We're Hopeful That Cannabix Technologies (CSE:BLO) Will Use Its Cash Wisely

We can readily understand why investors are attracted to unprofitable companies. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

So should Cannabix Technologies (CSE:BLO) shareholders be worried about its cash burn? In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. Let's start with an examination of the business's cash, relative to its cash burn.

Check out our latest analysis for Cannabix Technologies

How Long Is Cannabix Technologies's Cash Runway?

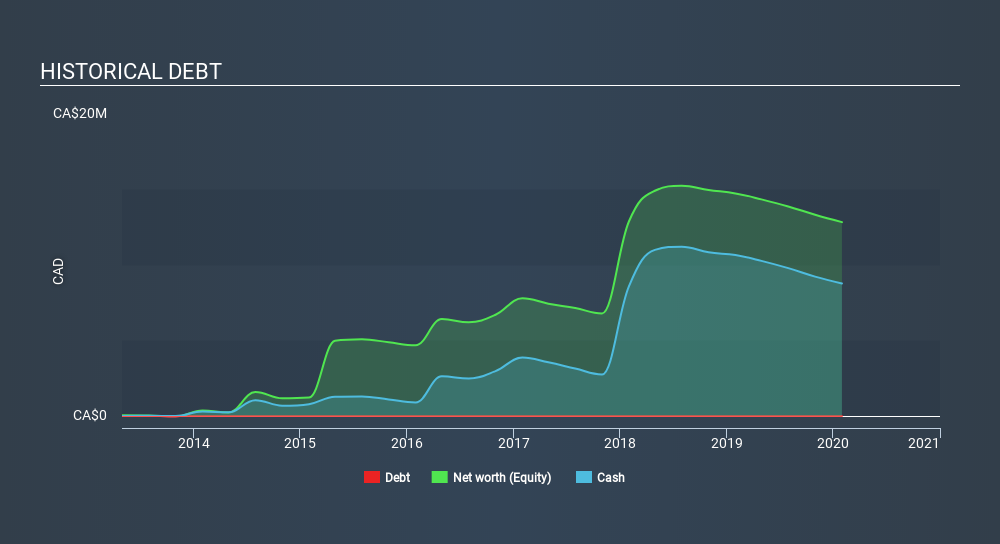

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. When Cannabix Technologies last reported its balance sheet in January 2020, it had zero debt and cash worth CA$8.8m. Looking at the last year, the company burnt through CA$2.1m. So it had a cash runway of about 4.3 years from January 2020. A runway of this length affords the company the time and space it needs to develop the business. The image below shows how its cash balance has been changing over the last few years.

How Is Cannabix Technologies's Cash Burn Changing Over Time?

Because Cannabix Technologies isn't currently generating revenue, we consider it an early-stage business. So while we can't look to sales to understand growth, we can look at how the cash burn is changing to understand how expenditure is trending over time. Over the last year its cash burn actually increased by 40%, which suggests that management are increasing investment in future growth, but not too quickly. That's not necessarily a bad thing, but investors should be mindful of the fact that will shorten the cash runway. Cannabix Technologies makes us a little nervous due to its lack of substantial operating revenue. We prefer most of the stocks on this list of stocks that analysts expect to grow.

How Hard Would It Be For Cannabix Technologies To Raise More Cash For Growth?

While Cannabix Technologies does have a solid cash runway, its cash burn trajectory may have some shareholders thinking ahead to when the company may need to raise more cash. Companies can raise capital through either debt or equity. Commonly, a business will sell new shares in itself to raise cash to drive growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Cannabix Technologies's cash burn of CA$2.1m is about 4.4% of its CA$47m market capitalisation. Given that is a rather small percentage, it would probably be really easy for the company to fund another year's growth by issuing some new shares to investors, or even by taking out a loan.

Is Cannabix Technologies's Cash Burn A Worry?

It may already be apparent to you that we're relatively comfortable with the way Cannabix Technologies is burning through its cash. For example, we think its cash runway suggests that the company is on a good path. Although its increasing cash burn does give us reason for pause, the other metrics we discussed in this article form a positive picture overall. After taking into account the various metrics mentioned in this report, we're pretty comfortable with how the company is spending its cash, as it seems on track to meet its needs over the medium term. Taking a deeper dive, we've spotted 5 warning signs for Cannabix Technologies you should be aware of, and 1 of them shouldn't be ignored.

Of course Cannabix Technologies may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About CNSX:BLO

Cannabix Technologies

A technology company, develops marijuana and alcohol breathalyzer for employers, law enforcement, workplaces, and laboratories in the United States.

Flawless balance sheet very low.

Similar Companies

Market Insights

Community Narratives