Lumine Group (TSXV:LMN): Evaluating Valuation Following Strong Q3 Revenue and Profit Growth

Reviewed by Simply Wall St

Lumine Group (TSXV:LMN) just posted its third quarter earnings, delivering stronger revenue and net income compared to the same period last year. Investors are paying close attention as these numbers indicate a steady upward trend.

See our latest analysis for Lumine Group.

Even with Lumine Group’s strong improvement in revenue and profitability this quarter, recent share price momentum has been sharply negative, with a 30-day share price return of -30.56% and a full-year total shareholder return of -37.20%. The stock’s slide suggests that the market is still recalibrating its growth outlook despite the healthy fundamentals.

If Lumine’s volatility has you thinking about what else is out there, it could be the right time to expand your perspective and discover fast growing stocks with high insider ownership

With these gains and a steep discount to analyst targets, is the market overlooking Lumine Group’s progress, or is all the upside already factored in, leaving little room for a buying opportunity?

Price-to-Earnings of 48.9x: Is it justified?

Lumine Group's shares are currently trading at a price-to-earnings (P/E) ratio of 48.9x, placing them just below the Canadian software industry average of 50.9x. This slight discount may suggest the market is not fully recognizing the company’s future earnings potential, even following its recent swing into profitability.

The price-to-earnings ratio measures how much investors are willing to pay for each dollar of earnings. In the software sector, higher P/E ratios are often justified for companies expected to deliver robust earnings growth or those enjoying expanding margins. Lumine’s premium reflects its transformation to profitability and ongoing revenue improvements, signaling investor anticipation for sustained growth.

Compared to its industry peers, Lumine Group's P/E is slightly more attractive than the sector average. This may draw attention from value-focused investors. However, relative to the estimated fair price-to-earnings ratio of 28.8x, the current valuation appears expensive. If the market adjusts towards this fair ratio, the share price could face further pressure.

Explore the SWS fair ratio for Lumine Group

Result: Price-to-Earnings of 48.9x (OVERVALUED)

However, persistent negative share momentum and a premium valuation remain key risks. These factors could potentially limit upside if market sentiment does not quickly improve.

Find out about the key risks to this Lumine Group narrative.

Another View: Discounted Cash Flow Perspective

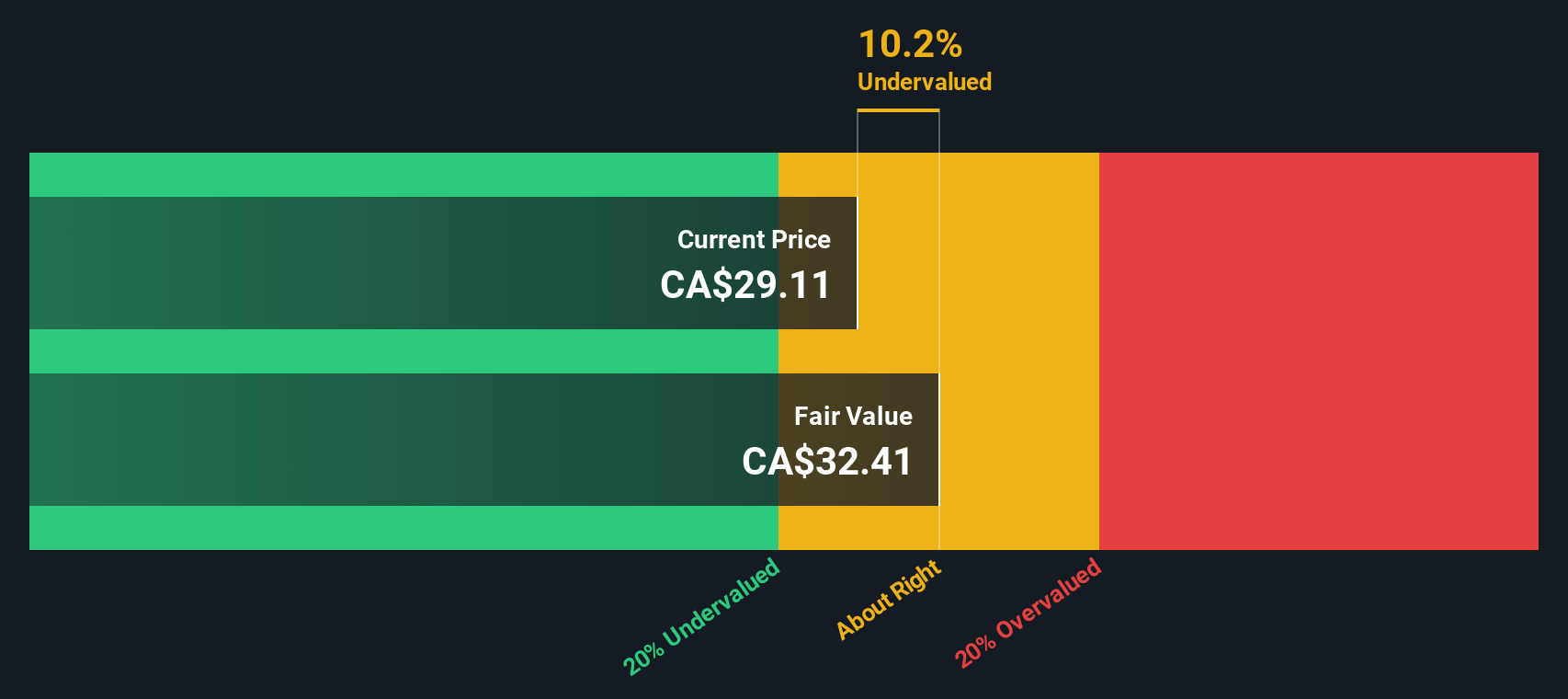

While the market’s preferred earnings measure suggests Lumine Group is overvalued, our DCF model offers a different perspective. According to the SWS DCF model, the shares are trading at an 18.3% discount to fair value. Could this model be signaling overlooked value, or are other risks holding back investor enthusiasm?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Lumine Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 865 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Lumine Group Narrative

If you have a different perspective or want to dive deeper into the numbers, it’s quick and easy to piece together your own analysis and viewpoint. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Lumine Group.

Looking for more investment ideas?

Smart investors never limit their options. Broaden your horizons and give yourself an edge by checking out curated lists of stocks making headlines and showing strong momentum.

- Start your search for reliable passive income opportunities by reviewing these 14 dividend stocks with yields > 3%, which features yields above 3% and consistent performance.

- Unlock high-potential sectors by comparing these 25 AI penny stocks, a selection of companies leading in artificial intelligence and innovation.

- Capture undervalued opportunities before the crowd with these 865 undervalued stocks based on cash flows, focused on strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:LMN

Lumine Group

Offers develops, installs, and customizes of software worldwide.

Excellent balance sheet and good value.

Market Insights

Community Narratives