Despite currently being unprofitable, Noble Iron (CVE:NIR.H) has delivered a 860% return to shareholders over 3 years

No-one enjoys it when they lose money on a stock. But when the market is down, you're bound to have some losers. The Noble Iron Inc. (CVE:NIR.H) is down 97% over three years, but the total shareholder return is 860% once you include the dividend. That's better than the market which returned 23% over the last three years. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

Since Noble Iron has shed CA$136k from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

Check out our latest analysis for Noble Iron

Noble Iron didn't have any revenue in the last year, so it's fair to say it doesn't yet have a proven product (or at least not one people are paying for). We can't help wondering why it's publicly listed so early in its journey. Are venture capitalists not interested? So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. Investors will be hoping that Noble Iron can make progress and gain better traction for the business, before it runs low on cash.

Companies that lack both meaningful revenue and profits are usually considered high risk. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some such companies do very well over the long term, others become hyped up by promoters before eventually falling back down to earth, and going bankrupt (or being recapitalized). Some Noble Iron investors have already had a taste of the bitterness stocks like this can leave in the mouth.

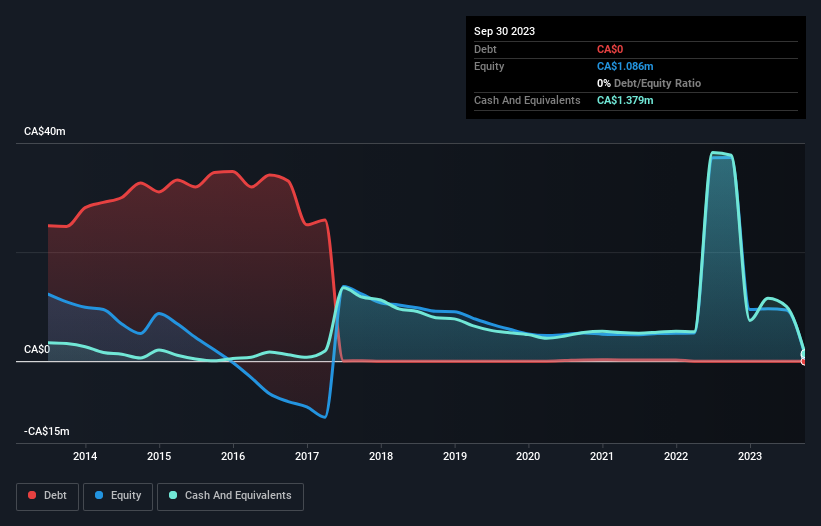

Noble Iron had cash in excess of all liabilities of just CA$1.0m when it last reported (September 2023). So if it has not already moved to replenish reserves, we think the near-term chances of a capital raising event are pretty high. With that in mind, you can understand why the share price dropped 25% per year, over 3 years. You can see in the image below, how Noble Iron's cash levels have changed over time (click to see the values).

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. Given that situation, would you be concerned if it turned out insiders were relentlessly selling stock? I'd like that just about as much as I like to drink milk and fruit juice mixed together. It costs nothing but a moment of your time to see if we are picking up on any insider selling.

What About The Total Shareholder Return (TSR)?

We've already covered Noble Iron's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Noble Iron hasn't been paying dividends, but its TSR of 860% exceeds its share price return of -97%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

It's good to see that Noble Iron has rewarded shareholders with a total shareholder return of 23% in the last twelve months. However, that falls short of the 92% TSR per annum it has made for shareholders, each year, over five years. The pessimistic view would be that be that the stock has its best days behind it, but on the other hand the price might simply be moderating while the business itself continues to execute. It's always interesting to track share price performance over the longer term. But to understand Noble Iron better, we need to consider many other factors. Even so, be aware that Noble Iron is showing 4 warning signs in our investment analysis , you should know about...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Noble Iron might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:NIR.H

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion