As the Canadian market navigates its current economic landscape, investors are increasingly interested in exploring diverse opportunities across various sectors. While the term 'penny stock' might evoke a sense of nostalgia, these stocks can still offer substantial value by representing smaller or newer companies with potential for growth. By focusing on those with strong financials and solid fundamentals, investors may uncover promising prospects that could lead to impressive returns.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Findev (TSXV:FDI) | CA$0.465 | CA$13.32M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.26 | CA$118.05M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.59 | CA$556.63M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.30 | CA$223.45M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.475 | CA$968.15M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.23 | CA$32.24M | ★★★★★★ |

| New Gold (TSX:NGD) | CA$4.08 | CA$3.22B | ★★★★★☆ |

| Hemisphere Energy (TSXV:HME) | CA$1.84 | CA$185.31M | ★★★★★☆ |

| Enterprise Group (TSX:E) | CA$1.79 | CA$116.34M | ★★★★☆☆ |

Click here to see the full list of 930 stocks from our TSX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Avricore Health (TSXV:AVCR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Avricore Health Inc. operates in the health data and point-of-care technologies sector in Canada, with a market cap of CA$8.10 million.

Operations: The company's revenue is primarily generated from its Healthtab - Point of Care segment, amounting to CA$4.72 million.

Market Cap: CA$8.1M

Avricore Health Inc., with a market cap of CA$8.10 million, has transitioned to profitability over the past year, reporting sales of CA$1.2 million in Q3 2024 and a net income for the first nine months of CA$0.0435 million. Despite its low return on equity at 4.1%, Avricore benefits from being debt-free and having short-term assets exceeding liabilities by a considerable margin (CA$1.4M vs CA$535.4K). The company's earnings are deemed high quality, though share price volatility remains high compared to most Canadian stocks, reflecting typical penny stock risks despite recent profit growth.

- Click here and access our complete financial health analysis report to understand the dynamics of Avricore Health.

- Review our historical performance report to gain insights into Avricore Health's track record.

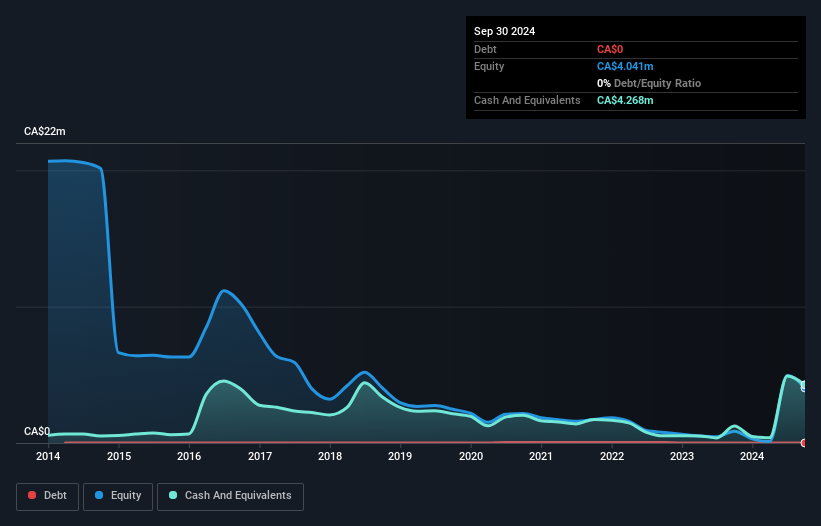

Commander Resources (TSXV:CMD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Commander Resources Ltd. is involved in the acquisition and exploration of mineral resource properties in Canada and Mexico, with a market cap of CA$3.54 million.

Operations: Commander Resources Ltd. has not reported any revenue segments.

Market Cap: CA$3.54M

Commander Resources Ltd., with a market cap of CA$3.54 million, is pre-revenue and recently agreed to be acquired by Enduro Metals Corporation for CA$3.8 million, subject to shareholder and regulatory approvals. The company has no debt and its short-term assets of CA$4.4 million exceed liabilities of CA$485.1K, indicating solid financial positioning despite high share price volatility typical in penny stocks. Recent geophysical surveys at the Burn Property have identified promising exploration targets, although substantial development remains ahead. The board's unanimous support for the acquisition suggests confidence in strategic alignment with Enduro's operations post-transaction completion.

- Click here to discover the nuances of Commander Resources with our detailed analytical financial health report.

- Gain insights into Commander Resources' past trends and performance with our report on the company's historical track record.

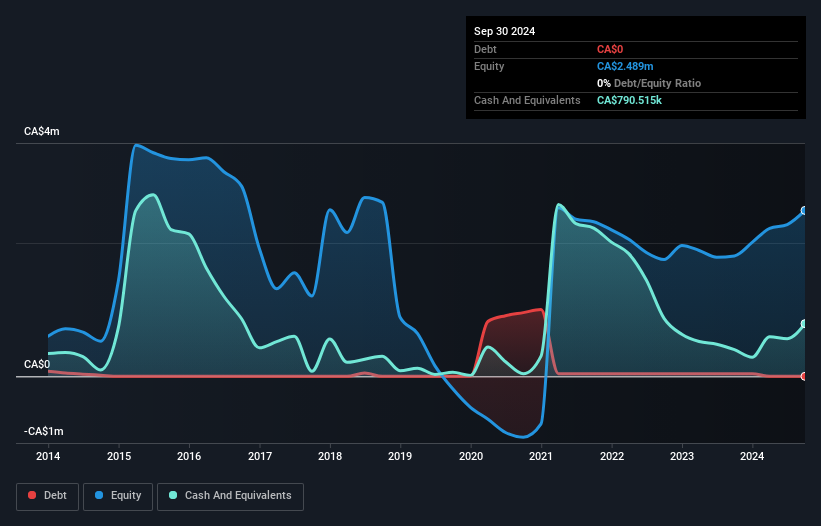

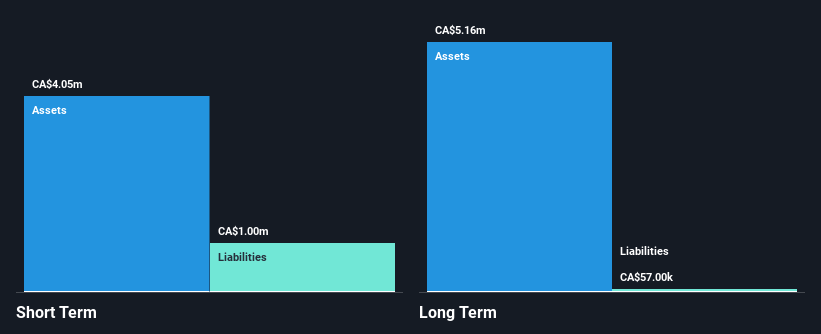

AirIQ (TSXV:IQ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: AirIQ Inc. operates in the telematics industry in North America with a market cap of CA$11.95 million.

Operations: The company generates CA$5.33 million in revenue from developing and operating a telematics asset management system.

Market Cap: CA$11.95M

AirIQ Inc., with a market cap of CA$11.95 million, operates debt-free and maintains a stable financial position, as its short-term assets of CA$4.0 million surpass both short- and long-term liabilities. While the company has experienced significant earnings growth over the past five years, recent performance shows negative earnings growth and reduced profit margins compared to last year. Despite these challenges, AirIQ's price-to-earnings ratio remains below the industry average, suggesting potential value for investors. Recent earnings reports indicate slight revenue declines but stable sales figures year-over-year for the second quarter and six months ended September 2024.

- Get an in-depth perspective on AirIQ's performance by reading our balance sheet health report here.

- Learn about AirIQ's historical performance here.

Seize The Opportunity

- Get an in-depth perspective on all 930 TSX Penny Stocks by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:IQ

Flawless balance sheet low.

Market Insights

Community Narratives