As the Canadian market continues to navigate a landscape marked by evolving economic trends and strategic portfolio adjustments, investors are looking for opportunities that align with their long-term financial goals. Penny stocks, though sometimes considered a relic of past investment strategies, still hold potential as they often represent smaller or newer companies poised for growth. By focusing on those with strong financial health and solid fundamentals, investors can uncover hidden gems that might offer significant upside in today's market climate.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Pulse Seismic (TSX:PSD) | CA$2.28 | CA$115M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.54 | CA$15.47M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.17 | CA$950.75M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.53 | CA$501.61M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.28 | CA$221.48M | ★★★★★☆ |

| Vox Royalty (TSX:VOXR) | CA$3.33 | CA$174.29M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.25 | CA$32.24M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.84 | CA$182.38M | ★★★★★☆ |

| Enterprise Group (TSX:E) | CA$1.86 | CA$113.88M | ★★★★☆☆ |

Click here to see the full list of 948 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Hypercharge Networks (TSXV:HC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hypercharge Networks Corp. offers electric vehicle charging equipment and solutions in Canada and the United States, with a market cap of CA$4.60 million.

Operations: The company's revenue is primarily generated from the sale of electric vehicle charging equipment, software, and maintenance contracts, totaling CA$3.93 million.

Market Cap: CA$4.6M

Hypercharge Networks Corp., with a market cap of CA$4.60 million, is currently unprofitable but has shown revenue growth, reporting CA$2.28 million for the first half of 2024. Despite its financial challenges, including a cash runway of less than one year and shareholder dilution, it remains debt-free and continues to secure significant contracts, such as the delivery of charging stations to major developments like King George Hub and agreements with Dawson & Sawyer Developments Ltd. Recent executive changes include the resignation of CFO Navraj Dosanjh, potentially impacting future strategic direction.

- Dive into the specifics of Hypercharge Networks here with our thorough balance sheet health report.

- Assess Hypercharge Networks' previous results with our detailed historical performance reports.

Pivotree (TSXV:PVT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Pivotree Inc. designs, integrates, deploys, and manages digital platforms in commerce, data management, and supply chain for retail and branded manufacturers globally, with a market cap of CA$19.25 million.

Operations: The company's revenue is generated from Professional Services, which account for CA$43.05 million, and Managed & IP Solutions (MIPS) & Legacy Managed Services (LMS), contributing CA$37.99 million.

Market Cap: CA$19.25M

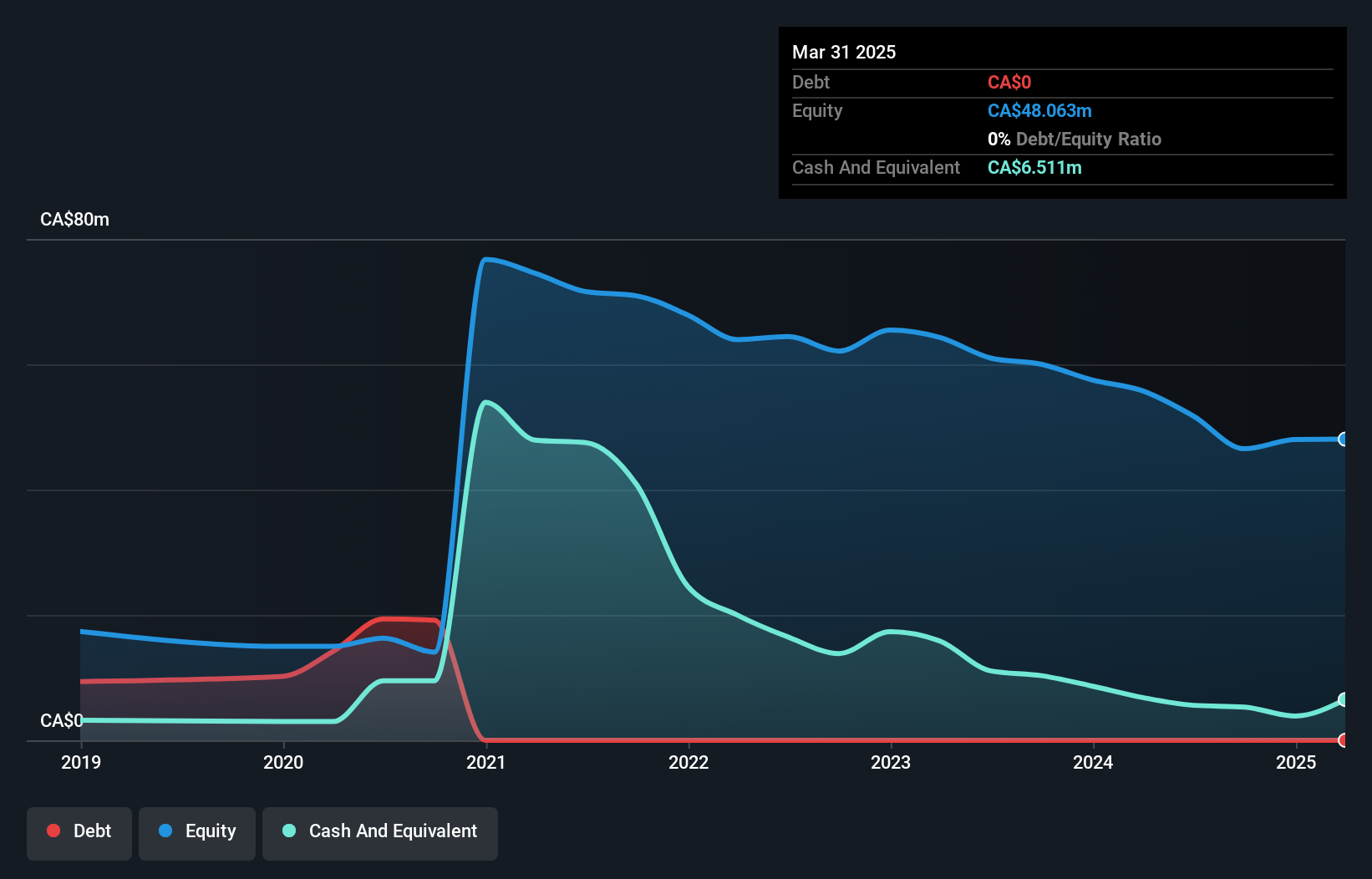

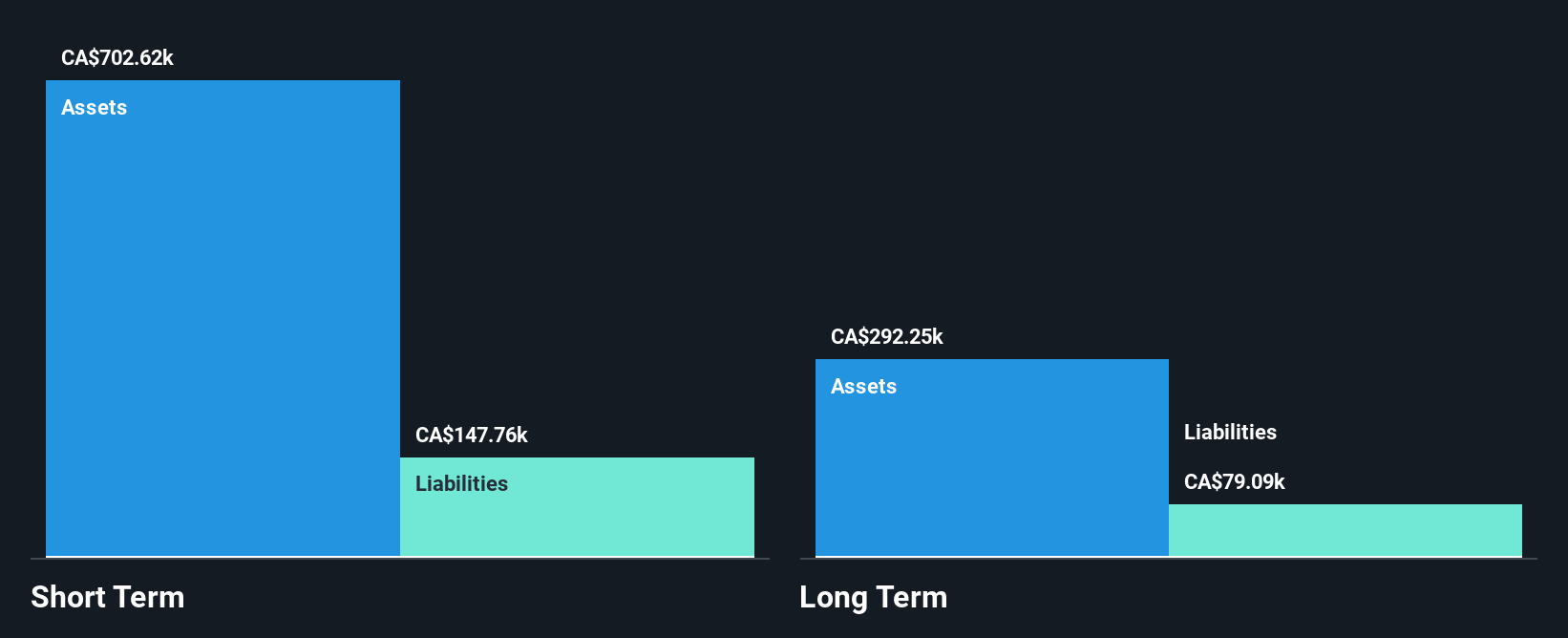

Pivotree Inc., with a market cap of CA$19.25 million, is unprofitable and reported declining sales for the third quarter of 2024 at CA$18.82 million, down from CA$21.05 million the previous year, with net losses widening to CA$5.08 million. Despite financial challenges, Pivotree remains debt-free and maintains sufficient cash runway for over a year based on current free cash flow. Recent strategic initiatives include launching an Electronics SKUs library to enhance data management efficiency in the electronics sector and expanding its partnership with Sonepar Canada to automate data enrichment processes using AI/ML technology for improved operational cost savings and speed-to-market efficiency.

- Get an in-depth perspective on Pivotree's performance by reading our balance sheet health report here.

- Understand Pivotree's earnings outlook by examining our growth report.

Volcanic Gold Mines (TSXV:VG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Volcanic Gold Mines Inc. and its subsidiaries focus on acquiring and exploring resource properties, with a market cap of CA$2.28 million.

Operations: Volcanic Gold Mines Inc. does not report any revenue segments as it primarily concentrates on acquiring and exploring resource properties.

Market Cap: CA$2.28M

Volcanic Gold Mines Inc. operates with a market cap of CA$2.28 million and remains pre-revenue, focusing on resource property acquisition and exploration. The company has no debt but faces financial constraints with less than a year of cash runway based on current free cash flow levels. While its short-term assets exceed liabilities, the management team is relatively inexperienced, averaging 1.9 years in tenure. Recent earnings reports indicate ongoing losses, with net loss for the third quarter at CA$0.23 million compared to CA$0.50 million the previous year, reflecting continued operational challenges amidst high share price volatility over recent months.

- Unlock comprehensive insights into our analysis of Volcanic Gold Mines stock in this financial health report.

- Understand Volcanic Gold Mines' track record by examining our performance history report.

Seize The Opportunity

- Reveal the 948 hidden gems among our TSX Penny Stocks screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:PVT

Pivotree

Designs, integrates, deploys, and manages digital platforms in commerce, data management, and supply chain for retail and branded manufacturers worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives