As global markets show signs of easing trade tensions and U.S. equities experience a rebound, small- and mid-cap stocks have posted gains for the third consecutive week despite a slowdown in business activity growth. In this environment, identifying high-growth tech stocks can be particularly appealing as they often thrive on innovation and adaptability, characteristics that can provide resilience amid economic uncertainties and evolving market dynamics.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| KebNi | 21.07% | 67.27% | ★★★★★★ |

| Pharma Mar | 25.21% | 43.09% | ★★★★★★ |

| Seojin SystemLtd | 31.68% | 39.34% | ★★★★★★ |

| Ascelia Pharma | 43.57% | 70.39% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| CD Projekt | 33.78% | 37.39% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

| Suzhou Gyz Electronic TechnologyLtd | 27.52% | 121.67% | ★★★★★★ |

Underneath we present a selection of stocks filtered out by our screen.

Qi An Xin Technology Group (SHSE:688561)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Qi An Xin Technology Group Inc. is a cybersecurity company offering products and services to government, enterprises, and institutions in China and internationally, with a market cap of CN¥20.98 billion.

Operations: Qi An Xin Technology Group generates revenue by providing cybersecurity solutions to various sectors, including government and enterprises. The company's offerings include a range of products and services designed to protect against cyber threats.

Qi An Xin Technology Group's recent performance underscores the challenges and potential within the high-growth tech sector. Despite a year-over-year revenue dip from CNY 704.75 million to CNY 686.08 million in Q1 2025, and a significant full-year sales drop from CNY 6.44 billion in 2024, there are signs of recovery as the net loss decreased from CNY 480.28 million to CNY 417.68 million in the same period. The company's commitment to turning around its financial health is evident with an expected annual profit growth of a robust 64.58% and revenue projected to outpace the Chinese market at an annual rate of 20.4%. These figures suggest Qi An Xin is navigating its unprofitable phase with strategic adjustments poised for future profitability, reflecting resilience and adaptability in a competitive landscape.

- Take a closer look at Qi An Xin Technology Group's potential here in our health report.

Gain insights into Qi An Xin Technology Group's past trends and performance with our Past report.

COL GroupLtd (SZSE:300364)

Simply Wall St Growth Rating: ★★★★★☆

Overview: COL Group Co., Ltd. operates in the digital publishing industry in China with a market capitalization of CN¥15.82 billion.

Operations: The company focuses on digital publishing in China, leveraging its expertise to generate revenue primarily from content creation and distribution. With a market capitalization of CN¥15.82 billion, it strategically positions itself within the growing digital media landscape.

COL GroupLtd's recent financials reflect a nuanced trajectory in the tech sector, with first-quarter sales rising to CNY 233.07 million from CNY 222.67 million year-over-year, yet grappling with an increased net loss of CNY 87.94 million compared to CNY 68.46 million previously. Despite these challenges, the firm is actively managing its capital; it repurchased shares worth CNY 27 million since last year, underscoring a commitment to shareholder value amidst volatility. This strategy, coupled with an annual revenue growth forecast of 20.9%, positions COL GroupLtd to potentially leverage market dynamics for recovery and growth as it navigates its unprofitable phase.

- Click to explore a detailed breakdown of our findings in COL GroupLtd's health report.

Understand COL GroupLtd's track record by examining our Past report.

Topicus.com (TSXV:TOI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Topicus.com Inc. is a company that offers vertical market software and platforms both in the Netherlands and internationally, with a market cap of CA$13.70 billion.

Operations: Topicus.com Inc. generates revenue primarily through its software and programming segment, which reported €1.29 billion. The company focuses on providing specialized software solutions across various vertical markets internationally.

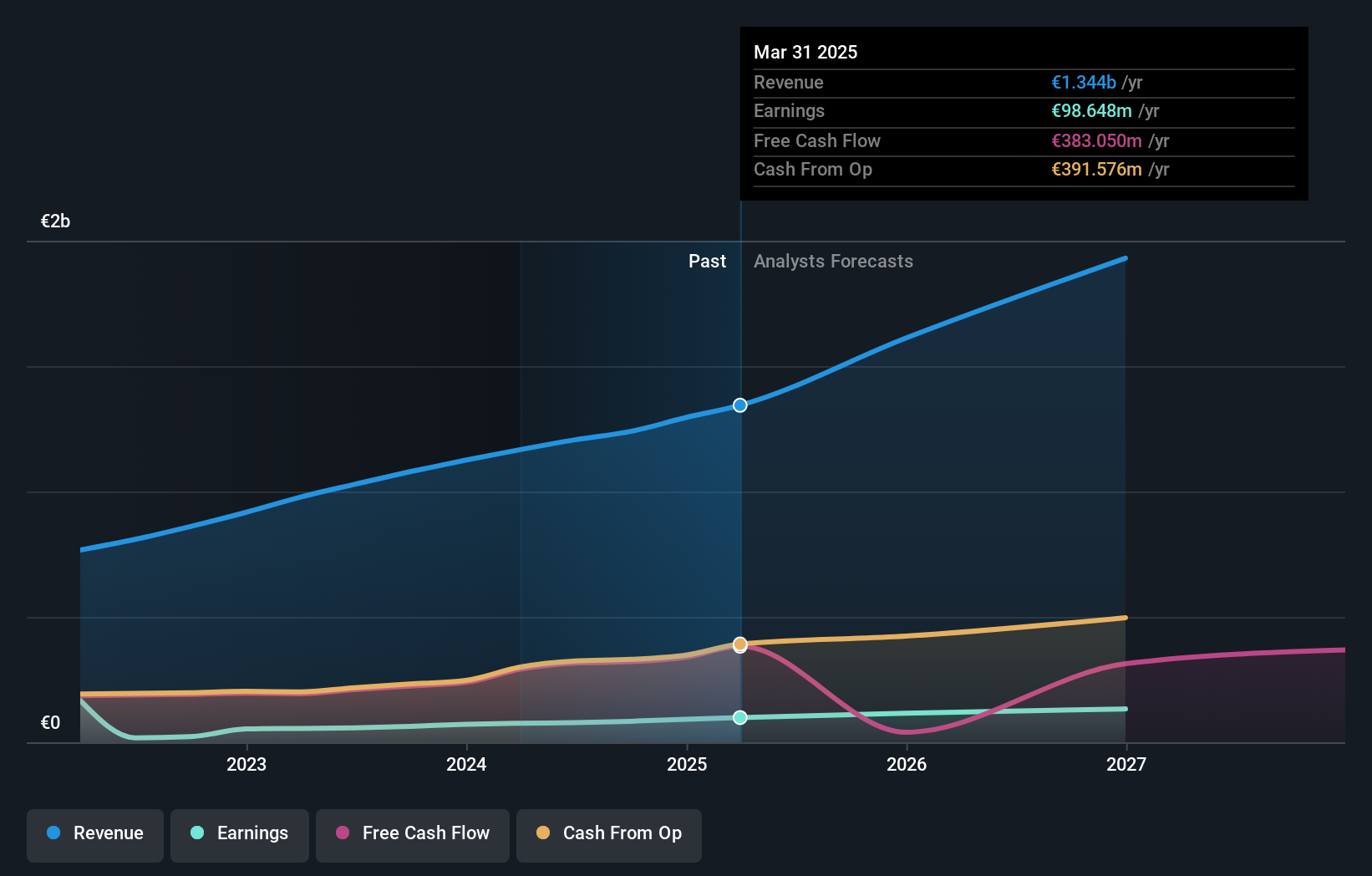

Topicus.com Inc. has demonstrated robust financial performance with a significant increase in annual revenue to EUR 1.29 billion, up from EUR 1.12 billion the previous year, reflecting a growth of 15.4%. This growth is complemented by an impressive rise in net income from EUR 71.75 million to EUR 91.99 million and an earnings per share increase from EUR 0.88 to EUR 1.11, highlighting efficient operational management and profitability enhancement strategies. Despite not outperforming the software industry's earnings growth rate last year, Topicus.com's consistent R&D investment positions it well for future technological advancements and market competitiveness, especially given its projected earnings growth of approximately 21.81% annually over the next three years.

- Get an in-depth perspective on Topicus.com's performance by reading our health report here.

Examine Topicus.com's past performance report to understand how it has performed in the past.

Make It Happen

- Delve into our full catalog of 730 Global High Growth Tech and AI Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Qi An Xin Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688561

Qi An Xin Technology Group

A cybersecurity company, provides cybersecurity products and services for government, enterprises, and other institutions in China and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)