Why Digihost Technology's (CVE:DGHI) Healthy Earnings Aren’t As Good As They Seem

Shareholders didn't seem to be thrilled with Digihost Technology Inc.'s (CVE:DGHI) recent earnings report, despite healthy profit numbers. Our analysis suggests they may be concerned about some underlying details.

View our latest analysis for Digihost Technology

A Closer Look At Digihost Technology's Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. This ratio tells us how much of a company's profit is not backed by free cashflow.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

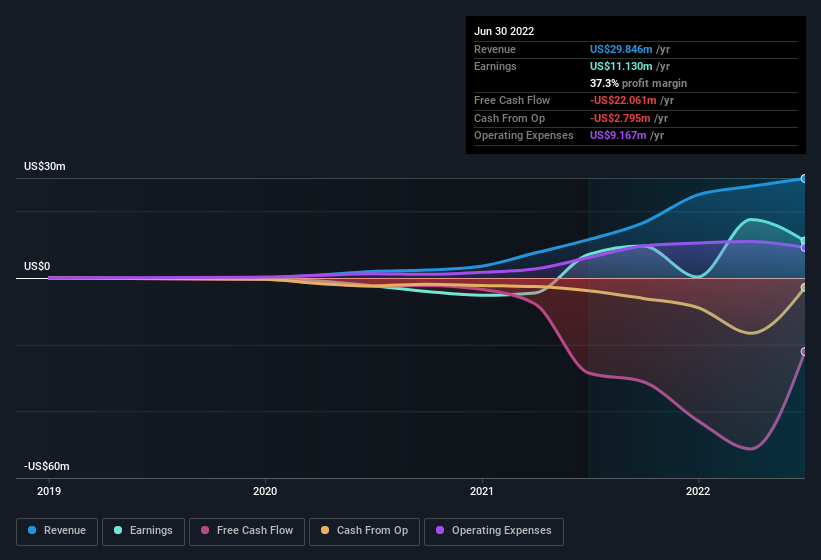

Over the twelve months to June 2022, Digihost Technology recorded an accrual ratio of 0.68. Statistically speaking, that's a real negative for future earnings. And indeed, during the period the company didn't produce any free cash flow whatsoever. In the last twelve months it actually had negative free cash flow, with an outflow of US$22m despite its profit of US$11.1m, mentioned above. We also note that Digihost Technology's free cash flow was actually negative last year as well, so we could understand if shareholders were bothered by its outflow of US$22m. Having said that, there is more to consider. We must also consider the impact of unusual items on statutory profit (and thus the accrual ratio), as well as note the ramifications of the company issuing new shares.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. As it happens, Digihost Technology issued 13% more new shares over the last year. Therefore, each share now receives a smaller portion of profit. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. Check out Digihost Technology's historical EPS growth by clicking on this link.

How Is Dilution Impacting Digihost Technology's Earnings Per Share (EPS)?

Three years ago, Digihost Technology lost money. On the bright side, in the last twelve months it grew profit by 57%. But EPS was far less impressive, dropping 3.2% in that time. This is a great example of why it's rather imprudent to rely only on net income as a growth measure. So you can see that the dilution has had a bit of an impact on shareholders.

In the long term, if Digihost Technology's earnings per share can increase, then the share price should too. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

The Impact Of Unusual Items On Profit

The fact that the company had unusual items boosting profit by US$2.8m, in the last year, probably goes some way to explain why its accrual ratio was so weak. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. And that's as you'd expect, given these boosts are described as 'unusual'. Digihost Technology had a rather significant contribution from unusual items relative to its profit to June 2022. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

Our Take On Digihost Technology's Profit Performance

In conclusion, Digihost Technology's weak accrual ratio suggested its statutory earnings have been inflated by the unusual items. The dilution means the results are weaker when viewed from a per-share perspective. For all the reasons mentioned above, we think that, at a glance, Digihost Technology's statutory profits could be considered to be low quality, because they are likely to give investors an overly positive impression of the company. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. For instance, we've identified 5 warning signs for Digihost Technology (1 is concerning) you should be familiar with.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:DGX

Digi Power X

An energy infrastructure company, develops data centers to drive the expansion of energy assets in the United States.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion