Lumine Group (TSXV:LMN) Profitability Milestone Challenges Skeptical Narratives as Margins Turn Top-Tier

Reviewed by Simply Wall St

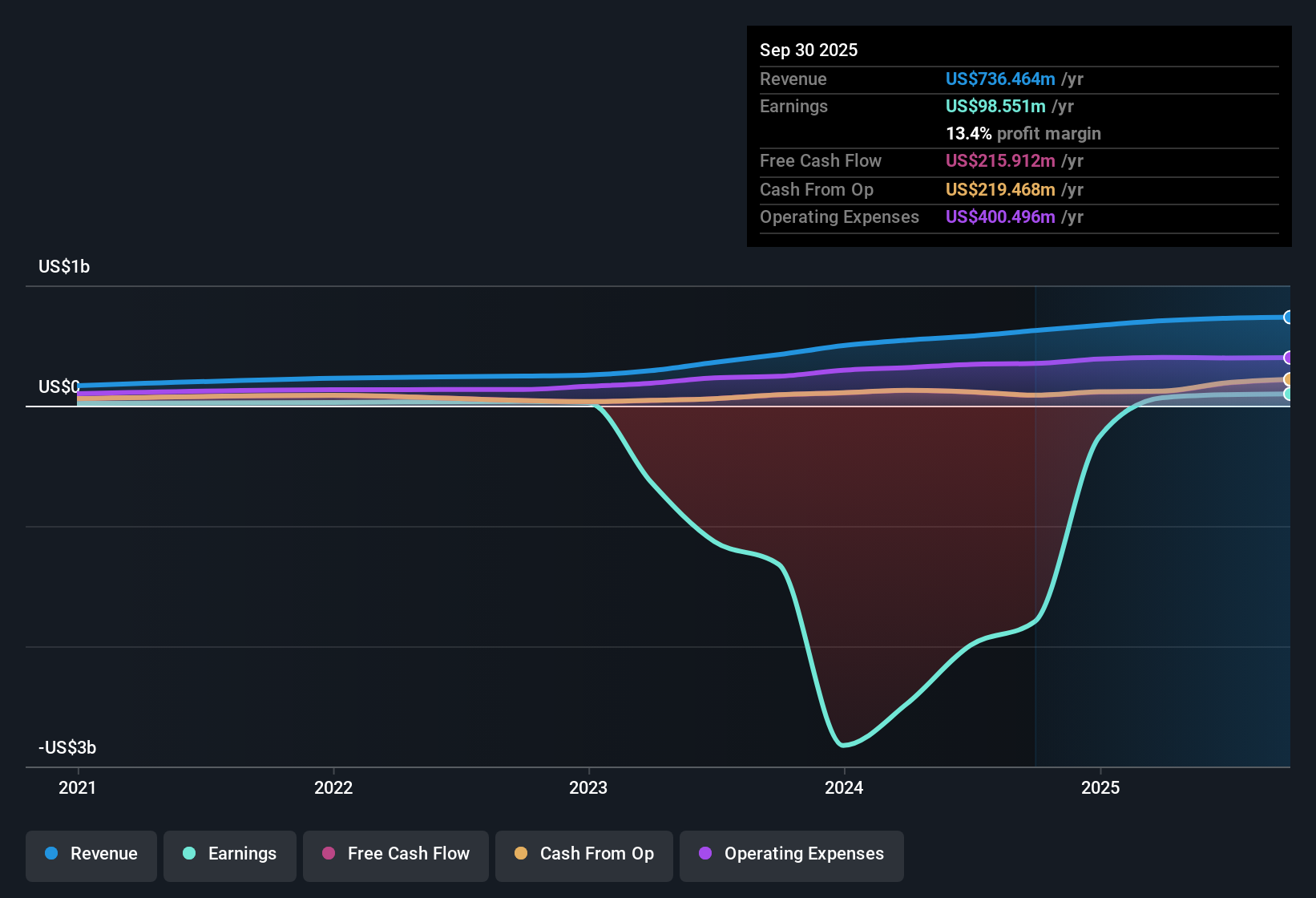

Lumine Group (TSXV:LMN) just posted headline numbers that have turned some heads. Revenue is forecast to rise 18% annually, outpacing the Canadian market’s 5.1% growth rate. EPS is expected to grow 12.6% each year, ahead of the market’s 11.8%. The company recently transitioned to profitability, posting strong net profit margins and overall earnings quality, after averaging a -14.3% earnings decline over the past five years. With the share price at CA$30.39 and trading below a discounted cash flow fair value estimate, investors will now look to the ongoing profit and revenue trajectory as a driver for sentiment.

See our full analysis for Lumine Group.The next section puts Lumine’s earnings performance in the context of the market’s key narratives. Evidence will be brought to bear on the stories investors are watching most closely.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Margins Now Top-Tier

- Lumine Group's newly achieved profitability is marked by high net profit margins and strong overall earnings quality. This stands out after a five-year average annual earnings decline of 14.3%.

- This strongly supports the bullish view that Lumine’s operating model has robust momentum.

- The move from an extended loss-making period to sustained profitability is unusual in vertical market software, where turnarounds can be slow and margins are typically thin.

- The fact that net margins and earnings quality are now labeled "high" directly supports the belief that recent growth is both real and durable, rather than a fluke rebound.

Peer Valuation: Premium but Justified?

- Lumine trades at a Price-to-Earnings Ratio of 56.2x, which is above the Canadian software industry average of 54.4x but below the peer group’s 68.2x multiple.

- The recent transition to profitability challenges typical concerns about companies carrying a premium valuation.

- Critics highlight that the P/E premium over the industry average could imply the stock is expensive. However, the lower valuation compared to peers suggests relative value for investors seeking growth at a reasonable price.

- This creates space for both skeptics and bulls as the market weighs whether future growth can sustain or expand this valuation gap.

DCF Fair Value Points to Upside

- The current share price of CA$30.39 is below the DCF fair value of CA$32.69, indicating a potential discount to intrinsic value.

- This gap challenges the view that Lumine’s stock has already “priced in” all its improvement in profitability and growth.

- Investors referencing this discount might argue the company’s recent operational turnaround, along with forecasts for 18% revenue and 12.6% earnings growth, justifies a higher valuation.

- Meanwhile, the absence of flagged risks reinforces the idea that the market could reward Lumine’s steady upward trajectory.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Lumine Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite Lumine’s impressive turnaround, its profit margins and earnings are recent developments. This may raise questions about the reliability of its growth over time.

If you prefer companies with a proven record of delivering consistent revenue and earnings regardless of market cycles, consider discovering stable growth stocks screener (2083 results) now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:LMN

Lumine Group

Offers develops, installs, and customizes of software worldwide.

Excellent balance sheet with acceptable track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion