Investors Who Bought Urbanimmersive (CVE:UI) Shares Three Years Ago Are Now Down 62%

While not a mind-blowing move, it is good to see that the Urbanimmersive Inc. (CVE:UI) share price has gained 15% in the last three months. But that doesn't change the fact that the returns over the last three years have been disappointing. Regrettably, the share price slid 62% in that period. So it is really good to see an improvement. While many would remain nervous, there could be further gains if the business can put its best foot forward.

See our latest analysis for Urbanimmersive

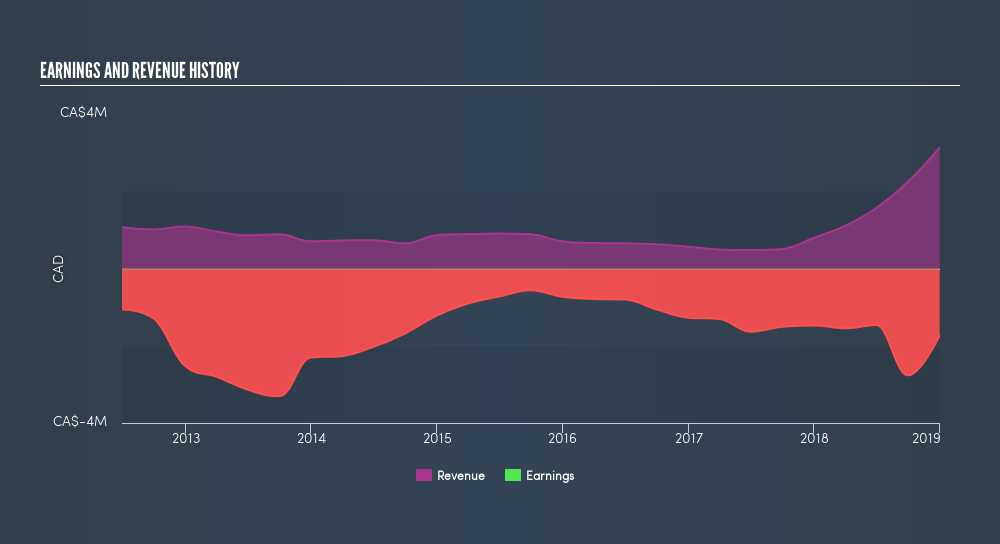

Urbanimmersive isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over three years, Urbanimmersive grew revenue at 59% per year. That is faster than most pre-profit companies. The share price has moved in quite the opposite direction, down 27% over that time, a bad result. It seems likely that the market is worried about the continual losses. But a share price drop of that magnitude could well signal that the market is overly negative on the stock.

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

If you are thinking of buying or selling Urbanimmersive stock, you should check out this FREEdetailed report on its balance sheet.

A Different Perspective

While the broader market gained around 7.6% in the last year, Urbanimmersive shareholders lost 29%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 10% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. You could get a better understanding of Urbanimmersive's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

But note: Urbanimmersive may not be the best stock to buy. So take a peek at this freelist of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSXV:UI

Urbanimmersive

Engages in the development and commercialization of real estate photography technologies and services in Canada.

Slight and slightly overvalued.

Similar Companies

Market Insights

Community Narratives