Celestica (TSX:CLS) recently experienced a 18% increase over the past week, a notable positive move amid a robust market up 8.4% in the last 7 days. This performance aligns with overall market trends, despite the broader technology sector facing headwinds due to U.S. restrictions on chip exports to China, which led to declines in stocks like Nvidia and AMD. While these trade tensions and resulting market fluctuations present challenges, Celestica's upward trajectory demonstrates resilience. The market's overall strength, with all sectors gaining, likely provided additional support for the company's robust share price movement during this period.

Celestica has 2 warning signs we think you should know about.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Celestica's recent share price increase of 18% in a single week highlights its resilience amid broader trade tensions affecting the technology sector. Over a longer-term five-year period, the company achieved a total shareholder return of approximately 1,728.84%, a very large increase reflecting substantial value creation for investors. This performance significantly surpasses its one-year performance against the Canadian Electronic industry, which had a return of 74.9%, underscoring Celestica's robust growth trajectory.

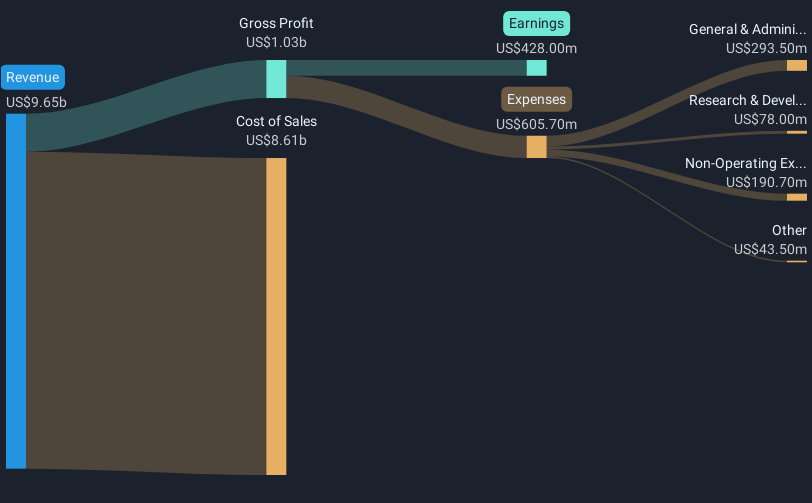

In light of the announced strategic investments in AI platforms and 800G networking, the potential for increased revenue and earnings forecasts is apparent. These developments could further enhance Celestica's financial outlook, with projected earnings expected to reach $805 million by April 2028 according to analyst consensus. The planned diversification and customer base expansion may help mitigate risks associated with revenue concentration and bolster future financial stability.

Given the current share price of CA$98.05 and an analyst consensus price target of CA$229.80, which is 57.3% higher, recent market movements may indicate growing investor confidence in Celestica's future growth prospects. The share repurchase plans and effective capital management could continue to support shareholder returns, potentially impacting the company's valuation further towards the analyst's price target.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CLS

Celestica

Provides supply chain solutions in Asia, North America, and internationally.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion