Voxtur Analytics (CVE:VXTR) adds CA$11m to market cap in the past 7 days, though investors from three years ago are still down 89%

While not a mind-blowing move, it is good to see that the Voxtur Analytics Corp. (CVE:VXTR) share price has gained 28% in the last three months. But only the myopic could ignore the astounding decline over three years. The share price has sunk like a leaky ship, down 89% in that time. So it's about time shareholders saw some gains. The thing to think about is whether the business has really turned around. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

While the stock has risen 15% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

See our latest analysis for Voxtur Analytics

Voxtur Analytics isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last three years, Voxtur Analytics' revenue dropped 20% per year. That means its revenue trend is very weak compared to other loss making companies. The swift share price decline at an annual compound rate of 24%, reflects this weak fundamental performance. We prefer leave it to clowns to try to catch falling knives, like this stock. It's worth remembering that investors call buying a steeply falling share price 'catching a falling knife' because it is a dangerous pass time.

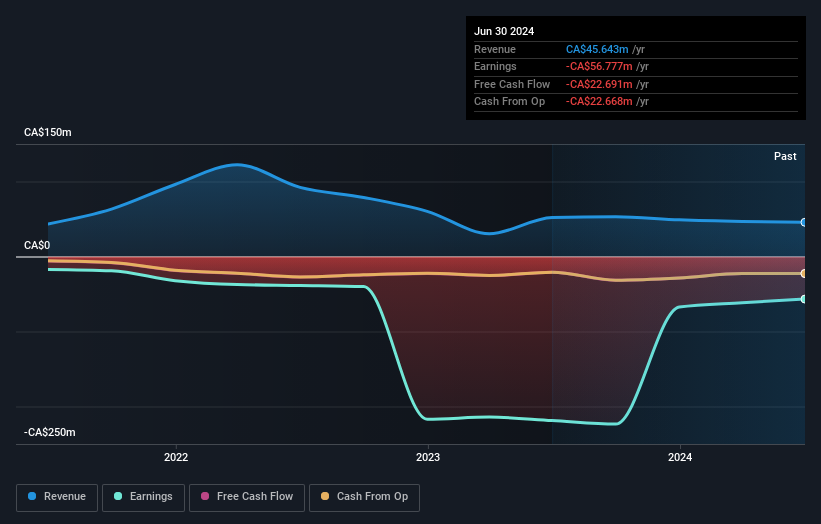

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Investors in Voxtur Analytics had a tough year, with a total loss of 12%, against a market gain of about 29%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 7% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 5 warning signs for Voxtur Analytics you should be aware of, and 2 of them are significant.

But note: Voxtur Analytics may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:VXTR

Voxtur Analytics

Operates as a real estate technology company in the United States and Canada.

Moderate and slightly overvalued.

Market Insights

Community Narratives