Wishpond Technologies Ltd. (CVE:WISH) Looks Inexpensive After Falling 28% But Perhaps Not Attractive Enough

To the annoyance of some shareholders, Wishpond Technologies Ltd. (CVE:WISH) shares are down a considerable 28% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 65% loss during that time.

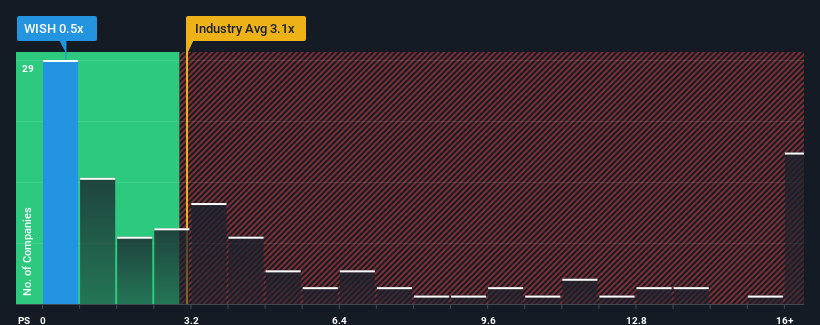

After such a large drop in price, Wishpond Technologies' price-to-sales (or "P/S") ratio of 0.5x might make it look like a strong buy right now compared to the wider Software industry in Canada, where around half of the companies have P/S ratios above 3x and even P/S above 8x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Our free stock report includes 1 warning sign investors should be aware of before investing in Wishpond Technologies. Read for free now.See our latest analysis for Wishpond Technologies

How Wishpond Technologies Has Been Performing

Wishpond Technologies could be doing better as it's been growing revenue less than most other companies lately. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Wishpond Technologies will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as depressed as Wishpond Technologies' is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Still, the latest three year period has seen an excellent 86% overall rise in revenue, in spite of its uninspiring short-term performance. So while the company has done a solid job in the past, it's somewhat concerning to see revenue growth decline as much as it has.

Shifting to the future, estimates from the three analysts covering the company suggest revenue growth is heading into negative territory, declining 5.6% over the next year. With the industry predicted to deliver 20% growth, that's a disappointing outcome.

In light of this, it's understandable that Wishpond Technologies' P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

Wishpond Technologies' P/S looks about as weak as its stock price lately. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Wishpond Technologies' analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

Having said that, be aware Wishpond Technologies is showing 1 warning sign in our investment analysis, you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Wishpond Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:WISH

Wishpond Technologies

Provides marketing focused online business solutions in the United States, Canada, and internationally.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives