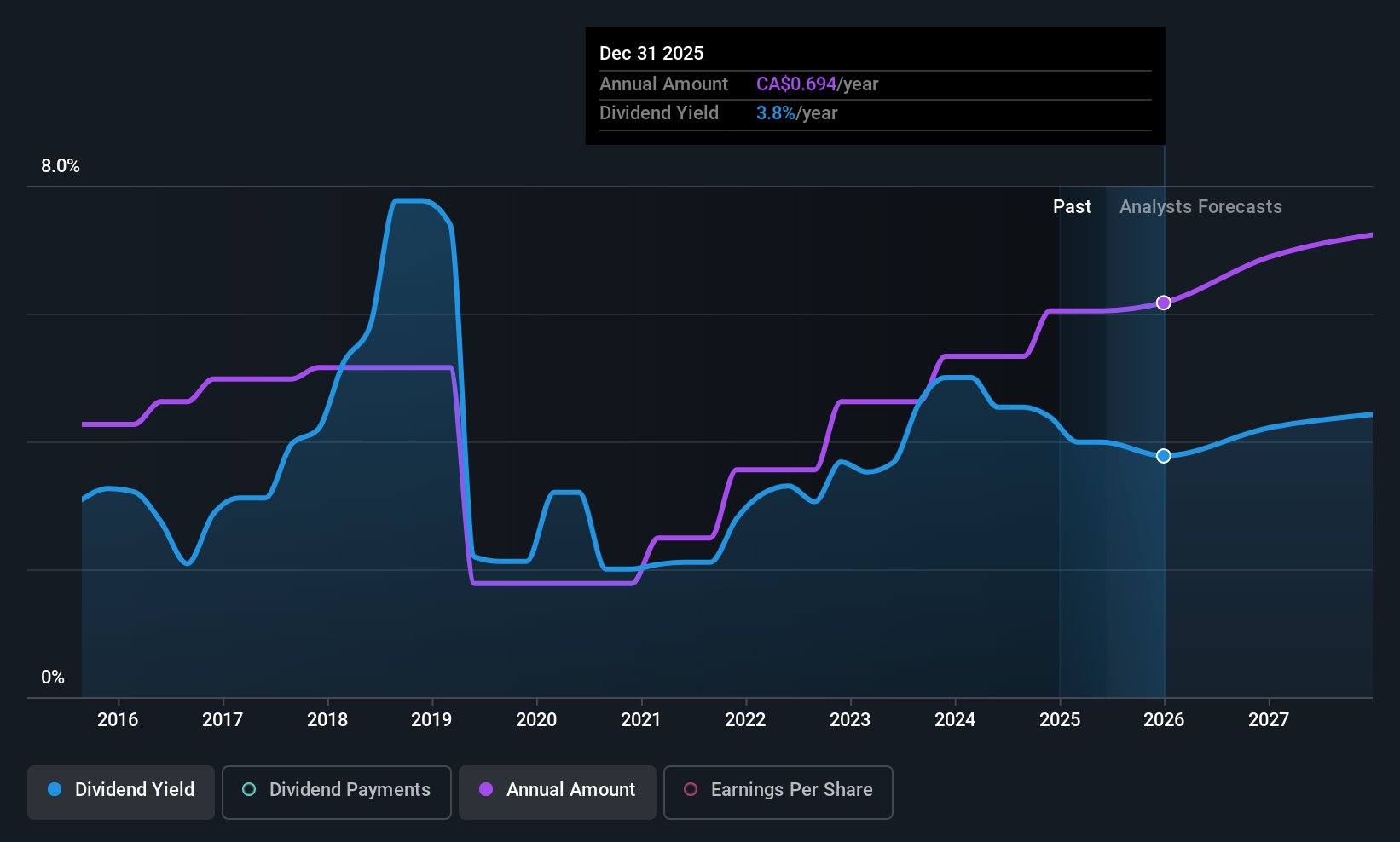

High Liner Foods (TSX:HLF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: High Liner Foods Incorporated processes and markets prepared and packaged frozen seafood products in North America, with a market cap of CA$489.73 million.

Operations: High Liner Foods generates revenue of $971.97 million from its manufacturing and marketing of prepared and packaged frozen seafood segment.

Dividend Yield: 4%

High Liner Foods maintains a quarterly dividend of C$0.17 per share, with payments covered by earnings (payout ratio: 28.9%) and cash flows, though past volatility raises concerns about reliability. Recent executive changes may impact strategic direction, as Kimberly Stephens steps in as CFO. Despite a lower yield compared to top Canadian payers and an unstable dividend track record, the company trades at good value relative to peers and has completed significant share repurchases totaling C$20.3 million.

- Unlock comprehensive insights into our analysis of High Liner Foods stock in this dividend report.

- Our valuation report unveils the possibility High Liner Foods' shares may be trading at a discount.

