We Think Baylin Technologies Inc.'s (TSE:BYL) CEO Compensation Package Needs To Be Put Under A Microscope

Shareholders will probably not be too impressed with the underwhelming results at Baylin Technologies Inc. (TSE:BYL) recently. Shareholders can take the chance to hold the board and management accountable for the unsatisfactory performance at the next AGM on 11 May 2021. It would also be an opportunity for shareholders to influence management through voting on company resolutions such as executive remuneration, which could impact the firm significantly. We present the case why we think CEO compensation is out of sync with company performance.

See our latest analysis for Baylin Technologies

How Does Total Compensation For Randy Dewey Compare With Other Companies In The Industry?

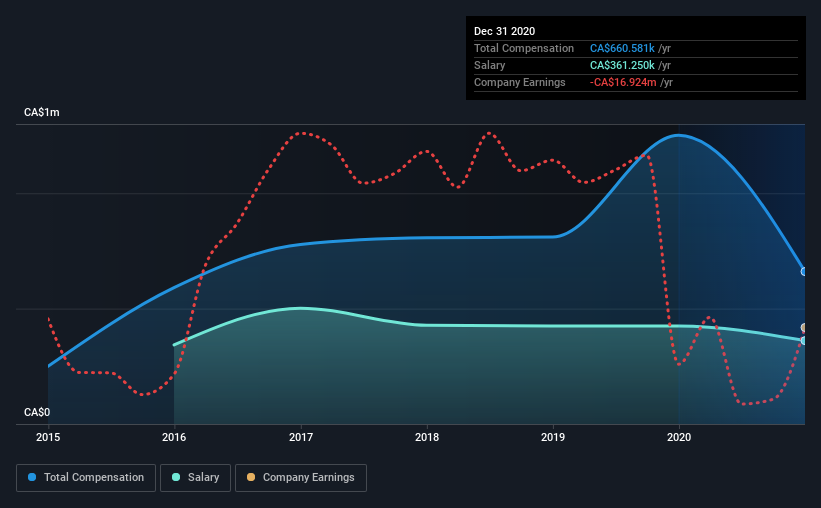

According to our data, Baylin Technologies Inc. has a market capitalization of CA$66m, and paid its CEO total annual compensation worth CA$661k over the year to December 2020. We note that's a decrease of 47% compared to last year. We note that the salary of CA$361.3k makes up a sizeable portion of the total compensation received by the CEO.

In comparison with other companies in the industry with market capitalizations under CA$246m, the reported median total CEO compensation was CA$218k. Hence, we can conclude that Randy Dewey is remunerated higher than the industry median. Moreover, Randy Dewey also holds CA$516k worth of Baylin Technologies stock directly under their own name.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CA$361k | CA$425k | 55% |

| Other | CA$299k | CA$826k | 45% |

| Total Compensation | CA$661k | CA$1.3m | 100% |

Talking in terms of the industry, salary represented approximately 76% of total compensation out of all the companies we analyzed, while other remuneration made up 24% of the pie. It's interesting to note that Baylin Technologies allocates a smaller portion of compensation to salary in comparison to the broader industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Baylin Technologies Inc.'s Growth Numbers

Over the last three years, Baylin Technologies Inc. has shrunk its earnings per share by 48% per year. Its revenue is down 22% over the previous year.

The decline in EPS is a bit concerning. And the impression is worse when you consider revenue is down year-on-year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Baylin Technologies Inc. Been A Good Investment?

The return of -63% over three years would not have pleased Baylin Technologies Inc. shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We did our research and identified 4 warning signs (and 1 which can't be ignored) in Baylin Technologies we think you should know about.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Baylin Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:BYL

Baylin Technologies

Researches, designs, develops, manufactures, and sells passive and active radio frequency (RF) products, satellite communications products, and supporting services.

Undervalued with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026