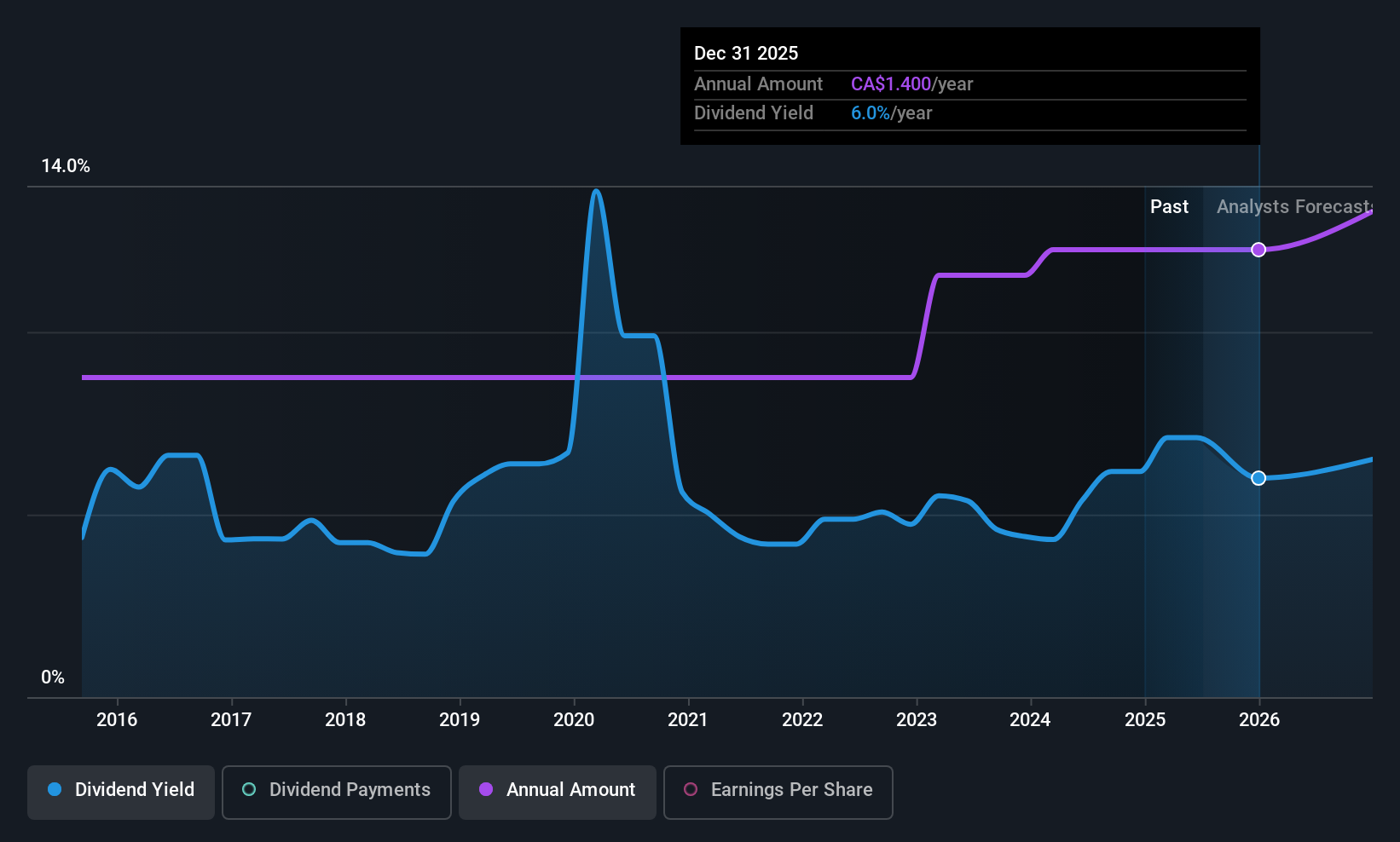

Wajax (TSX:WJX)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Wajax Corporation is a Canadian company that supplies industrial products and services, with a market capitalization of CA$536.47 million.

Operations: Wajax Corporation's revenue segments include industrial products and services in Canada, contributing to its market presence.

Dividend Yield: 5.6%

Wajax offers a stable dividend yield of 5.59%, supported by a payout ratio of 65.7% and low cash payout ratio of 16.9%, indicating strong coverage by earnings and cash flows. The company has maintained reliable dividends over the past decade, with consistent growth in payments. Despite its high debt level, Wajax's recent earnings report showed improved net income, reinforcing its ability to sustain dividends, as affirmed with a quarterly CAD 0.35 per share payment announcement.

- Take a closer look at Wajax's potential here in our dividend report.

- The analysis detailed in our Wajax valuation report hints at an inflated share price compared to its estimated value.

Next Steps

- Navigate through the entire inventory of 19 Top TSX Dividend Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Evertz Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ET

Evertz Technologies

Engages in the design, manufacture, and distribution of video and audio infrastructure solutions for the production, post-production, broadcast, and telecommunications markets in Canada, the United States, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion